Red Robin (NASDAQ:RRGB) Beats Q4 Sales Targets But Stock Drops

Burger restaurant chain Red Robin (NASDAQ:RRGB) beat analysts' expectations in Q4 FY2023, with revenue up 6.5% year on year to $309 million. On the other hand, the company's full-year revenue guidance of $1.26 billion at the midpoint came in 1.5% below analysts' estimates. It made a non-GAAP loss of $0.66 per share, improving from its loss of $1.35 per share in the same quarter last year.

Is now the time to buy Red Robin? Find out by accessing our full research report, it's free.

Red Robin (RRGB) Q4 FY2023 Highlights:

Revenue: $309 million vs analyst estimates of $305 million (1.3% beat)

EPS (non-GAAP): -$0.66 vs analyst estimates of -$0.46

Management's revenue guidance for the upcoming financial year 2024 is $1.26 billion at the midpoint, missing analyst estimates by 1.5% and implying -3.1% growth (vs 2.6% in FY2023)

Gross Margin (GAAP): 14.5%, down from 14.9% in the same quarter last year

Same-Store Sales were down 2.7% year on year (miss vs. expectations of down 0.8% year on year)

Market Capitalization: $136.2 million

G.J. Hart, Red Robin’s President and Chief Executive Officer said, “2023 was a successful transformational year for our iconic brand. Operationally, we made significant investments in what we serve and how we serve it to ensure the Guest experience at Red Robin is a memorable one and we continue to receive positive feedback from Guests. Financially, we made substantial progress by delivering a 1.6% increase in comparable restaurant revenue, a 33% increase in Adjusted EBITDA, and we strengthened our balance sheet by completing two tranches of sale-leaseback transactions to reduce our long-term debt by almost $25 million dollars.”

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Red Robin is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

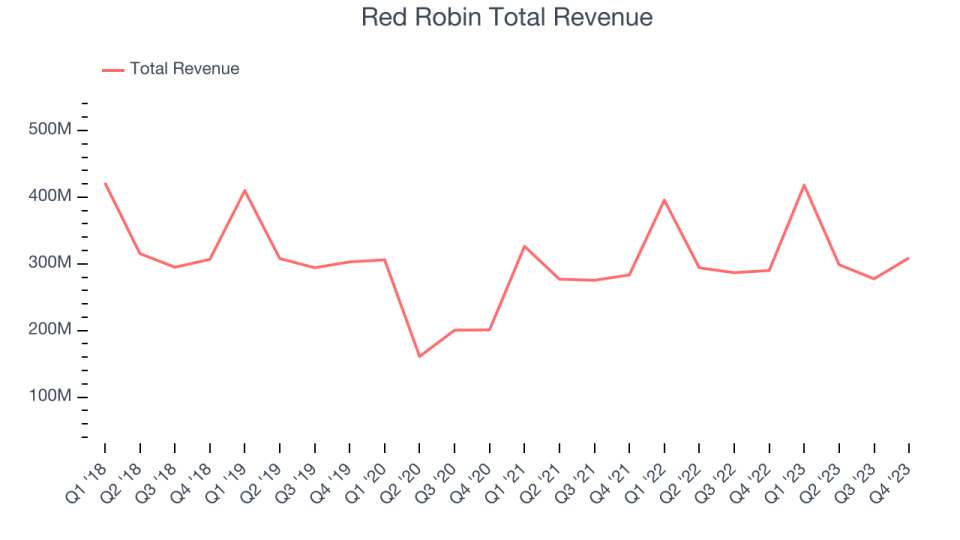

As you can see below, the company's revenue was flat over the last four years (we compare to 2019 to normalize for COVID-19 impacts) as it closed restaurants.

This quarter, Red Robin reported solid year-on-year revenue growth of 6.5%, and its $309 million in revenue outperformed Wall Street's estimates by 1.3%. Looking ahead, Wall Street expects revenue to decline 1.4% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

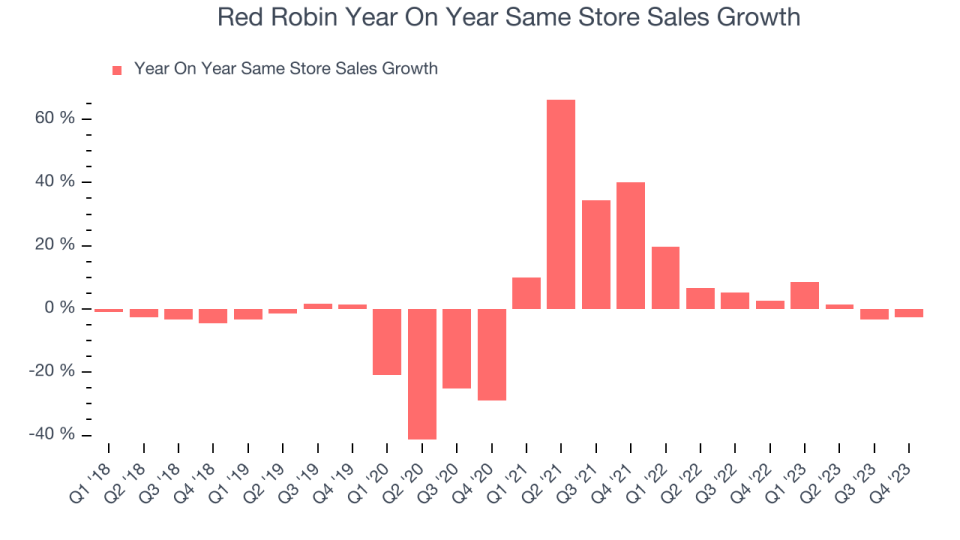

Red Robin's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 4.8% year on year. Given its declining physical footprint over the same period, this performance stems from increased foot traffic at existing restaurants, which is sometimes a side effect of reducing the total number of locations.

In the latest quarter, Red Robin's same-store sales fell 2.7% year on year. This decline was a reversal from the 2.5% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Red Robin's Q4 Results

We liked how revenue outperformed Wall Street's estimates. On the other hand, its EPS missed and its full-year revenue guidance was below Wall Street's estimates. Overall, this was a mediocre quarter for Red Robin. The company is down 11% on the results and currently trades at $7.65 per share.

So should you invest in Red Robin right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.