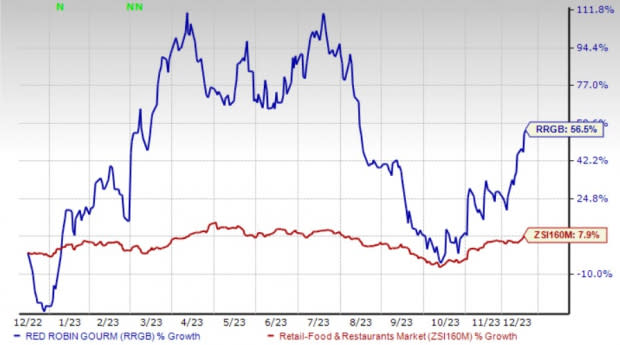

Red Robin (RRGB) Up 57% in a Year: Will the Trend Continue?

Over the past year, Red Robin Gourmet Burgers, Inc. RRGB has demonstrated strong performance, with a notable gain of 56.5%, surpassing the industry's modest increase of 7.9%. The company is capitalizing on a robust loyalty program, digitalization, and innovative additions to its menu. However, high costs remain a concern for the company. Let’s delve deeper.

Growth Drivers

The company is gaining from the strong loyalty program. RRGB is focused on enhancing its ability to efficiently reach a broader audience through digital infrastructure and an omnichannel approach. On the third quarter of 2023 earnings call, the company stated that it is undergoing certain enhancements in its loyalty program, which is scheduled to launch in early 2024. The improvements will focus on its strategy of moving toward rewarding its loyal guests rather than concentrating on heavy discounting. The enhancements include its aim of delivering more relevant messaging to its more than 13 million members, transforming the program into a notable experience accompanied by acquiring new members to foster a new generation of Red Robin ambassadors.

Red Robin, too, has been investing more in technology and data infrastructure. Going forward, the company intends to collaborate with new third-party delivery partners and improve its digital platform through website enhancements and a new Red Robin mobile app. Backed by cost-effective channels, the initiatives are likely to boost operational execution, drive higher-order conversion and increase guests’ frequency and royalty participation.

Red Robin continues to focus on menu innovation to drive growth. Although the company has scaled down its menu from pre-pandemic levels, it has been witnessing positive customer feedback regarding its limited-time offer menu items complemented by everyday value that includes affordable prices, generous portions and signature bottomless sides and drinks. Going forward, the company intends to focus on creative recipes to drive higher checks and margins.

In October 2023, Red Robin gave its burgers gourmet status under the banner of Turn Up the YUMMM. In addition to this, it launched new entrees, appetizers, beverages and seasonal additions.

Image Source: Zacks Investment Research

Concerns

A decline in margin continues to hurt the company. Red Robin has been witnessing rising costs and expenses in recent quarters. Moreover, the company is investing heavily in several sales-building initiatives like advertising and technical upgrades, which will result in elevated costs. Remodeling, restaurant maintenance and staffing costs will also contribute to rising expenses.

During the third quarter of fiscal 2023, labor costs rose 3.2% year over year to $103.7 million, while as a percentage of restaurant revenues, the metric increased 240 basis points to 38%. The increase was primarily due to investments in hourly and management labor, payroll taxes, and incentive compensation, partially offset by group insurance. For fiscal 2023, the company anticipates commodity inflation to sequentially step down. For the same fiscal year, our model predicts labor costs to increase 5.1% to $463 million year over year.

Zacks Rank & Key Picks

Presently, Red Robin carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Retail-Wholesale sector are:

Arcos Dorados Holdings Inc. ARCO currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 28.3%, on average. The stock has gained 60% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ARCO’s 2023 sales and earnings per share (EPS) suggests a rise of 19.3% and 18.8%, respectively, from the year-ago period’s levels.

Abercrombie & Fitch Co. ANF flaunts a Zacks Rank #1 at present. It has a trailing four-quarter earnings surprise of 713%, on average. Shares of ANF have surged 259.8% in the past year.

The Zacks Consensus Estimate for ANF’s 2023 sales and EPS suggests increases of 12.8% and 2,088%, respectively, from the year-ago period’s levels.

Beacon Roofing Supply, Inc. BECN currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 11.1%, on average. Shares of BECN have gained 39.5% in the past year.

The Zacks Consensus Estimate for BECN’s 2023 sales and EPS indicates 7.2% and 8.2% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report