Red Robin (RRGB) Q2 Loss Wider Than Expected, Stock Down

Shares of Red Robin Gourmet Burgers, Inc. RRGB declined 11.8% during the after-market trading session on Aug 10 following the company’s lower-than-expected second-quarter 2022 results. The operator of a casual dining restaurant chain reported a loss that widened from the year-ago period. It also witnessed a sharp contraction in the restaurant-level operating profit margin. Citing a tough operating environment, sluggishness in industry sales trends and rising commodity prices, management updated full-year guidance. Red Robin trimmed its adjusted EBITDA view.

Earnings & Revenue Picture

Red Robin posted an adjusted loss of 75 cents per share, wider than the Zacks Consensus Estimate of a loss of 12 cents. In the year-ago quarter, RRGB reported an adjusted loss of 22 cents a share. The sharp increase in the net loss was due to higher commodity and wage rate inflation, other charges, repairs and maintenance, utilities and marketing expenses. These were partly offset by higher restaurant revenues and a decline in management incentive compensations as well as group insurance costs.

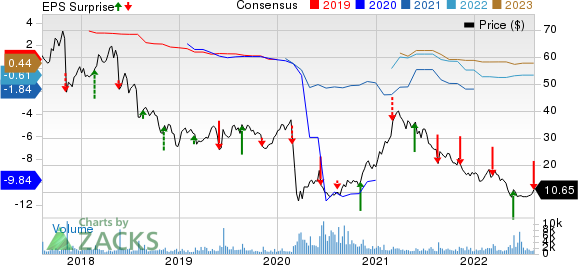

Red Robin Gourmet Burgers, Inc. Price, Consensus and EPS Surprise

Red Robin Gourmet Burgers, Inc. price-consensus-eps-surprise-chart | Red Robin Gourmet Burgers, Inc. Quote

Total revenues of $294.1 million increased 6.2% from the year-ago period. However, the top line fell short of the Zacks Consensus Estimate of $299.1 million. Restaurant revenues, which comprise primarily food and beverage sales, grew 6.1% year over year to $288.7 million, while Franchise royalties, fees and other revenues jumped 12.8% to $5.4 million.

Restaurant revenues increased due to a 6.7% rise in comparable restaurant revenues. However, sales at non-comparable restaurants declined $1.6 million.

We note that comparable restaurant revenues grew due to a 9.6% jump in the average Guest check, partially offset by a 2.9% drop in the Guest count. The rise in the average Guest check can be attributed to a 3.7% increase in the menu mix, a 6% improvement in pricing and a 0.1% decline due to higher discounts. The increase in the menu mix stemmed from limited time menu offerings and higher dine-in sales volumes.

Margins & Costs

The restaurant-level operating profit margin shrunk 210 basis points year over year to 13.6% due to commodity and wage rate inflation, partly offset by sales leverage and other labor costs. Restaurant labor costs (as a percentage of restaurant revenues) contracted 120 basis points to 35.2%, driven by sales leverage as well as lower group insurance and management incentive compensation costs, partly offset by a higher wage rate.

During the quarter, the cost of sales rose 17.4% year over year to $72.7 million, while, as a percentage of restaurant revenues, the metric increased 240 basis points to 25.2%. While other operating costs, as a percentage of restaurant revenues, jumped 80 basis points to 18%, occupancy costs increased 10 basis points to 8%.

Adjusted EBITDA declined to $11.9 million from $19 million in the year-ago quarter.

Other Financial Information

Red Robin ended the quarter with cash and cash equivalents of $50.3 million, long-term debt of $189.4 million and total stockholders’ equity of $61.6 million.

2022 Guidance

Red Robin has been strategically increasing prices to mitigate the impact of inflation while maintaining a strong value proposition at the same time. For 2022, the company expects pricing in the mid-single digit. It foresees mid-double digit commodity cost inflation compared with its prior view of the low double digit. It anticipates restaurant labor cost inflation in the mid-to-high single digit.

Management now envisions full-year SG&A costs in the range of $142 million-$147 million compared with its prior view of $145 million to $155 million. It now expects adjusted EBITDA to be at least $65 million, down from its prior forecast range of $80 million-$90 million.

Red Robin projected full-year capital expenditures between $40 million and $45 million compared with its previously guided range of $40 million-$50 million.

Shares of this Zacks Rank #3 (Hold) company have risen 22% in the past three months compared with the industry’s rise of 14.4%.

Stocks Hogging the Limelight

Here we have highlighted three better-ranked stocks, namely Ruth's Hospitality Group, Inc. RUTH, Costco COST and Dollar Tree DLTR.

Ruth's Hospitality Group, the operator of fine dining restaurants, currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ruth's Hospitality Group’s current financial-year revenues and earnings per share suggests growth of 18.1% and 24.8%, respectively, from the year-ago reported figure. RUTH has a trailing four-quarter earnings surprise of 35.2%, on average.

Costco, which is engaged in the operation of membership warehouses, carries a Zacks Rank #2. COST has an expected earnings per share growth rate of 9.2% for three to five years.

The Zacks Consensus Estimate for Costco’s current financial-year sales and earnings per share suggests growth of 15.4% and 18.2%, respectively, from the year-ago period. COST has a trailing four-quarter earnings surprise of 9.7%, on average.

Dollar Tree operates discount variety retail stores. The stock currently carries a Zacks Rank #2. DLTR has an expected earnings per share growth rate of 15.5% for three to five years.

The Zacks Consensus Estimate for Dollar Tree’s current financial-year revenues and earnings per share suggests growth of 6.7% and 40.5%, respectively, from the year-ago reported figure. DLTR has a trailing four-quarter earnings surprise of 13.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Ruth's Hospitality Group, Inc. (RUTH) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

To read this article on Zacks.com click here.