Red Rock Resorts (RRR) Q2 Earnings Beat Estimates, Revenues Lag

Red Rock Resorts, Inc. RRR reported mixed second-quarter 2023 results, with earnings surpassing the Zacks Consensus Estimate and revenues missing the same. Earnings beat the consensus mark for the 13th straight quarter. The metrics declined on a year-over-year basis.

Following the announcement, shares of the company dropped 2.1% during the after-hours trading session on Aug 3.

Earnings & Revenues

In the quarter under review, adjusted earnings per share (EPS) came in at 65 cents, beating the Zacks Consensus Estimate of 44 cents. In the prior-year quarter, the company recorded adjusted EPS of $1.27.

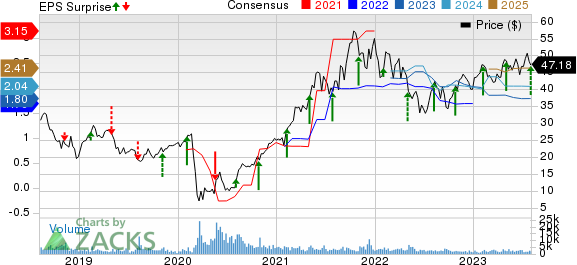

Red Rock Resorts, Inc. Price, Consensus and EPS Surprise

Red Rock Resorts, Inc. price-consensus-eps-surprise-chart | Red Rock Resorts, Inc. Quote

Quarterly revenues of $416.1 million missed the Zacks Consensus Estimate of $418 million and declined 1.5% on a year-over-year basis. Adjusted EBITDA in the quarter was $175.3 million, down 7.2% year over year. Our model estimated the metric to decline 6.4% year over year to $176.7 million.

Segmental Details

Las Vegas Operations: During second-quarter 2023, revenues in the segment totaled $412.6 million, down 1.8% from $420.1 million reported in the prior-year quarter. Our estimate was $414 million. The segment’s adjusted EBITDA was $193.1 million, down 7.1% year over year.

Native American Management: During the quarter under discussion, the company did not report any revenues in the Native American Management segment.

Other Financial Details

As of Jun 30, 2023, Red Rock Resorts had cash and cash equivalent of $100.9 million compared with $117.3 million at 2022-end.

Outstanding debt at the end of the second quarter amounted to $3.2 billion compared with $2.88 billion reported in the year-ago quarter.

Zacks Rank

Red Rock Resorts currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Consumer Discretionary Releases

MGM Resorts International MGM reported impressive second-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Both metrics surpassed the consensus estimate for the third consecutive quarter. Moreover, the top and bottom lines increased on a year-over-year basis.

MGM’s upside was primarily driven by growth in business volume and travel activity, primarily at MGM China and Las Vegas Strip Resorts.

Caesars Entertainment, Inc. CZR reported solid second-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate. The top and the bottom line increased on a year-over-year basis.

Despite a tough year-over-year comparison, CZR benefited from strong leisure and casino demand in Las Vegas and solid digital segment performance. Also, improved marketing capabilities and capital projects delivered solid returns.

Boyd Gaming Corporation BYD reported second-quarter 2023 results, with earnings and revenues beating the Zacks Consensus Estimate. Both metrics surpassed the consensus mark for the 13th straight quarter. Also, the top and bottom lines increased on a year-over-year basis.

BYD’s quarterly results benefited from online gaming and Sky River Casino.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Caesars Entertainment, Inc. (CZR) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report