Reddit Is Going Public Soon. Here's Why That Could Be Good News for Investment Banks.

Reddit, which claims to be "the front page of the internet," will be making its public debut as a stock on March 21. It will be the first significant tech initial public offering (IPO) of the year and could be an important test for prospective companies looking to go public. It'll also be an important barometer for investment banks and could signal an intriguing investing opportunity.

Favorable market conditions could lead to a pickup in IPOs

Over the past few years, IPOs have become quite scarce as companies grappled with rising interest rates and challenging market conditions. In March 2022, the Federal Reserve began aggressively raising its benchmark interest rate to dampen inflationary pressures that were beginning to emerge. Over the next several months, the benchmark federal funds rate rose 525 basis points, major stock market indexes sold off, and newly listed publicly traded companies struggled especially.

This created an unfavorable environment, and companies put their IPO plans on hold until conditions improved. According to consulting firm PwC, the past two years were some of the lowest-volume years for IPOs. After a record year in 2021, when 951 companies went public through IPO, the past two years saw 175 total.

Although it was a slow year, there were some big IPOs in 2023. Semiconductor designer Arm Holdings went public in September at a nearly $55 billion valuation. Other big-name IPOs included Instacart ($10 billion valuation), Birkenstock ($7.5 billion), and Kenvue ($41 billion). Reddit's IPO this month will be valued at around $6.5 billion and could be an important test of how receptive markets are to new listings.

Investment banks could get a big boost

Investment bankers hope 2024 will be a bounce-back year for IPOs. Morgan Stanley (NYSE: MS) and Goldman Sachs (NYSE: GS) are two investment banks working with Reddit on its IPO and eagerly anticipate what will happen next.

Morgan Stanley's investment banking revenue has dropped significantly, down 55% over the past two years. Goldman Sachs has seen a similar drop, with its investment banking revenue falling 56% over two years. These companies have managed to navigate a tough investment banking market through solid trading revenues and wealth management businesses. However, if the appetite for risk returns and IPOs perform well, these stocks could get a big boost.

The fact that leading IPO candidates are returning to the market is positive, showing that companies finally believe they can once again leap into public ownership. The Federal Reserve's putting a pause on interest rate hikes is another positive development. Year-over-year inflation readings have retreated from their high levels in 2022, and many are hopeful that the Fed will achieve a soft landing, bringing down inflation without inducing too much pain on the economy.

A great value opportunity

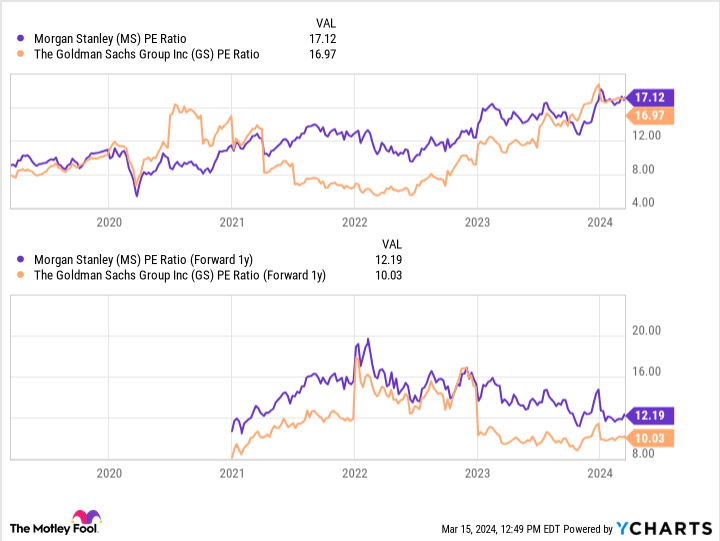

Morgan Stanley and Goldman Sachs are two large investment banks in the U.S. that could be intriguing investment opportunities. Both stocks trade around a price-to-earnings ratio of 17. However, for cyclical stocks, these higher valuations are due to these companies experiencing an earnings slump. In comparison, the investment banks were seemingly cheap in 2021, but that was more due to the surge in earnings that turned out to be a value trap.

Based on their one-year-forward projected earnings, Morgan Stanley and Goldman Sachs are priced at 12.2 and 10 times forward earnings, respectively. Both businesses have navigated a challenging environment for investment banking, and with Reddit's IPO on the way, now could be an excellent time to scoop up these investment banks while they're still cheap.

Should you invest $1,000 in Morgan Stanley right now?

Before you buy stock in Morgan Stanley, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Morgan Stanley wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Courtney Carlsen has positions in Morgan Stanley. The Motley Fool has positions in and recommends Goldman Sachs Group and Kenvue. The Motley Fool recommends the following options: long January 2026 $13 calls on Kenvue. The Motley Fool has a disclosure policy.

Reddit Is Going Public Soon. Here's Why That Could Be Good News for Investment Banks. was originally published by The Motley Fool