Reddit's Sky-High IPO: Too Much Enthusiasm and Overvaluation

Reddit INc. (NYSE:RDDT) completed its initial public offering on March 21. The stock was initially priced at $34 per share. On the first day, its share price skyrocketed a staggering 48.40% to $50.44, valuing the company at more than $8 billion.

I think the market optimism has pushed its share price too high, overvaluing Reddit now.

Growing revenue, but unprofitable

Reddit can be considered a global digital city where people from around the world can join various communities to connect with each other. It is one of the most substantial open archives of human experience, where communities can share ideas, experiences and learn from one another. Trusted content promotes authentic interactions and engagement in the platform. Currently, Reddit has more than 1 billion posts and more than 16 billion comments. In 2023, it received 1.20 million posts and 7.50 million comments daily. By the end of 2023, the platform attracted more than 500 million visitors.

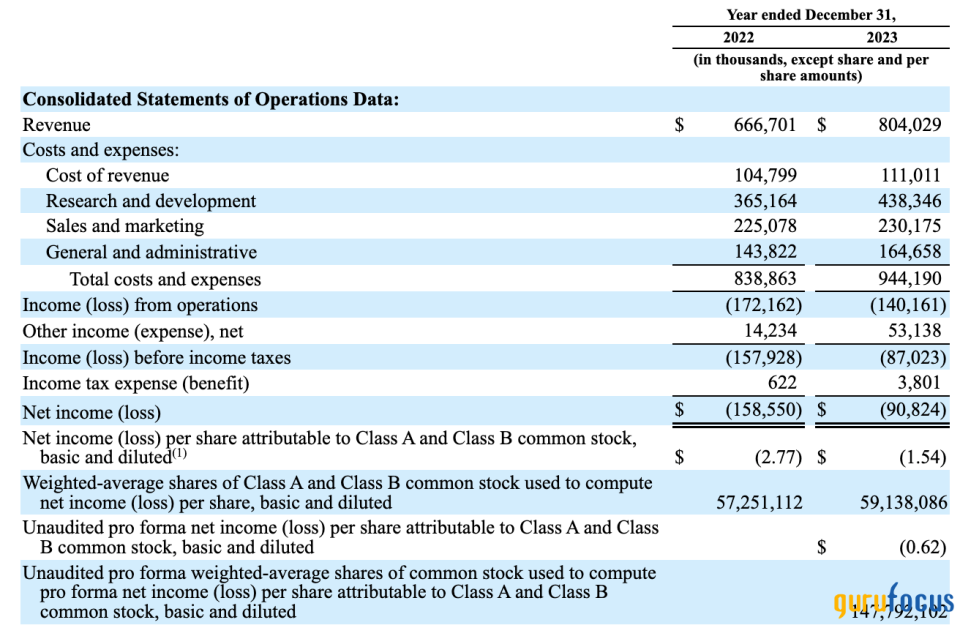

Most of Reddit's revenue comes from advertisments on its website and mobile app. Its revenue experienced a year-over-year increase of 20.60% from $666.70 million in 2022 to $804 million in 2023. The losses before income taxes narrowed from $157.90 million to $87 million over the same period. The operating losses were mainly caused by its high research and development expenses. This suggests the company is committed to investing in innovation to enhance product and service offerings for customers and improve user experiences. In 2023, the research and development expenses accounted for 54.50% of total revenue. Despite nearly two decades of operation, it is quite surprising to me that Reddit is still producing losses and generating negative cash flow . Over the past two years, the operating cash flow remained negative. The 2023 operating cash flow was -$75 million.

Source: Reddit's prospectus

Debt-free balance sheet

Reddit has a decent debt-free balance sheet. As of December 2023, it had $401.2 million in cash and cash equivalents and nearly $812 million in marketable securities, including certificate of deposits, commercial paper, U.S. and non-U.S. government securities and investment-grade corporate and government agency securities. The company has no interest-bearing debt, only $19.50 million in operating lease liabilities. However, it recorded a stockholders' deficit of $412.92 million, mainly due to a staggering $716.56 million in losses it has accumulated over the years.

There are also 73 million outstanding convertible preferred shares with a value of around $1.85 billion. The preferred stock is entitled to noncumulative dividends at an annual rate of 8% of their original issue prices, varying between 21 cents and $4.94 per share. If those 73 million outstanding convertible preferred shares were to be converted into common stock on a one-to-one basis, this would result in a 46% increase in the total number of shares, leading to a significant dilution for current shareholders.

IPO with insiders selling shares

The recent IPO achieve two main objectives: to raise additional capital for the company and to offer liquidity to existing shareholders. Of the 22 million shares available in the IPO, Reddit itself sold 15.30 million shares, while 6.70 million shares are being offered by current shareholders.

Notably, key insiders participated in the offering. CEO Steven Huffman sold 500,000 shares, while Jen Wong, the chief operating officer, sold 514,000 shares. In my view, the decision by insiders to sell shares during the IPO raises concerns and potentially makes the stock less attractive as a buying opportunity.

Significantly overvalued

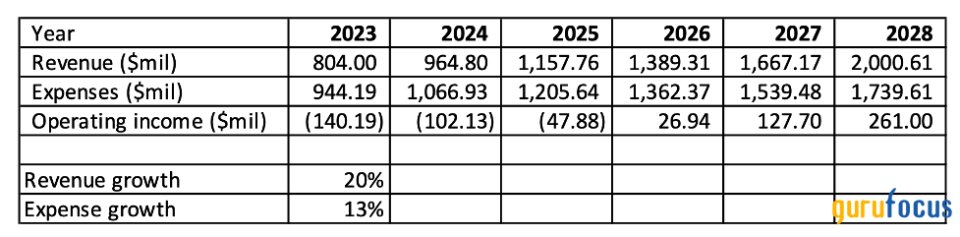

Assuming Reddit's total revenue continues to grow at a rate of 20% annually, while its costs and expenses increase by 13%, the company would be profitable by 2026. Its operating income is expected to reach $261 million by 2028. Applying an optimistic operating income multiple of 30, Reddit's enterprise value would be approximately $7.83 billion.

Source: Author's calculation

Applying a 7% discount rate, Reddit's enterprise value should be worth only $5.50 billion. After adjusting for net cash of $382 million, its equity value would be $5.89 billion. Assuming all convertible preferred shares are converted into common shares, the company's total number of shares would increase to 232 million. Thus, each of Reddit's shares should be worth only $25.35, nearly 50% lower than the current share price.

The bottom line

Reddit's IPO success, with its valuation soaring to $8 billion, highlights investor enthusiasm in the company. Founded in 2005, Reddit has grown into a major online community hub, yet it is still facing financial challenges, including negative cash flows and substantial accumulated losses. The company's aggressive investment in research and developments has not yet led to profitability, and the IPO has raised concerns due to insider selling. My analysis suggests Reddit's market value might be overly optimistic, indicating potential significant overvaluation at its current share price.

This article first appeared on GuruFocus.