Redfin Corp (RDFN) Reports Mixed Results Amidst Market Challenges

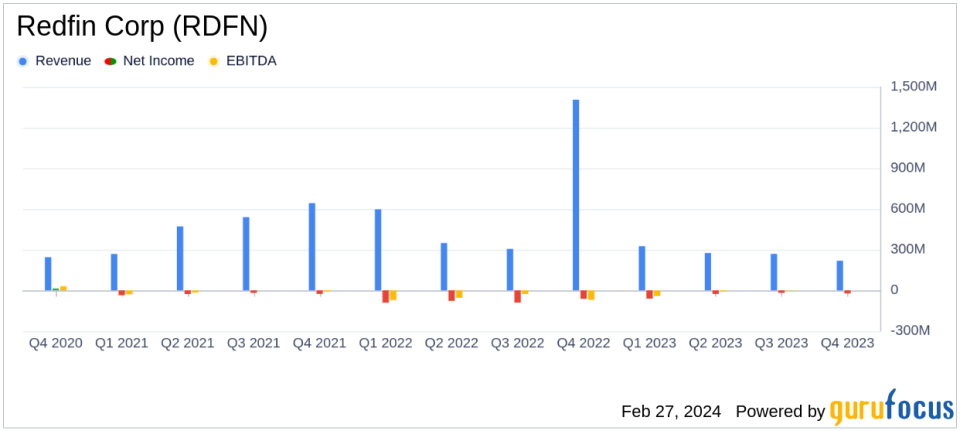

Revenue: Q4 revenue slightly decreased by 2% year-over-year to $218.1 million, while full-year revenue dropped by 11%.

Gross Profit: Q4 gross profit rose by 32% to $73.2 million, with full-year gross profit up by 7%.

Net Loss: Q4 net loss improved to $22.9 million from a net loss of $61.9 million in Q4 2022, with full-year net loss also narrowing.

Adjusted EBITDA: Q4 adjusted EBITDA loss reduced to $13.5 million from $40.2 million in the prior year's quarter.

Market Share: Redfin's market share slightly decreased by 4 basis points to 0.76% of U.S. existing home sales in 2023.

On February 27, 2024, Redfin Corp (NASDAQ:RDFN), a technology-powered real estate company, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. Despite a challenging housing market, the company reported a year-over-year increase in gross profit and a significant reduction in net loss, signaling improvements in operational efficiency.

Redfin Corp is known for integrating technology with human expertise to provide real estate services, mortgage loans, and title and settlement services. The company operates through four segments: real estate services, properties, rentals, and mortgage, with the majority of its revenue stemming from real estate services.

Financial Performance and Challenges

Redfin's fourth-quarter revenue dipped slightly to $218.1 million, a 2% decrease compared to the same period in 2022. However, the company's gross profit saw a substantial increase of 32% year-over-year, reaching $73.2 million. This improvement was driven by a 14% increase in real estate services gross profit and an expansion of the real estate services gross margin to 22.5% from 18.0% in the prior year's quarter. Despite these gains, the company experienced an 11% decrease in full-year revenue, which CEO Glenn Kelman attributed to the "dreadful housing market."

Redfin's net loss for the quarter showed a marked improvement, shrinking to $22.9 million from a net loss of $61.9 million in the fourth quarter of 2022. The full-year net loss also narrowed significantly. Adjusted EBITDA loss for the quarter was $13.5 million, a substantial improvement from the $40.2 million loss in the same quarter of the previous year.

Financial Achievements and Importance

The company's ability to improve gross margins and reduce net loss in a difficult market is a testament to its operational efficiency and cost management. These financial achievements are particularly important for a company in the real estate sector, which has been facing headwinds due to economic uncertainty and fluctuating housing demand.

Key Financial Metrics

Redfin's balance sheet shows a decrease in cash and cash equivalents to $149.8 million from $232.2 million in the previous year. The company also reduced its net loss per share attributable to common stock, diluted, to $0.20 from $0.57 in Q4 2022, and to $1.16 from $2.99 for the full year. These metrics are crucial as they reflect the company's liquidity position and profitability per share, which are key indicators of financial health for investors.

In a dreadful housing market, Redfin got more efficient in the fourth quarter, again improving gross margins and operating margins, even as we laid the foundation for meaningful long-term growth, said Redfin CEO Glenn Kelman.

Analysis of Company Performance

Redfin's performance in the fourth quarter and full year of 2023 demonstrates resilience in the face of a challenging real estate market. The company's strategic initiatives, such as the "Sign & Save" program and the expansion of the Redfin Next agent pay plan, are designed to drive growth and improve customer acquisition. While the company's market share experienced a slight decline, its focus on efficiency and margin improvement positions it well for future recovery in the housing market.

For the first quarter of 2024, Redfin anticipates total revenue between $214 million and $223 million, with a net loss expected to be between $72 million and $65 million. Adjusted EBITDA loss is projected to be between $36 million and $29 million. These forward-looking statements are subject to substantial uncertainty, particularly given the unpredictable nature of the housing market.

For detailed financial tables and further information, readers can refer to Redfin's full earnings release and filings with the SEC.

Investors and those interested in the real estate market can find additional insights and data by visiting GuruFocus.com, where we provide in-depth analysis and up-to-date information on market trends and company performances.

Explore the complete 8-K earnings release (here) from Redfin Corp for further details.

This article first appeared on GuruFocus.