Is Redhall Group plc (AIM:RHL) A Financially Sound Company?

Investors are always looking for growth in small-cap stocks like Redhall Group plc (AIM:RHL), with a market cap of GBP £24.14M. However, an important fact which most ignore is: how financially healthy is the business? Given that RHL is not presently profitable, it’s crucial to assess the current state of its operations and pathway to profitability. I believe these basic checks tell most of the story you need to know. Though, since I only look at basic financial figures, I recommend you dig deeper yourself into RHL here.

Does RHL generate an acceptable amount of cash through operations?

RHL has built up its total debt levels in the last twelve months, from £6M to £9M , which comprises of short- and long-term debt. With this growth in debt, RHL’s cash and short-term investments stands at £1M , ready to deploy into the business. However, its small level of operating cash flow means calculating cash-to-debt wouldn’t be too useful, though these low levels of cash means that operational efficiency is worth a look. For this article’s sake, I won’t be looking at this today, but you can assess some of RHL’s operating efficiency ratios such as ROA here.

Can RHL meet its short-term obligations with the cash in hand?

Looking at RHL’s most recent £9M liabilities, it seems that the business has been able to meet these obligations given the level of current assets of £13M, with a current ratio of 1.42x. For construction and engineering companies, this ratio is within a sensible range as there’s enough of a cash buffer without holding too capital in low return investments.

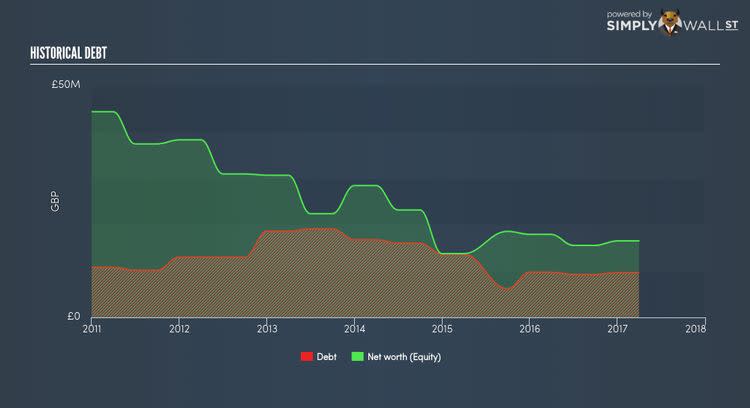

Is RHL’s level of debt at an acceptable level?

With a debt-to-equity ratio of 58.51%, RHL can be considered as an above-average leveraged company. This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. But since RHL is presently unprofitable, sustainability of its current state of operations becomes a concern. Running high debt, while not yet making money, can be risky in unexpected downturns as liquidity may dry up, making it hard to operate.

Next Steps:

Are you a shareholder? At its current level of cash flow coverage, RHL has room for improvement to better cushion for events which may require debt repayment. Though, the company will be able to pay all of its upcoming liabilities from its current short-term assets. Given that RHL’s financial situation may change. I suggest keeping on top of market expectations for RHL’s future growth on our free analysis platform.

Are you a potential investor? Although near-term liquidity isn’t a concern, RHL’s high debt levels on top of poor cash coverage may not be what you’re after in an investment. Though, keep in mind that this is a point-in-time analysis, and today’s performance may not be representative of RHL’s track record. I encourage you to continue your research by taking a look at RHL’s past performance analysis on our free platform in order to determine for yourself whether its debt position is justified.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.