Redmile Group, LLC Boosts Stake in Neoleukin Therapeutics Inc

San Francisco-based investment firm, Redmile Group, LLC (Trades, Portfolio), recently increased its holdings in Neoleukin Therapeutics Inc (NASDAQ:NLTX), a biopharmaceutical company based in the USA. This article provides an in-depth analysis of the transaction, the profiles of both Redmile Group and Neoleukin Therapeutics, and an evaluation of the latter's financial health and industry position.

Details of the Transaction

On July 17, 2023, Redmile Group added 1,064,628 shares of Neoleukin Therapeutics to its portfolio at a trade price of $0.925 per share. This transaction increased Redmile's total holdings in Neoleukin to 2,912,228 shares, representing a 57.62% change. The trade had a 0.04% impact on Redmile's portfolio and increased the firm's holdings in Neoleukin to 6.60%.

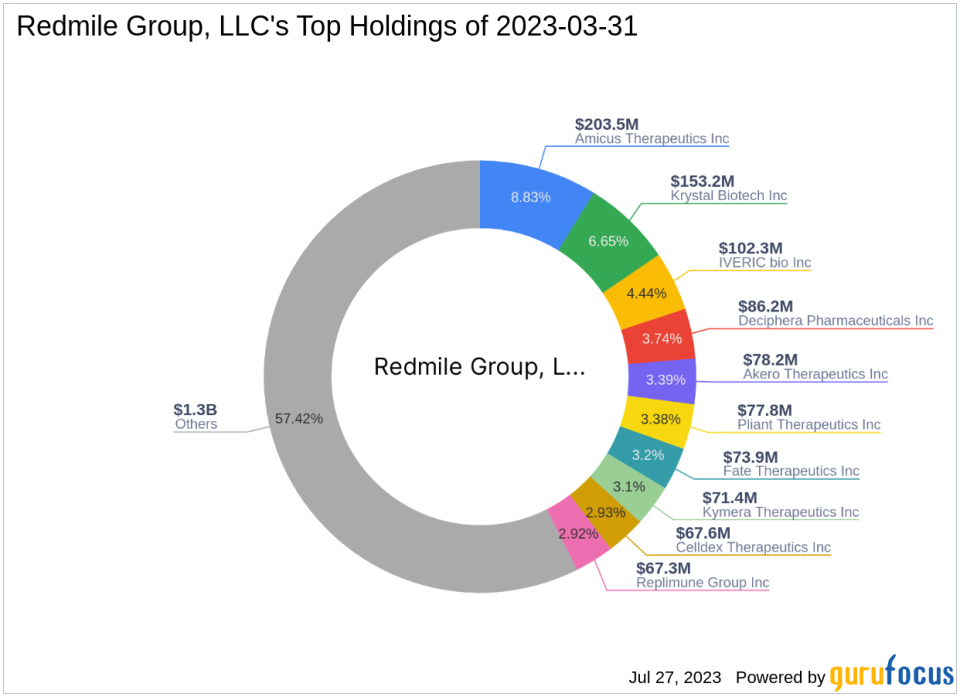

Profile of Redmile Group, LLC (Trades, Portfolio)

Redmile Group, LLC (Trades, Portfolio), located at One Letterman Drive, San Francisco, CA, is an investment firm with a portfolio of 76 stocks. The firm's top holdings include Amicus Therapeutics Inc (NASDAQ:FOLD), IVERIC bio Inc (NASDAQ:ISEE), Krystal Biotech Inc (NASDAQ:KRYS), Deciphera Pharmaceuticals Inc (NASDAQ:DCPH), and Akero Therapeutics Inc (NASDAQ:AKRO). Redmile Group's equity stands at $2.31 billion.

Overview of Neoleukin Therapeutics Inc

Neoleukin Therapeutics Inc, trading under the symbol NLTX, is a biopharmaceutical company that designs proteins for the treatment of serious diseases, including cancer, inflammatory, and autoimmune disorders. The company's product line includes NL-201, a combined IL-2 and IL-15 agonist designed to eliminate alpha receptor binding. Neoleukin has a market capitalization of $29.889 million and went public on March 7, 2014.

Analysis of Neoleukin Therapeutics Inc's Stock Performance

As of July 28, 2023, Neoleukin's stock price stands at $0.679. The stock has experienced a 26.59% decrease since the transaction and a 94.25% decrease since its IPO. However, it has seen a 34.46% increase year-to-date. Due to insufficient data, the GF Valuation and GF Value of the stock cannot be evaluated.

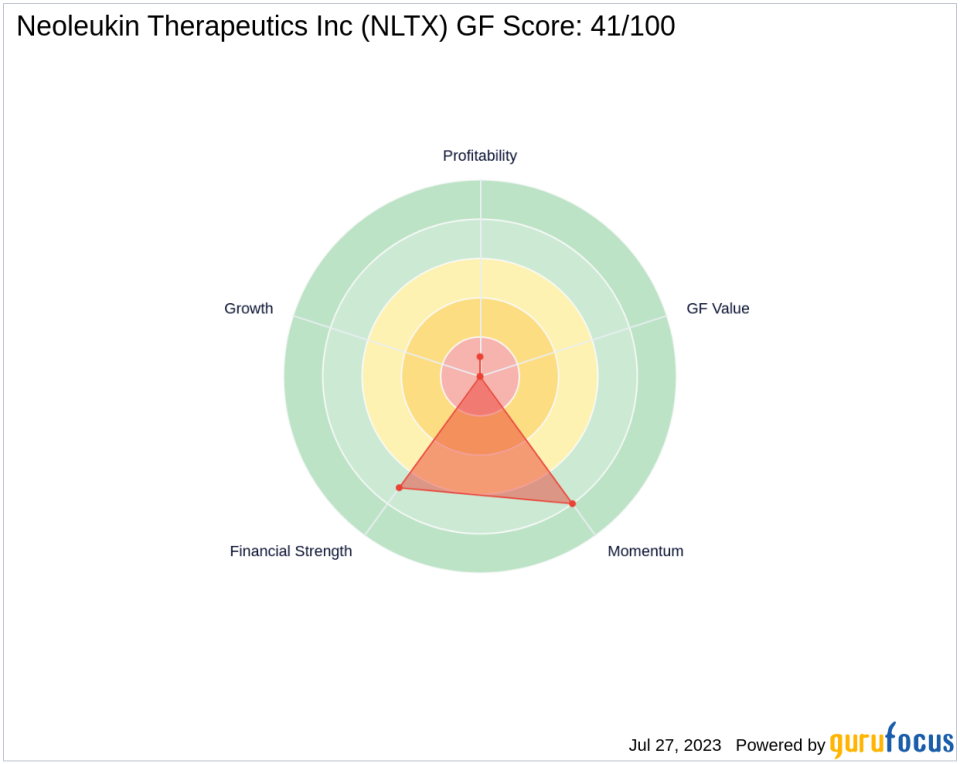

Evaluation of Neoleukin Therapeutics Inc's Financial Health

Neoleukin Therapeutics has a GF Score of 41/100, indicating poor future performance potential. The company's Balance Sheet Rank is 7/10, while its Profitability Rank and Growth Rank stand at 1/10 and 0/10, respectively. Neoleukin has an F Score of 1, a Z Score of 0.00, and a Cash to Debt ratio of 7.14, ranking 811th in this category.

Analysis of Neoleukin Therapeutics Inc's Industry Position

In the biotechnology industry, Neoleukin Therapeutics has a Return on Equity (ROE) of -53.40% and a Return on Assets (ROA) of -44.97%, ranking 806th and 935th, respectively. The company's Gross Margin Growth, Operating Margin Growth, and 3-year EBITDA and Earning Growth are all at 0.00%, except for the EBITDA Growth which stands at -6.80%.

Conclusion

In conclusion, Redmile Group's recent acquisition of Neoleukin Therapeutics shares signifies a notable addition to its portfolio. Despite Neoleukin's current financial health and industry position, the transaction could potentially yield significant returns for Redmile Group, given the firm's investment philosophy and track record. However, value investors should conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.