Redwire Corp (RDW) Reports Significant Improvement in 2023 Financial Results

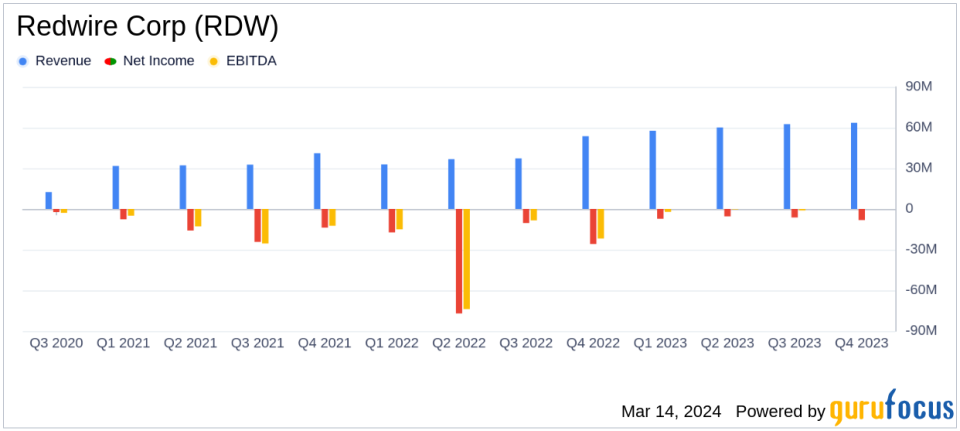

Revenue Growth: Full year 2023 revenues increased by 51.9% to $243.8 million.

Net Loss Improvement: Net loss for the full year 2023 improved by $103.4 million to $(27.3) million.

Adjusted EBITDA: Adjusted EBITDA for the full year 2023 increased by $26.3 million to $15.3 million.

Book-to-Bill Ratio: Fourth quarter book-to-bill ratio stood at 2.81, indicating strong future revenue potential.

Liquidity Position: Total available liquidity was $48.3 million as of December 31, 2023.

Contracted Backlog: Increased by 19.1% year-over-year to $372.8 million as of December 31, 2023.

2024 Revenue Forecast: Redwire forecasts full year revenues of $300 million for 2024.

On March 14, 2024, Redwire Corp (NYSE:RDW) released its 8-K filing, detailing a year of substantial financial growth and operational progress. Redwire Corp, a leader in space infrastructure solutions, has reported a significant increase in its full-year 2023 revenues, a considerable reduction in net loss, and a positive adjusted EBITDA, marking a year of robust financial performance.

Company Overview

Redwire Corp is at the forefront of the next generation space economy, offering mission-critical space solutions and reliable components. With intellectual property in solar power generation and in-space 3D printing and manufacturing, Redwire plays a pivotal role in addressing the complex challenges of future space missions. Its business areas span space commercialization, digitally engineered spacecraft, on-orbit servicing, assembly, and manufacturing, advanced sensors and components, and space domain awareness and resiliency.

Financial Performance and Challenges

The company's financial achievements in 2023 reflect a significant stride towards profitability and operational efficiency. The 51.9% increase in annual revenue to $243.8 million underscores Redwire's expanding market presence and successful execution of its business strategy. The improvement in net loss by $103.4 million to $(27.3) million, coupled with a positive adjusted EBITDA of $15.3 million, demonstrates Redwire's enhanced cost management and growing operational maturity.

Despite these achievements, Redwire faces challenges inherent in the aerospace and defense industry, such as economic uncertainty, supply chain disruptions, and the need for continuous innovation. These challenges could impact future performance if not managed effectively. However, the company's strong book-to-bill ratio of 2.81 in the fourth quarter suggests a healthy pipeline of future revenues, which is critical for sustaining growth in this capital-intensive industry.

Key Financial Metrics

Redwire's balance sheet as of December 31, 2023, shows a solid liquidity position with $30.3 million in cash and cash equivalents and $18.0 million in available borrowings. The contracted backlog, a key indicator of future revenue, stood at $372.8 million, a 19.1% increase from the previous year, signaling potential for continued revenue growth.

Adjusted EBITDA, a measure of the company's operational profitability, turned positive, reaching $15.3 million for the full year, compared to a negative $11.0 million in the prior year. This metric is particularly important as it excludes non-cash expenses and provides a clearer picture of Redwire's operating performance.

Management Commentary

Redwire's management expressed optimism about the company's trajectory. CEO Peter Cannito stated,

During 2023, Redwire achieved four consecutive quarters of revenue growth and positive Adjusted EBITDA. This trend is expected to continue in 2024 with Contracted Backlog of $372.8 million at the start of the year."

Chief Financial Officer Jonathan Baliff added,

Redwire finished 2023 with strong commercial and financial performance in the fourth quarter, recognizing record revenues of $63.5 million and positive Adjusted EBITDA of $1.7 million in Q4 2023."

Analysis and Outlook

Redwire's 2023 performance indicates a company on the rise, with a solid foundation for future growth. The company's focus on scaling production, expanding offerings, and bidding on larger contracts is expected to drive further revenue growth, as evidenced by the forecasted $300 million in revenues for 2024. The financial improvements and strategic contracts, such as the $142 million deal for Roll Out Solar Arrays, position Redwire favorably within the aerospace and defense industry.

Investors and stakeholders can anticipate Redwire's continued momentum, supported by its strong backlog and strategic initiatives. The company's focus on innovation and market expansion is likely to yield further financial improvements and enhance shareholder value.

For a more detailed analysis of Redwire Corp's financial results and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Redwire Corp for further details.

This article first appeared on GuruFocus.