Reflecting On Consumer Internet Stocks’ Q3 Earnings: Overstock (NASDAQ:OSTK)

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Overstock (NASDAQ:OSTK) and the rest of the consumer internet stocks fared in Q3.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 33 consumer internet stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.6% while next quarter's revenue guidance was 1.2% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but consumer internet stocks held their ground better than others, with the share prices up 19.7% on average since the previous earnings results.

Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $373.3 million, down 18.9% year on year, falling short of analyst expectations by 5.8%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

“Over the last three months, we have accelerated efforts to build a company with a bigger, brighter, and bolder future,” said Jonathan Johnson, Chief Executive Officer.

The stock is up 9.7% since the results and currently trades at $16.78.

Read our full report on Overstock here, it's free.

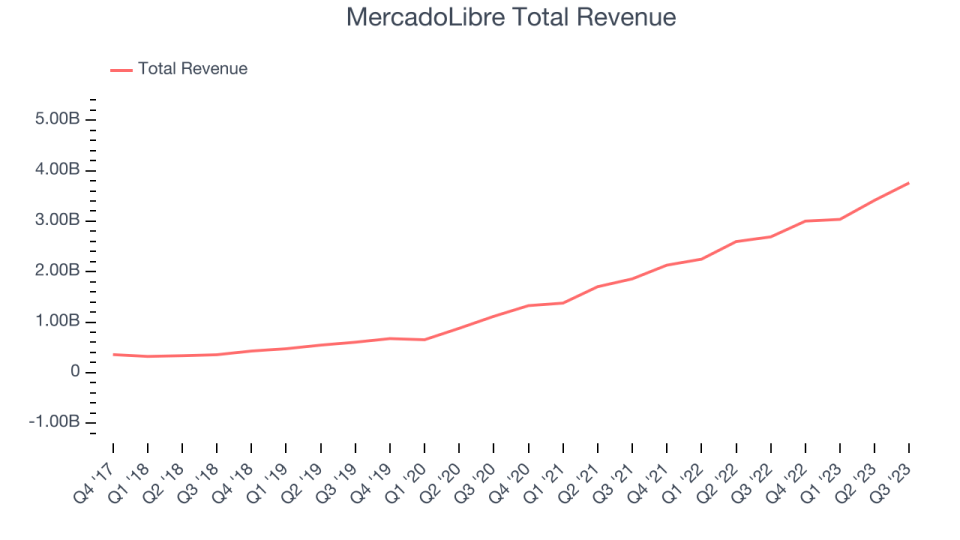

Best Q3: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $3.76 billion, up 39.8% year on year, outperforming analyst expectations by 5.9%. It was a very good quarter for the company, with impressive growth in its user base and exceptional revenue growth.

MercadoLibre scored the fastest revenue growth among its peers. The company reported 120 million daily active users, up 36.4% year on year. The stock is up 36.5% since the results and currently trades at $1,771.91.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $371.8 million, down 25.3% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The stock is up 44.8% since the results and currently trades at $2.39.

Read our full analysis of Angi's results here.

Fiverr (NYSE:FVRR)

Based in Tel Aviv, Fiverr (NYSE:FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $92.53 million, up 12.1% year on year, surpassing analyst expectations by 1.5%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is up 10.4% since the results and currently trades at $26.6.

Read our full, actionable report on Fiverr here, it's free.

Sea (NYSE:SE)

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $3.31 billion, up 4.9% year on year, surpassing analyst expectations by 3.1%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The company reported 40.5 million users, down 21.4% year on year. The stock is down 15.1% since the results and currently trades at $39.09.

Read our full, actionable report on Sea here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned