Reflecting On Specialty Retail Stocks’ Q3 Earnings: Sally Beauty (NYSE:SBH)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Sally Beauty (NYSE:SBH), and the best and worst performers in the specialty retail group.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 7 specialty retail stocks we track reported a mixed Q3; on average, revenues missed analyst consensus estimates by 1.1% while next quarter's revenue guidance was 2.3% above consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but specialty retail stocks held their ground better than others, with the share prices up 17.1% on average since the previous earnings results.

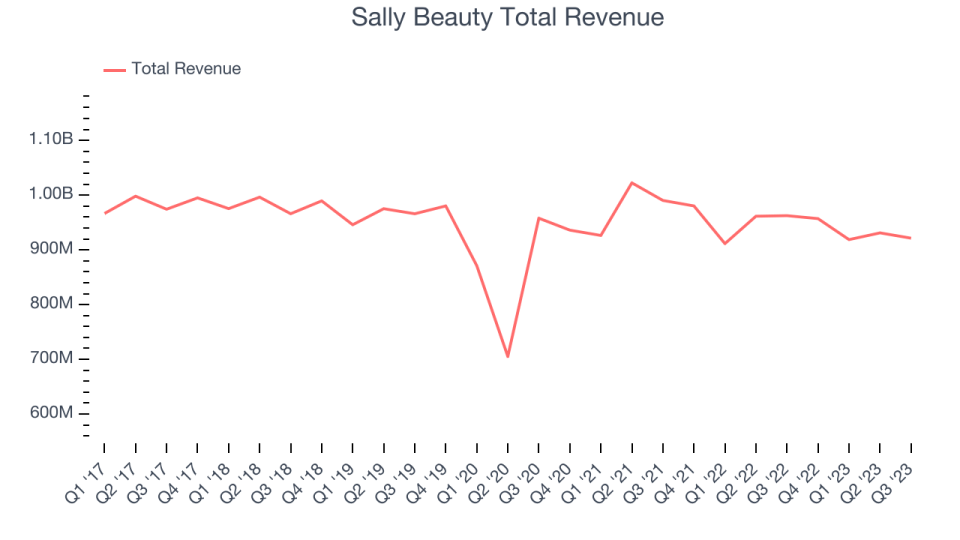

Sally Beauty (NYSE:SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Sally Beauty reported revenues of $921.4 million, down 4.3% year on year, falling short of analyst expectations by 1.1%. It was a slower quarter for the company, with a miss of analysts' earnings and revenue estimates.

“We are pleased to report full year financial results in line with the expectations we laid out at the beginning of fiscal 2023,” said Denise Paulonis, president and chief executive officer.

The stock is up 54.5% since the results and currently trades at $12.56.

Read our full report on Sally Beauty here, it's free.

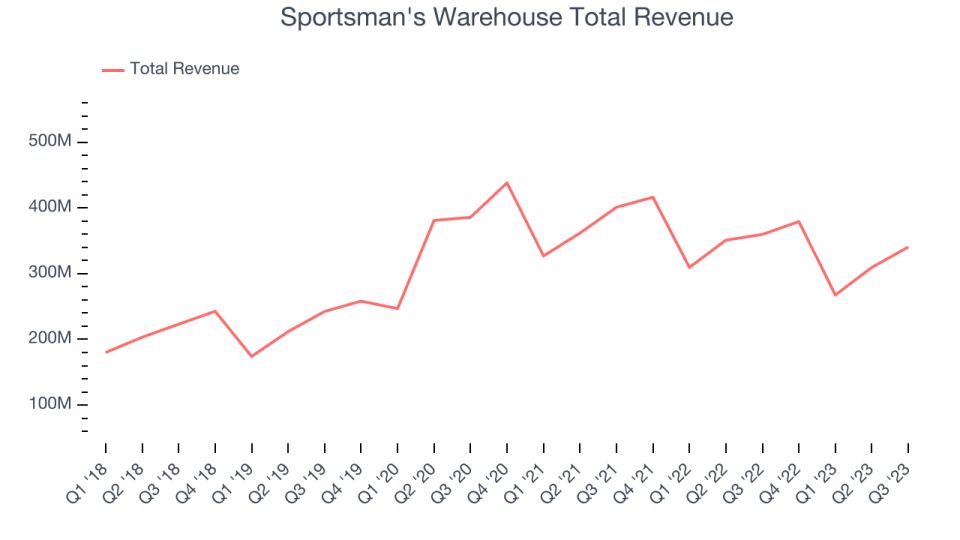

Best Q3: Sportsman's Warehouse (NASDAQ:SPWH)

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ:SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sportsman's Warehouse reported revenues of $340.6 million, down 5.3% year on year, outperforming analyst expectations by 5.1%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings and revenue estimates.

Sportsman's Warehouse delivered the biggest analyst estimates beat among its peers. The stock is down 25.2% since the results and currently trades at $3.98.

Is now the time to buy Sportsman's Warehouse? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Academy Sports (NASDAQ:ASO)

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Academy Sports reported revenues of $1.40 billion, down 6.4% year on year, falling short of analyst expectations by 3%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 30.4% since the results and currently trades at $65.9.

Read our full analysis of Academy Sports's results here.

GameStop (NYSE:GME)

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

GameStop reported revenues of $1.08 billion, down 9.1% year on year, falling short of analyst expectations by 8.8%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates. On the other hand, its revenue unfortunately missed analysts' expectations, driven by worse-than-expected hardware and software sales.

GameStop had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 1.1% since the results and currently trades at $14.68.

Read our full, actionable report on GameStop here, it's free.

Best Buy Co (NYSE:BBY)

With humble beginnings as a stereo equipment seller, Best Buy (NYSE:BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy Co reported revenues of $9.76 billion, down 7.8% year on year, falling short of analyst expectations by 1.4%. It was a slower quarter for the company, with full-year revenue guidance missing analysts' expectations.

Best Buy Co had the weakest full-year guidance update among its peers. The stock is up 7.7% since the results and currently trades at $73.34.

Read our full, actionable report on Best Buy Co here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned