Regeneron (REGN) to Buy Checkmate Pharmaceuticals for $250M

Regeneron Pharmaceuticals, Inc. REGN has announced that it will acquire clinical-stage biopharmaceutical Checkmate Pharmaceuticals, Inc. CMPI for $10.50 per share or $250 million.

The acquisition will add investigational candidate vidutolimod to its pipeline. Vidutolimod is a potential best-in-class TLR9 agonist, with demonstrated clinical responses observed in PD-1 refractory melanoma as monotherapy.

The transaction is expected to close in mid-2022.

Vidutolimod is administered into the tumor and is supposed to induce and expand anti-tumor T cells and induce tumor regression as a monotherapy in patients whose tumors previously progressed on PD-1 checkpoint inhibition.

Vidutolimod is currently being studied in combination with other agents for melanoma, non-melanoma skin cancers, and head and neck cancer.

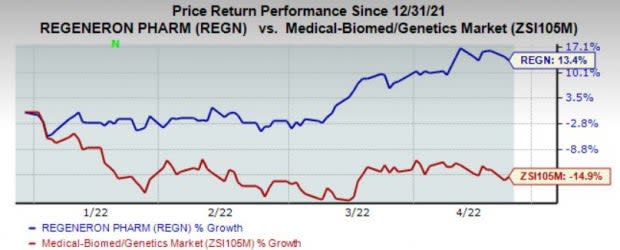

Shares of the company have gained 13.4% in the year so far against the industry’s decline of 14.9%. Shares of Checkmate Pharmaceuticals soared 325.9% on the acquisition news as Regeneron’s offer price of $10.50 represents a 335% premium to CMPI’s closing price of $2.41 on Apr 18.

Image Source: Zacks Investment Research

The acquisition should strengthen Regeneron’s portfolio of diverse and combinable immuno-oncology candidates. We note that Regeneron’s Libtayo is approved for the treatment of patients with metastatic or locally advanced cutaneous squamous cell carcinoma (CSCC) who are not candidates for curative surgery or curative radiation has diversified the portfolio. The drug’s label was recently expanded to include non-small cell lung cancer (NSCLC) and basal cell carcinoma (BCC).

Regeneron’s performance in 2021 was spectacular on the back of the solid performance of key drugs and contribution from the COVID-19 antibody cocktail, REGEN-COV.

However, in January 2022, the FDA revised the authorizations for a few monoclonal antibody treatments, including Regeneron’s REGEN-COV (casirivimab and imdevimab), as data indicated that these treatments are highly unlikely to be active against the Omicron variant. Hence, this will dent sales in 2022 from this stream.

Regeneron has two key growth drivers – Eylea and Dupixent – which should drive growth in 2022 and beyond. Moreover, small tuck-in acquisitions like these strengthen the pipeline of this biotech bigwig, which is sitting on a pile of cash.

Demand for lead ophthalmology drug Eylea (approved for neovascular age-related macular degeneration, diabetic macular edema and macular edema, among others) maintains momentum for the company on strong demand. Regeneron has a collaboration agreement with Bayer BAYRY for Eylea. Recent label expansions into additional indications have boosted sales and should maintain momentum for the drug despite lingering competition. The company is working on expanding the drug’s label further, which should boost performance.

While REGN records net product sales of Eylea in the United States, Bayer records net product sales of the drug outside the country. Regeneron records its share of profits/losses in connection with the international sales of Eylea.

Regeneron has a collaboration agreement with Sanofi SNY for some other drugs like Dupixent and Kevzara. Sanofi records global net product sales of Dupixent, Kevzara and ZALTRAP.

Regeneron records its share of profits/losses in connection with global sales of Dupixent and Kevzara, and Sanofi pays the company a percentage of net sales of ZALTRAP. Strong performance of Dupixent has driven growth for Regeneron in the last couple of years. The drug is approved for moderate-to-severe atopic dermatitis and asthma, among others.

Regeneron’s efforts to bring additional products to the market are impressive. Moreover, these drugs diversify the company’s revenue base.

Regeneron currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Checkmate Pharmaceuticals, Inc. (CMPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research