Regeneron (REGN) Q4 Earnings & Sales Top, Eylea Sales Decline

Regeneron Pharmaceuticals, Inc. REGN delivered better-than-expected fourth-quarter 2023 results, despite declining sales of its lead drug, Eylea (aflibercept). Dupixent maintained its stellar performance, driven by continued strong demand in the approved indications, atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyposis, eosinophilic esophagitis and prurigo nodularis.

The company reported fourth-quarter earnings per share of $11.86, which beat the Zacks Consensus Estimate of $10.43. The year-ago quarter recorded earnings per share of $12.56.

Total revenues in the reported quarter were up 1% year over year to $3.43 billion, which also beat the Zacks Consensus Estimate of $3.26 billion.

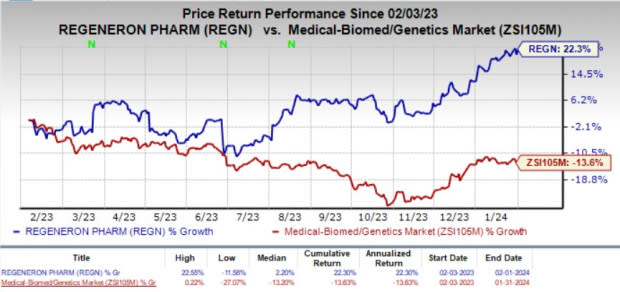

Regeneron’s shares have jumped 22.3% in the past year against the industry’s decline of 13.6%.

Image Source: Zacks Investment Research

Quarterly Highlights

Lead drug Eylea’s sales in the United States were $1.34 billion, down 11% year over year, primarily due to increased competition. Please note that Regeneron co-developed Eylea with the HealthCare unit of Bayer AG BAYRY. Eylea’s sales also missed the Zacks Consensus Estimate of $1.45 billion.

Regeneron records net product sales of Eylea in the United States and Bayer records net product sales of Eylea outside the United States. Regeneron records its share of profits/losses in connection with sales of Eylea outside the United States

In August 2023, the FDA approved Eylea HD (higher dose of Eylea) for the treatment of patients with wet age-related macular degeneration, diabetic macular edema and diabetic retinopathy.

The fourth quarter of 2023 marks the first full-quarter sales of Eylea HD, generating revenues worth $123 million in the United States.

Total revenues include collaboration revenues of $1.37 billion from Sanofi SNY and Bayer, down 13.7% from the $1.59 billion recorded in the year-ago quarter. Total collaboration revenues beat the Zacks Consensus Estimate of $1.35 billion.

Sanofi’s collaboration revenues increased 19% to $1 billion, driven by profits associated with higher Dupixent sales. We note that Sanofi records global net product sales of Dupixent and Kevzara, while Regeneron records its share of profits/losses in connection with global sales of both drugs. Dupixent’s sales soared 31% year over year to $3.22 billion.

Bayer’s collaboration revenues came in at $377 million, up 6% from the year-ago quarter.

Regeneron records net product sales of Praluent in the United States and Sanofi records net product sales of Praluent outside the United States and pays REGN a royalty on such sales. Before Jul 1, 2022, Regeneron recorded net product sales of Libtayo in the United States and Sanofi recorded net product sales of Libtayo outside the United States. Effective Jul 1, 2022, Regeneron records global net product sales of Libtayo outside the United States and pays a royalty to Sanofi on such sales.

Total Libtayo sales came in at $244 million. Praluent’s net sales in the United States came in at $61 million in the reported quarter, up 69% year over year. Kevzara recorded global sales of $112.2 million, up 38% from the year-ago quarter.

REGEN-COV, its antibody cocktail for COVID-19, did not generate any sales in the quarter. Regeneron records net product sales of REGEN-COV in connection with its agreements with the U.S. government, and its partner Roche RHHBY records net product sales of the antibody cocktail outside the United States. Roche and Regeneron share gross profits from global sales based on a pre-specified formula.

Adjusted R&D expenses jumped 13.2% to $1.03 billion, while adjusted SG&A expenses increased 7.5% to $621.8 million in the year-ago quarter.

2023 Results

Total revenues in 2023 were $13.12 billion, which rose 7.8% from the $12.17 billion recorded in 2022, surpassing the Zacks Consensus Estimate of $12.93 billion.

Adjusted diluted earnings per share were $43.79, which declined from the $44.98 recorded in 2022 but beat the Zacks Consensus Estimate of $42.20.

Regeneron Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Regeneron Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Regeneron Pharmaceuticals, Inc. Quote

Pipeline and Regulatory Update

During the reported quarter, Regeneron announced positive results from the phase I/II pivotal study (LINKER-MM1) evaluating its experimental candidate, linvoseltamab,in patients with relapsed/refractory (R/R) multiple myeloma (MM). Linvoseltamab is an investigational BCMAxCD3 bispecific antibody. MM is the second most common blood cancer.

In a separate press release issued today, Regeneron announced the European regulatory body has accepted for review its marketing authorization-seeking application for linvoseltamab to treat adult patients in the EU with R/R MMwho have progressed after at least three prior therapies. The approval-seeking application is based on the positive LINKER-MM1 study data.

A regulatory application was also submitted to the FDA in the United States in December 2023, seeking approval for linvoseltamab to treat the same MM indication.

In January 2024, Regeneron and Sanofi announced that the FDA has approved Dupixent for the treatment of pediatric patients aged one to 11 years, weighing at least 15 kg, with eosinophilic esophagitis (EoE). This approval expands the initial FDA approval for EoE in May 2022 for patients aged 12 years and older, weighing at least 40 kg.

Last month, REGN also announced that the FDA has updated the label for Dupixent for the indication of atopic dermatitis. Per the latest FDA update, efficacy and safety data for patients aged 12 years and older with atopic dermatitis with uncontrolled moderate-to-severe hand and/or foot involvement will be added to the existing label.

Our Take

Regeneron’s fourth-quarter results beat estimates, but Eylea’s sales declined. Eylea sales have been under pressure in the last couple of quarters due to competition from Roche’s Vabysmo.

Nevertheless, the company should benefit from Dupixent’s continued label expansions and solid demand. The approval of Eylea HD is also a great boost, generating incremental revenues for the company. Regeneron’s progress with the oncology portfolio is also impressive.

Zacks Rank

Regeneron currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report