Regeneron (REGN), Sanofi's Dupixent Gets Label Update in US

Regeneron Pharmaceuticals, Inc. REGN and partner Sanofi SNY announced that the FDA has updated the label for Dupixent (dupilumab) for the indication of atopic dermatitis.

Per the latest FDA update, efficacy and safety data for patients aged 12 years and older with atopic dermatitis with uncontrolled moderate-to-severe hand and/or foot involvement will be added to the existing label.

The label update is based on data from the late-stage LIBERTY-AD-HAFT study, which evaluated the efficacy and safety of Dupixent in 133 adult and adolescent (aged 12 to 17 years) patients with atopic dermatitis with moderate-to-severe hand and/or foot involvement who had an inadequate response or intolerance to topical corticosteroids. Patients with hand and foot disease, predominantly driven by allergic or irritant contact dermatitis, were excluded from the trial.

Patients received Dupixent (n=67) (adults 300 mg, adolescents 200 mg or 300 mg based on body weight) or placebo (n=66) every two weeks. Results at the end of week 16 showed that 40% of patients treated with Dupixent achieved clear or almost clear skin on hands and feet compared to 17% achieved with placebo, the primary endpoint. Among the patients treated with Dupixent, 52% saw a clinically meaningful reduction in itch on hands and feet compared to 14% with placebo, the key secondary endpoint.

Per Regeneron and Sanofi, these phase III data are from the first and only trial evaluating a biologic specifically for this difficult-to-treat population. Dupixent’s label has also been updated for the same in the European Union, with regulatory submissions underway in additional countries.

Dupixent has received regulatory approvals around the world for use in certain patients with atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyposis, eosinophilic esophagitis or prurigo nodularis in different age populations.

Dupixent clocked in sales of $8.4 billion in the first nine months of 2023, up 34%. Additional label expansion of the drug will boost sales.

We note that Sanofi records global net product sales of Dupixent and Kevzara, while Regeneron records its share of profits/losses in connection with global sales of both drugs.

Dupixent maintains its stellar performance, driven by continued strong demand in the approved indications. Profits from Dupixent maintain momentum for Regeneron as lead drug Eylea faces challenges.

Over the next few years, Sanofi expects to record low double-digit annual sales growth from Dupixent. The upside is expected to be driven by a potential approval in the chronic obstructive pulmonary disease space, which represents an immense opportunity for the company.

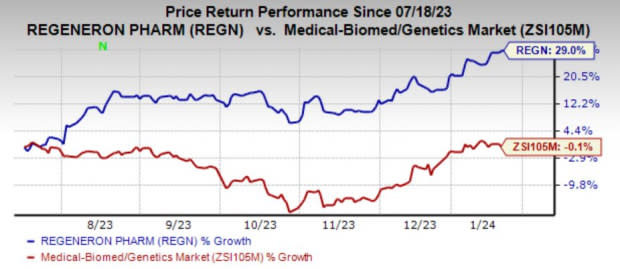

Shares of Regeneron have gained 29% in the past six months against the industry’s decline of 0.1%.

Image Source: Zacks Investment Research

Earlier in the month, Regeneron reported disappointing fourth-quarter preliminary sales for the lead drug Eylea. Sales of Eylea (aflibercept) and Eylea HD (higher dose of Eylea) came in at $1.46 billion in the United States.

Eylea sales came in at $1.34 billion in the United States and Eylea HD sales came in at $123 million in the fourth quarter of 2023. This was the first full quarter for Eylea HD following its launch.

In August 2023, the FDA approved aflibercept 8 mg for the treatment of patients with wet age-related macular degeneration, diabetic macular edema and diabetic retinopathy under the brand name Eylea HD.

Eylea sales have been under pressure in 2023 due to competition from Roche’s RHHBY Vabysmo.

The uptake of Vabysmo has been outstanding. RHHBY designed Vabysmo to block pathways involving Ang-2 and VEGF-A. The European Commission also approved Vabysmo for these indications.

Competition has impacted sales in the fourth quarter as well.

Meanwhile, Regeneron is looking to solidify its presence in the lucrative oncology space.

Regeneron currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Another top-ranked stock in the biotech sector is Puma Biotechnology, Inc. PBYI, which carries the same rank as Regeneron. In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 62 cents to 69 cents. In the past year, shares of PBYI have risen 23.3%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on one occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report