Regional Banks Reeling From Crisis; ETFs Are Holding On

The largest U.S. banks by asset size generally reported robust third-quarter earnings. Although for many of those banks, the strong results may not be clear based on their post-earnings stock-price action. That said, the earnings picture was the complete opposite for most regional banks, many of which are still reeling after the banking crisis earlier this year.

Themes From Q3 Earnings

For the most part, big banks posted positive surprises due to rapidly rising interest rates, but those higher rates had the opposite effect on regional banks. After the collapses of Silicon Valley Bank, First Republic Bank, and Signature Bank earlier this year, many customers made a beeline for the door at their local banks, pulling their deposits out of fear of further collapses.

As a result, many regional banks had to pay higher interest rates to convince customers to keep their money deposited with them. Of course, when banks are forced to pay higher interest rates, their profits take a hit, and when rates have risen so high as fast as they have this year, those hits have been huge.

Beyond high interest rates, other headwinds regional banks have had to deal with include higher Treasury yields, concerns about the possibility of new capital requirements, and other issues around the Federal Reserve’s monetary policy.

A review of many of the earnings reports from regional U.S. banks identified three main themes. The first is that these banks are stashing larger amounts of cash away for protection against possible defaults on business and consumer loans. The second is rising interest income, while the third is modestly increasing average deposit numbers.

Wrap-Up of Q3 Regional Banks Earnings

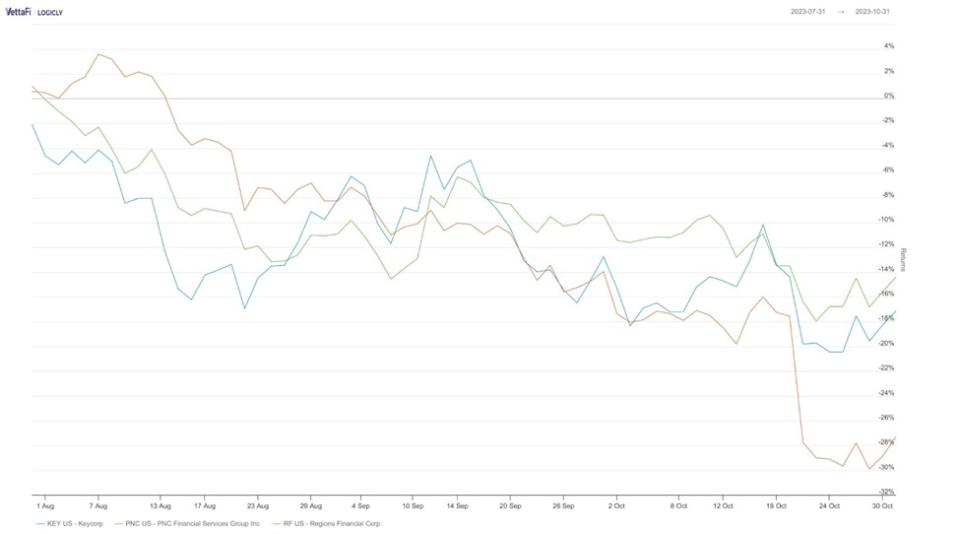

Unfortunately, PNC Financial Services Group (PNC), Regions Financial Corp. (RF), and KeyCorp (KEY) did not see the slight bump in deposits most other regional banks enjoyed during Q3. In fact, PNC reported a 4% decline in deposits as it announced plans to lay off 4% of its workforce on the back of reduced net income since last year.

Additionally, PNC came up a bit short on revenue, reporting $5.2 billion, versus the consensus of $5.3 billion. However, the bank did pull out a beat on earnings, coming in at $3.60 per share versus the consensus of $3.11 per share.

Citizens Financial Group (CFG) saw its profits plummet on falling interest income, although it did record a 2% quarter-over-quarter increase in average deposits. Missing estimates for both earnings and revenue for Q3, the bank reported earnings of 85 cents per share on $2.01 billion in revenue, versus the consensus of 91 cents per share on $2.4 billion in revenue.

KEY, PNC & Regions Performance, July 31, 2023 - October 31, 2023

KeyCorp edged out expectations for the third quarter, reporting earnings of 29 cents per share on $1.57 billion in revenue, versus the consensus numbers of 27 cents per share on $1.56 billion in revenue. Meanwhile, Truist Financial Corp. TFC reported mixed results, with earnings of 80 cents per share and revenue of $5.73 billion, versus expectations of 81 cents per share and $5.7 billion in revenue.

Fifth Third Bancorp FITB smashed earnings estimates and came out slightly ahead on revenue, with 91 cents per share and $2.16 billion in revenue, versus the consensus numbers of 82 cents per share and $2.15 billion. On the other hand, Regions Financial missed earnings expectations by a wide margin, coming in at 49 cents per share versus the estimate of 58 cents per share. The bank reported $1.86 billion in revenue against the consensus of $1.89 billion.

Regional Banks ETFs

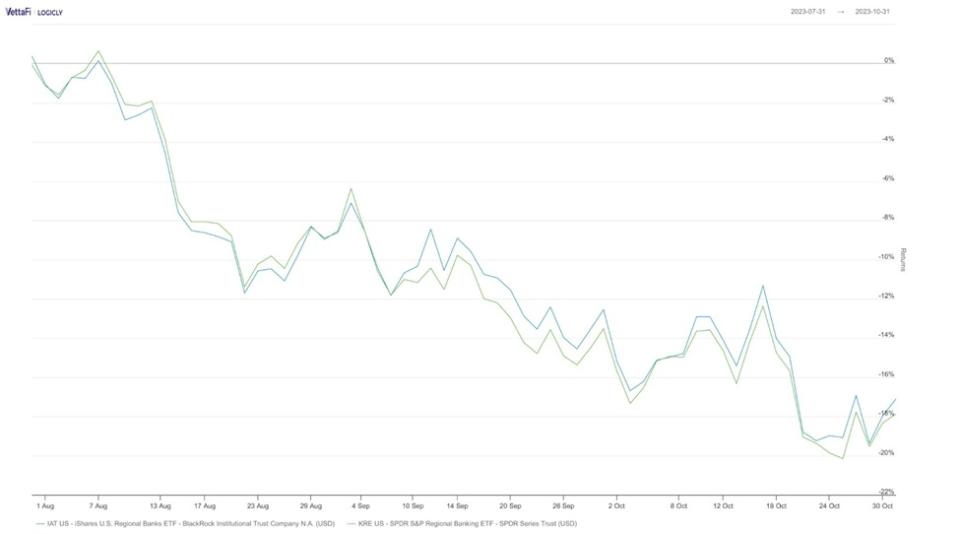

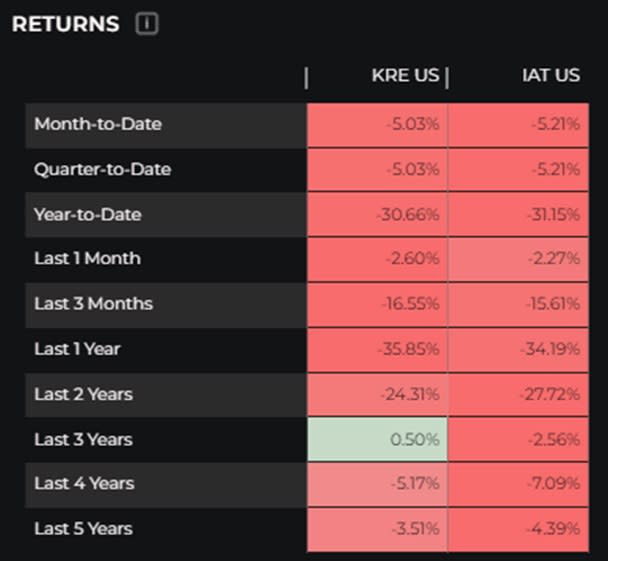

Following about one to two weeks of earnings reports, the bellwether SPDR S&P Regional Banking ETF (KRE A-) was roughly flat for the five-day period ending at midday on October 27. However, it was down by about 3% for the five days that ended at midday on October 24, so it did not take long for the ETF to bounce back from that brief slump.

IAT & KRE Performance, July 31, 2023 - October 31, 2023

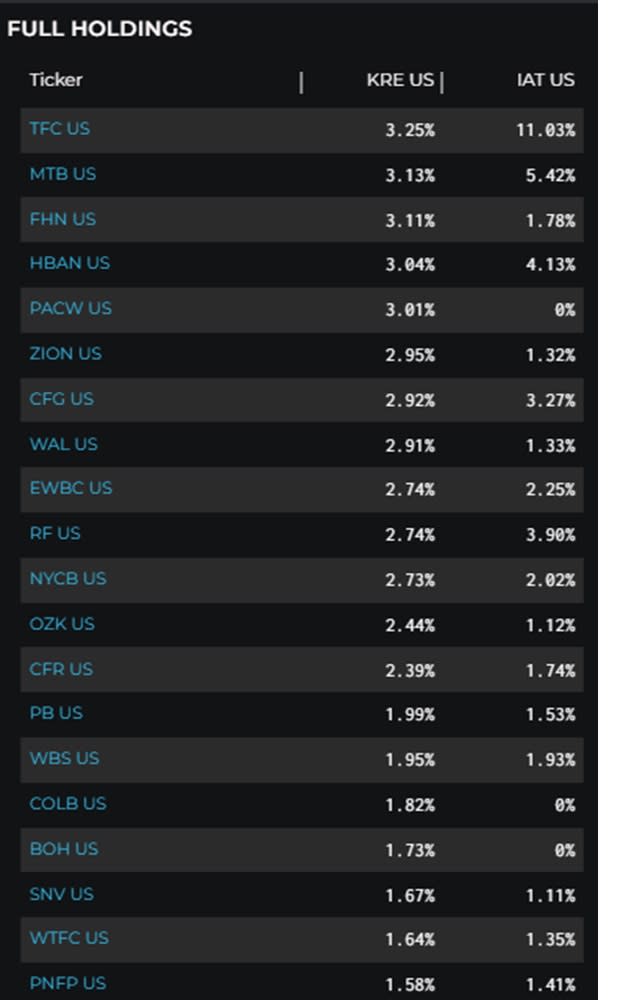

State Street’s KRE serves as a key benchmark for regional U.S. banks, so it’s definitely one to watch. The ETF’s top holdings are Truist Financial, M&T Bank, First Horizon, Huntington Bancshares, Zions Bancorp, Citizens Financial, Western Alliance Bancorp, New York Community Bancorp, Regional Financial, and East West Bancorp.

IAT & KRE Holdings

One other regional banking ETF worth a look is the iShares U.S. Regional Banks ETF (IAT B+), which was down 1% for the last five-day period as of midday on October 27. However, that decline included a 3% decline just on October 27 alone. IAT’s top holdings are U.S. Bancorp, PNC Financial, Truist Financial, M&T Bank, First Citizens Bancshares, Fifth Third Bancorp, Huntington Bancshares, Regions Financial, Citizens Financial, and KeyCorp.

IAT & KRE Returns

Despite the crisis that shuttered a few regional banks earlier this year, most of these banks probably have what it takes to survive. However, an ETF can offer a great way to get a bit of exposure to a long list of regional banks — while spreading the risk across the sector by limiting exposures to small percentages.

All charts via LOGICLY

For more news, information, and analysis, visit VettaFi | ETFDB.