RegTech Market to grow at a CAGR of 21.18% from 2022 to 2027: Growing demand for identifying financial crimes will drive growth - Technavio

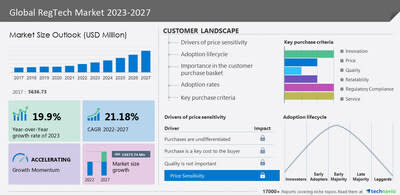

NEW YORK, Aug. 15, 2023 /PRNewswire/ -- The RegTech market size is estimated to grow by USD 15,673.74 million from 2022 to 2027, at a CAGR of 21.18% according to Technavio. Download a sample report now!

Regtech market insights -

Vendors: 15+, Including ACTICO GmbH, Ascent Technologies Inc., Broadridge Financial Solutions Inc., ComplyAdvantage, Confluence Technologies Inc., Acuant Inc., Hummingbird RegTech Inc., Intrasoft Technologies, International Business Machines Corp., MetricStream Inc., Mitratech Holdings Inc., NICE Ltd., RIMES Technologies Corp., SAS Institute Inc., SymphonyAI Sensa LLC, Thomson Reuters Corp., Trulioo Information Services Inc., VERMEG Ltd Legal, Wolters Kluwer NV, and Deloitte Touche Tohmatsu Ltd., among others

Coverage: Parent market analysis; key drivers, major trends, and challenges; customer and vendor landscape; vendor product insights and recent developments; key vendors; and market positioning of vendors

Segments: Component (Solutions and Services), End-user (Large enterprises, Small, and medium enterprises), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

To understand more about the Regtech market, request a sample report

Regtech market - Company Insights

The growing competition in the market is compelling vendors to adopt various growth strategies such as promotional activities and spending on advertisements to improve the visibility of their services. Technavio report analyzes the market's competitive landscape and offers information on several market vendors including ACTICO GmbH, Ascent Technologies Inc., Broadridge Financial Solutions Inc., ComplyAdvantage, Confluence Technologies Inc., Acuant Inc., Hummingbird RegTech Inc., Intrasoft Technologies, International Business Machines Corp., MetricStream Inc., Mitratech Holdings Inc., NICE Ltd., RIMES Technologies Corp., SAS Institute Inc., SymphonyAI Sensa LLC, Thomson Reuters Corp., Trulioo Information Services Inc., VERMEG Ltd Legal, Wolters Kluwer NV, and Deloitte Touche Tohmatsu Ltd.

RegTech Market – Market Dynamics

Key factor driving market growth

The growing demand for identifying financial crimes within financial organizations, owing to increasing fraud, electronic crimes, money laundering, terrorist financing, bribery and corruption, and insider dealing, is driving the growth of the market.

Financial organizations deal with a large volume of data on a daily basis.

RegTech is used for real-time fraud detection and prevention. It enables financial organizations to identify financial crimes in an automated and cost-effective manner.

RegTech uses analytics and cognitive capabilities to analyze financial transactions and provides timely alerts on any potential fraud or illegal transaction.

RegTech also provides end-users with intelligent process automation to increase the speed of routine tasks and minimize human intervention.

These factors will fuel the growth of the market during the forecast period.

Leading trends influencing the market

The integration of AI with RegTech is a key trend in the market.

The adoption of AI improves the identification of patterns and similarities even in unrelated sets of data, which is crucial for delivering insights from these data sets.

AI can process multiple data sets, which include behavior patterns within heterogeneous data sources, such as data gathered from social media and stock market prices.

The combination of AI with RegTech is expected to help end-users with complex pattern matching across data sets and the detection of data anoMalies.

Therefore, the application of AI is increasing in RegTech, which will support the market during the forecast period.

Major challenges hindering the market growth

The lack of a skilled workforce with adequate financial and technical knowledge to work on advanced technological platforms in the BFSI sector will challenge the market growth during the forecast period.

Training the workforce on advanced technologies such as blockchain or cybersecurity can be very expensive and time-consuming.

Banks and other financial institutions are competing with technology companies to hire the best IT workforce and train them on financial regulations and compliance standards.

Therefore, talent management has been the main hindrance for the BFSI sector.

These factors will impede the market growth during the forecast period.

The RegTech market report provides critical information and factual data, with a qualitative and quantitative study of the market based on market drivers and limitations as well as future prospects.

Why Buy?

Add credibility to strategy

Analyzes competitor's offerings

Get a holistic view of the market

Grow your profit margin with Technavio- Buy the Report

What are the key data covered in this RegTech Market report?

CAGR of the market during the forecast period

Detailed information on factors that will drive the growth of the RegTech market between 2023 and 2027

Precise estimation of the size of the RegTech market and its contribution to the market with a focus on the parent market

Accurate predictions about upcoming trends and changes in consumer behavior

Growth of the RegTech market across North America, Europe, APAC, South America, and Middle East and Africa

A thorough analysis of the market's competitive landscape and detailed information about vendors

Comprehensive analysis of factors that will challenge the growth of RegTech market vendors

Gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Related Reports:

The financial service application market is estimated to grow at a CAGR of 7.85% between 2022 and 2027. The size of the market is forecast to increase by USD 54.72 billion. This report extensively covers market segmentation by end-user (large enterprise, small, and medium enterprise), deployment (on-premise and cloud-based), and geography (North America, Europe, APAC, South America, and Middle East and Africa). The increasing government initiatives to digitalize the financial sector are notably driving market growth.

The IoT in banking and financial services market share is expected to increase by USD 7.63 million from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 7.91%. This report extensively covers IoT in banking and financial services market segmentation by component (solutions and services) and geography (North America, Europe, APAC, MEA, and South America). The disintermediation of banking services is notably driving the IoT in banking and financial services market growth.

RegTech Market Scope | |

Report Coverage | Details |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 21.18% |

Market growth 2023-2027 | USD 15,673.74 million |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 19.9 |

Regional analysis | North America, Europe, APAC, South America, and Middle East and Africa |

Performing market contribution | North America at 33% |

Key countries | US, Canada, China, UK, and France |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | ACTICO GmbH, Ascent Technologies Inc., Broadridge Financial Solutions Inc., ComplyAdvantage, Confluence Technologies Inc., Acuant Inc., Hummingbird RegTech Inc., Intrasoft Technologies, International Business Machines Corp., MetricStream Inc., Mitratech Holdings Inc., NICE Ltd., RIMES Technologies Corp., SAS Institute Inc., SymphonyAI Sensa LLC, Thomson Reuters Corp., Trulioo Information Services Inc., VERMEG Ltd Legal, Wolters Kluwer NV, and Deloitte Touche Tohmatsu Ltd. |

Market dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of contents

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation by Component

7 Market Segmentation by End-user

8 Customer Landscape

9 Geographic Landscape

10 Drivers, Challenges, and Trends

11 Vendor Landscape

12 Vendor Analysis

13 Appendix

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/regtech-market-to-grow-at-a-cagr-of-21-18-from-2022-to-2027-growing-demand-for-identifying-financial-crimes-will-drive-growth---technavio-301899901.html

SOURCE Technavio