This REIT Is Playing by Its Own Rules -- and Winning

W.P. Carey (NYSE: WPC) is a net lease real estate investment trust (REIT), much like the better-known Realty Income (NYSE: O). But while there are material similarities between the two companies, there are also a number of very important differences -- and the differences that set Carey apart might also make it a far more attractive income stock for some investors. Here's how Carey plays by its own rules, and why that may be just right for your portfolio.

The net lease thing

Realty Income and Carey, along with many other net lease companies, own properties for which lessees pay most of the operating costs. It's a fairly low-risk business that's often more like a financing transaction than a typical rental arrangement. In fact, it's normal for a company with property to sell it to an REIT like Carey and then instantly rent it back under a long-term lease.

Image source: Getty Images

The ultimate goal of the transaction is for the lessee to free up capital that can be used for other purposes (and not locked up in the ownership of a property). The money it gets from the sale can go to anything from an acquisition to internal expansion to simply shoring up the balance sheet. These are often important assets, so the company is happy to sign a long-term lease. Carey, meanwhile, earns the spread between its cost of capital and the lease rate, with minimal costs involved with owning the property. It's a win/win in most cases.

In this way, all net lease REITs are pretty similar. But Carey's path has taken some twists and turns. For example, it was at one point structured as a limited partnership. It is now a REIT. It also owned a material asset management business that created and managed non-traded REITs. It is in the process of shuttering that business, which only represents a small portion of revenue at this point.

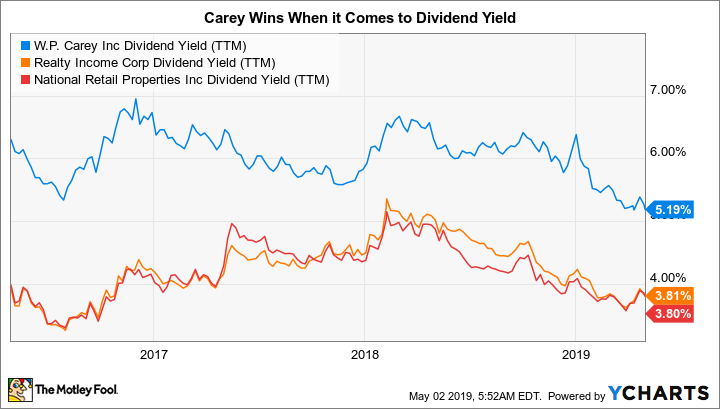

These are two of the reasons why investors may not be aware of Carey despite its impressive history of returning value to shareholders via regular dividend increases. With a 22-year streak of annual hikes, it can hold its own dividend-wise with Realty Income (27 years) and National Retail Properties (NYSE: NNN) (29 years). That's especially true when you add in the fact that Carey's 5.2% yield is well above the 3.7% and 3.6% available from Realty Income and National Retail Properties, respectively.

That said, there are some other differences that set Carey apart.

This big difference won't change

With Carey having adopted the REIT structure and refocused on net lease property ownership, it's conceptually a pretty simple company at this point. It's not much different from its peers, except for one big thing: It has long focused on diversification. This differentiation takes two main shapes.

Net Lease Portfolio Rental Diversification | |||

|---|---|---|---|

Property Type | W.P. Carey | Realty Income | National Retail Properties |

Office | 25% | 4% | -- |

Industrial | 23% | 12% | -- |

Warehouse | 20% | -- | -- |

Retail | 18% | 82% | 100% |

Other | Roughly 13% | 2% | -- |

Data source: W.P. Carey, Realty Income, and National Retail Properties

First, Carey's portfolio is spread among many different property types. Office makes up roughly 25% of rents, industrial 23%, warehouse 20%, retail 18%, and "other" the rest. Compare that to National Retail, where retail properties make up 100% of rents. Or Realty Income, where retail is roughly 82% of rents, industrial 12%, office 4%, and agricultural (vineyards) 2%. The interesting thing about Realty on this score is that it has increasingly ventured into areas that Carey has been in for years.

The second big difference is that Carey has a globally diversified business. National Realty is basically focused on the U.S market. Realty Income just recently inked a deal with a U.K. grocery chain, which puts its foreign exposure (excluding Canada) at around 2%. Europe makes up roughly a third of Carey's business, and it's been there for years.

Carey's broad diversification fits very well with its opportunistic approach to the business. It prefers to buy assets directly from companies (and not on the secondary market) so it can have a say in the lease terms of a deal. This often leads to better terms for Carey. It's easier to do this if Carey can ink deals across a broad spectrum of property types and geographic regions -- and it is the primary thing that sets Carey apart from competitors.

Two examples here will help. Toward the end of the 2007-2009 recession, Carey inked a deal with The New York Times (NYSE: NYT) to buy a portion of its headquarters for $225 million. That cash provided The Times with much needed cash as it dealt with the impact of the internet on its business. The deal allows The Times to buy the asset back for $250 million after 10 years (in 2019), which it is likely to exercise. If Carey refused to look at office properties, it wouldn't have been able to do this deal. Moreover, Carey was making a long-term bet that The Times was a strong enough brand to adjust and thrive, something that was far from certain at that point -- but is fairly obvious today. The worst-case scenario, meanwhile, would have left Carey with a desirable New York City office property. This is part of the company's maverick approach.

WPC Dividend Yield (TTM) data by YCharts

But there's another angle to consider here, too. While retail assets make up roughly 18% of Carey's portfolio, only 4% of the portfolio is in U.S. retail. The rest is located in Europe. Carey has long believed that the United States has too much retail, and that the risks outweigh the rewards. Europe, on the other hand, has much less retail property, and has historically represented a better opportunity. Once again, the company wouldn't be able to shift gears like that without broad diversification. And that U.S./Europe allocation decision was opportunistic, as it put shareholder money where management believed the best values lived.

If you are looking at net lease REITs, look at Carey

One fascinating thing to notice here is that Realty Income, the bellwether net lease REIT, is increasingly looking like W.P. Carey. While Realty gets most of the attention, however, investors appear to be giving Carey the cold shoulder. That's a mistake for a company with over two decades of annual dividend hikes behind it and a yield that handily beats those of Realty and National Retail.

If you are looking at the net lease space, you should put Carey at the top of your list. Yes, its history is a bit more complicated, but it's worth getting to know this high-yielding REIT if you are trying to maximize the income your portfolio generates.

More From The Motley Fool

Reuben Gregg Brewer owns shares of W. P. Carey. The Motley Fool recommends The New York Times. The Motley Fool has a disclosure policy.