Reliance Steel & Aluminum (RS) to Buy American Alloy Steel

Reliance Steel & Aluminum Co. RS has signed a definitive agreement to purchase all of American Alloy Steel, Inc.'s outstanding equity interests and related real estate assets.

American Alloy operates five service centers and a plate fabrication business in the United States. It also has a joint venture in Canada. It supplies to customers in the United States, Canada and Mexico, as well as certain foreign markets, and serves military, infrastructure, power generating, utility, refining, petrochemical and mining applications.

The addition of American Alloy will broaden Reliance Steel's value-added processing capabilities in areas such as burning, cutting, rolling and bevelling. American Alloy's annual net sales for the 12 months ended Dec 31, 2023, were roughly $310 million.

American Alloy expands Reliance Steel's product portfolio with specialty carbon steel plates as well as new production capabilities. The company expects to continue growing the American Alloy business, particularly in value-added processing, as well as leveraging collaboration efforts to broaden the product and service offerings of both American Alloy and the existing Reliance companies.

The transaction is scheduled to be completed within the next 60 days, pending regulatory approval and customary closing conditions. The present American Alloy team, including management, is likely to stay in place following the transaction closure. The terms of the deal were not disclosed.

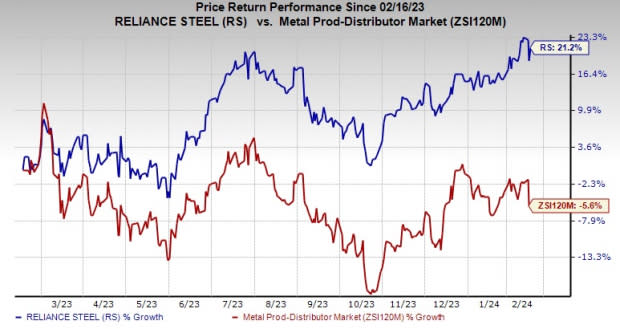

Shares of Reliance Steel have gained 21.2% over the past year against a 5.6% fall of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Reliance Steel currently carries a Zacks Rank #2 (Buy).

Better-ranked stocks in the basic materials space include United States Steel Corporation X, Carpenter Technology Corporation CRS and Alpha Metallurgical Resources Inc. AMR.

United States Steel carrying a Zacks Rank #1 (Strong Buy). X beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 54.8%. The company’s shares have soared 56.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have soared 22.1% in the past year.

The Zacks Consensus Estimate for AMR’s current-year earnings has been revised upward by 69% in the past 60 days. It currently carries a Zacks Rank #1. AMR delivered a trailing four-quarter earnings surprise of roughly 9.6%, on average. AMR shares are up around 129.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report