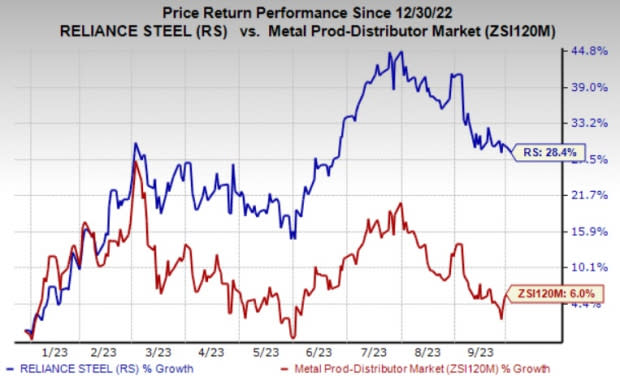

Reliance Steel (RS) Up 28% YTD: What's Driving the Stock?

Reliance Steel & Aluminum Co.’s RS shares have gained 28.4% year to date. The company has also outperformed its industry’s rise of 6% over the same time frame. Moreover, it has topped the S&P 500’s 11.7% rise over the same period.

Let’s dive into the factors behind this Zacks Rank #3 (Hold) stock’s price appreciation.

Image Source: Zacks Investment Research

What’s Aiding RS?

Reliance Steel is benefiting from strong underlying demand in its major markets. It envisions healthy demand to continue in most of its end markets in the third quarter of 2023.

Demand in non-residential construction, the company’s biggest market, increased in the second quarter. Based on the current customer state and backlogs, the company remains cautiously optimistic that non-residential construction activity in the sectors in which it participates will continue to be healthy in the third quarter.

Reliance Steel is also seeing higher demand for toll processing services for the automobile market. Its position in the automotive sector, together with recent advances in car production and the ongoing trend to increased aluminum content, gives the company confidence that demand for its toll processing services will remain strong in the third quarter.

Commercial aerospace demand also remained substantial in the second quarter. RS expects commercial aerospace demand to improve further in the third quarter as build rates grow from 2022 levels. Moreover, demand in Reliance Steel's aerospace business's military, defense and space segments remained robust, with substantial backlogs. The trend is projected to continue in the third quarter.

The company has been following an aggressive acquisition strategy for a while as part of its core business policy to drive operating results. The acquisitions of Rotax Metals, Admiral Metals and Nu-Tech Precision Metals are in sync with its strategy of investing in high-quality businesses. The acquisition of Southern Steel Supply also expands the company’s reach in the Southern United States and boosts its value-added processing services.

Reliance Steel also remains committed to boost returns to shareholders. RS returned $132.5 million to its stockholders during the second quarter of 2023 through dividends and the repurchases. It generated $295.1 million in cash flow from operations in the quarter, owing to its strong profitability and good working capital management. Reliance Steel, in Feb 2023, also increased its quarterly dividend by 14.3% to $1.00 per share.

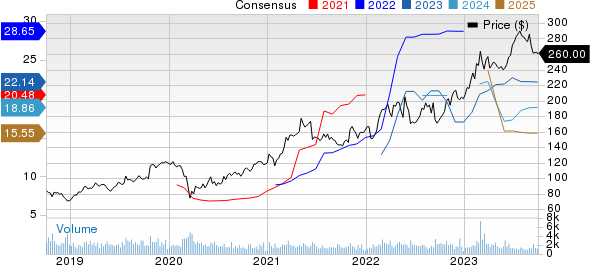

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. price-consensus-chart | Reliance Steel & Aluminum Co. Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and Alamos Gold Inc. AGI.

Hawkins has a projected earnings growth rate of 18.9% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has a trailing four-quarter earnings surprise of roughly 25.6%, on average. HWKN shares are up around 52% in a year.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #2 (Buy).

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 86% over the past year.

Alamos Gold currently carries a Zacks Rank #2. The Zacks Consensus Estimate for AGI's current-year earnings has been revised 7.5% upward over the past 60 days.

The Zacks Consensus Estimate for current fiscal-year earnings for Alamos Gold is currently pegged at 43 cents, implying year-over-year growth of 53.6%. AGI shares have rallied around 36% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report