Relmada Therapeutics Inc CEO Sergio Traversa Acquires 100,000 Shares

In a recent transaction on January 31, 2024, CEO Sergio Traversa of Relmada Therapeutics Inc (NASDAQ:RLMD) purchased 100,000 shares of the company's stock, according to a SEC Filing. The transaction has been officially filed with the Securities and Exchange Commission.

Relmada Therapeutics Inc is a clinical-stage biotechnology company focused on developing novel versions of proven drug products together with new chemical entities that potentially address areas of high unmet medical need in the treatment of pain. The company aims to provide therapies that are both safer and more efficacious than existing opioid analgesics.

Insider buying and selling activities are closely watched by investors as they can provide insights into a company's internal perspective. An insider purchase can suggest that the company's executives and directors are confident in the business's future prospects, while insider sales might indicate the opposite. However, these transactions can also be influenced by personal financial decisions and thus do not always reflect the company's performance or future outlook.

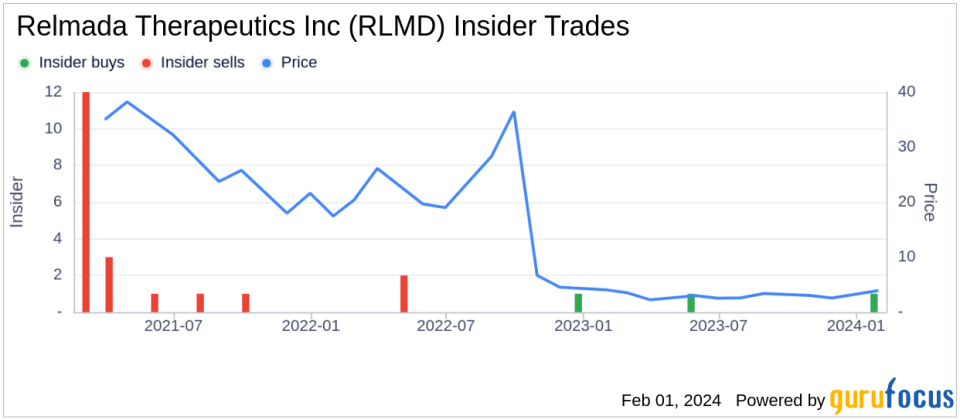

Over the past year, the insider, CEO Sergio Traversa, has engaged in the purchase of 100,000 shares in total and has not sold any shares. This latest acquisition is part of a pattern of insider buying activity at Relmada Therapeutics Inc, with a total of 4 insider buys recorded over the past year and no insider sales during the same period.

On the date of the insider's recent share acquisition, shares of Relmada Therapeutics Inc were trading at $3.87 each, giving the company a market capitalization of $136.95 million.

The insider transaction history and the current valuation of Relmada Therapeutics Inc are significant data points for investors. The company's market capitalization and share price, along with the insider buying trends, can provide a context for the insider's investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.