Remitly Global Inc (RELY) Reports Robust Growth in 2023 with Active Customer Base Expanding by 41%

Active Customers: Grew to 5.9 million in Q4, a 41% increase year over year.

Send Volume: Rose to $11.1 billion in Q4, marking a 38% increase year over year.

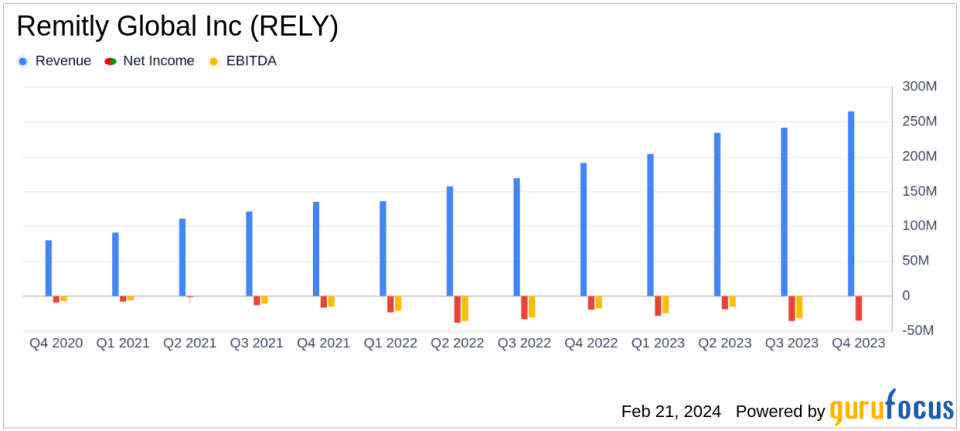

Revenue: Increased by 39% year over year in Q4, totaling $264.8 million.

Net Loss: Widened to $35.0 million in Q4 from $19.4 million the previous year.

Adjusted EBITDA: Improved to $8.2 million in Q4, up from $7.5 million year over year.

2024 Financial Outlook: Expects total revenue between $1,225 million to $1,250 million, with continued net loss but Adjusted EBITDA in the range of $75 million to $90 million.

On February 21, 2024, Remitly Global Inc (NASDAQ:RELY), a leading provider of digital financial services, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for facilitating international money transfers for immigrants, reported a significant increase in its active customer base, send volume, and revenue, indicating strong market demand for its services.

Remitly Global Inc (NASDAQ:RELY) supports cross-border transactions worldwide, generating revenue through transaction fees and foreign exchange spreads. The company's digital platform aims to provide quick, reliable, and cost-effective money transfer services.

Financial Performance and Challenges

The company's performance in 2023 was marked by substantial growth in key areas. Active customers surged to 5.9 million, a 41% increase from the previous year, while send volume rose by 38% to $11.1 billion. Revenue followed suit, climbing by 39% to $264.8 million for the quarter. For the full year, revenue reached $944.3 million, a 44% increase from 2022. This growth reflects Remitly's success in attracting and retaining customers, a critical factor for its business model.

However, Remitly's net loss widened to $35.0 million in the fourth quarter, from a net loss of $19.4 million in the same period last year. The full-year net loss also increased slightly to $117.8 million from $114.0 million. Despite these losses, the company's Adjusted EBITDA showed improvement, turning positive at $44.5 million for the year, a significant shift from the negative $13.6 million in 2022. This metric is important as it provides insight into the company's operational efficiency and underlying profitability, excluding non-cash expenses and one-time items.

Financial Achievements and Industry Impact

The positive Adjusted EBITDA and revenue growth are notable achievements for Remitly, as they demonstrate the company's ability to scale its operations while managing costs. In the competitive fintech industry, where customer acquisition and retention are paramount, Remitly's growth in active users is a testament to the strength of its product offering and market position.

Key Financial Metrics

Remitly's balance sheet reflects a solid financial position with $323.7 million in cash and cash equivalents at the end of 2023, up from $300.6 million the previous year. The company's ability to manage its liquidity is crucial for supporting its growth initiatives and maintaining customer trust.

For the year ahead, Remitly forecasts revenue growth of 30% to 32%, with total revenue expected to be between $1,225 million and $1,250 million. Although the company anticipates remaining in a net loss position, it projects a substantial increase in Adjusted EBITDA, setting a range of $75 million to $90 million for 2024.

Conclusion and Outlook

Remitly's 2023 performance highlights its potential in the digital financial services space, with significant growth in customers and revenue. The company's focus on customer satisfaction and expansion into new markets bodes well for its future, despite the challenges of a widening net loss. Investors and stakeholders will be watching closely to see if Remitly can continue its growth trajectory while moving towards profitability in the coming year.

For a more detailed analysis of Remitly Global Inc (NASDAQ:RELY)'s financial results and future outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Remitly Global Inc for further details.

This article first appeared on GuruFocus.