REMX: The Only Route for Rare Earth Investing

Rare earths aren’t really so rare. What’s tough to find is a way for investors to place bets on the metals.

Many of the leading commodities trade on futures exchanges worldwide, and the most liquid have ETF and ETN products that track the price action.

These metals only trade in the physical market, and when it comes to investing, the VanEck Rare Earth/Strategic Metals ETF (REMX) is the only game in town for investors looking for exposure.

Critical for Tech

A 2019 article in Scientific American pointed out that a U.S. Geographical Survey describes the metals as “relatively abundant in the Earth’s crust.” A group of seventeen metallic elements, including the fifteen lanthanides on the periodic table, scandium, and yttrium, makes up the rare earth metals. Rare earths are the commodities of today and tomorrow because their properties make them critical for technological advances.

Rare earths have unusual fluorescent, conductive, and magnetic properties, making them critical when alloyed or mixed in small quantities with more common metals such as iron. Chances are, many of the products we use daily and rely on for security and energy contain rare earth metals. The demand for these metals is only rising with technological advances.

China controls the vast majority of rare earth metal production, processing, and distribution through mining within its borders and strategic worldwide investments.

China distributed nearly four times as many rare earth metals as the U.S., the second-leading producing and distributing country, in 2021.

EPA Rules Limit US Progress

As rare earths are crucial commodities, the U.S. has taken action to secure a more significant market share in the international market. In a 2022 fact sheet, the Biden-Harris administration announced measures to ensure and expand the U.S.’s rare earth element supply chain. The U.S. Department of State is encouraging allies, partners, and commercial industry to enhance collaboration to “prioritize advancement of rare earth processing capabilities.”

One of the primary issues precluding rare earth metal processing is that mining wastewater can acidify the surrounding soil and groundwater. Mining solid waste can produce radioactive materials and heavy metal contamination, harming the environment. The U.S. and Europe have taken a far greener path toward energy and mining than China, which has permitted Chinese dominance of market. The irony is that processing the metals that are crucial ingredients for environmental initiatives involves ecological hazards.

REMX: Mining and Processing

While China dominates rare earth metals, other U.S. and international companies are mining and processing metals. The top holdings of REMX include leading Chinese, U.S., Australian and other miners and processors. On Nov. 21, REMX held 41.31% of its assets in Australian miners, 23.48% in Chinese miners, and 14.86% in U.S. rare earth companies.

At just below $90 per share, REMX had over $722 million in assets under management and trades an average of over 105,000 shares daily. REMX charges a 0.53% management fee, but the $5.89 dividend translates to a 6.57% yield.

Buying Opportunity?

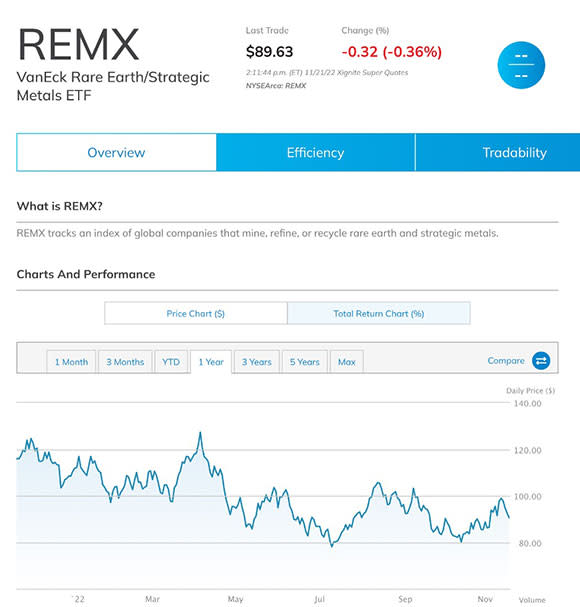

On April 4, REMX traded to a high of $127.50 and closed at $127.41 per share.

(For a larger view, click on the image above)

The chart shows at $89.65 on Nov. 21, REMX has corrected 30% from the most recent peak. Those looking for exposure to the technological commodities of today and tomorrow have few, if any, investment choices. REMX is a product that holds the companies that produce and process rare earths.

Rare earths are not only commodities that support technology; they are critical for national security as relations with China have deteriorated, increasing the potential for supply shortages over the coming years.

Recommended Stories