ReneSola (SOL) Acquires Europe-Based Solar Developer Emeren

ReneSola Ltd SOL recently announced the strategic acquisition of the U.K.-based utility-scale solar power and battery project developer in Europe, Emeren Limited.

With this acquisition, ReneSola aims to expand its footprint in Europe and capitalize on the growing trend of renewables in the region. The transaction involves an all-cash deal with an earn-out provision.

Benefits of the Acquisition

ReneSola has been co-developing ground-mounted solar and storage projects in collaboration with Emeren in Italy since 2021. The latest acquisition enhances ReneSola’s project pipeline in Europe by 2.5 gigawatts (GW), which comprises 2 GW of solar projects and more than 500 megawatts (MW) of storage projects.

Apart from project add-ons, ReneSola gets an opportunity to tap the growth of the European solar market, where the regulatory environment is currently favorable. Also, due to supply shortage in this region, increased solar power purchase agreement prices are expected to act as a catalyst for the company to expand its footprint in Europe through Emeren’s acquisition.

Moreover, the expertise and in-depth experience of Emeren should expand ReneSola’s presence in Europe and assist in creating value for its business. Also, the company expects the acquisition to be accretive to its EBITDA generation instantly.

Considering the aforementioned factors, one may safely conclude that the acquisition is likely to boost ReneSola’s growth trajectory in the European region and put the company a step ahead toward achieving its 100 MW of solar projects in Europe by mid-2023.

Peer Moves

Acquisition is one of the keys for companies to create strategic value in their businesses and augment their business strength. In this context, apart from Rene Sola, solar companies that engage in the acquisition strategy to stimulate their growth trajectory are as follows:

In October 2022, Enphase Energy ENPH completed its GreenCom Networks AG acquisition. The technical capabilities of the development team at GreenCom Networks will help accelerate Enphase’s home energy management solutions globally.

The Zacks Consensus Estimate for Enphase Energy’s 2022 earnings suggests a growth rate of 69.7% from the prior-year reported figure. ENPH has surged 50.7% in the past year.

In June 2022, Canadian Solar’s CSIQ subsidiary, Recurrent Energy, announced the acquisition of two standalone energy storage projects from Black Mountain Energy Storage. The projects are each anticipated to store up to 200 megawatt-hours of energy.

The Zacks Consensus Estimate for Canadian Solar’s 2022 earnings indicates a growth rate of 135.4% from the prior-year reported figure. CSIQ has rallied 8.4% in the past three months.

In October 2021, SunPower SPWR acquired Blue Raven Solar to quickly expand in the solar market and serve more customers in underpenetrated areas, including the Northwest and Mid-Atlantic regions.

The Zacks Consensus Estimate for SunPower’s 2022 earnings is pegged at 28 cents per share, which implies a growth rate of a solid 300% from the prior-year reported figure. SPWR shares have appreciated 24.3% in the past three months.

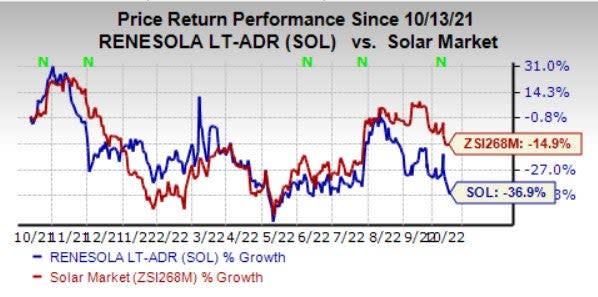

Price Movement

In the past year, shares of ReneSola have dropped 36.9% compared with the industry’s 14.9% decline.

Image Source: Zacks Investment Research

Zacks Rank

ReneSola currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Renesola Ltd. (SOL) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research