Repare Therapeutics Inc (RPTX) Reports Financial Outcomes for Q4 and Full Year 2023

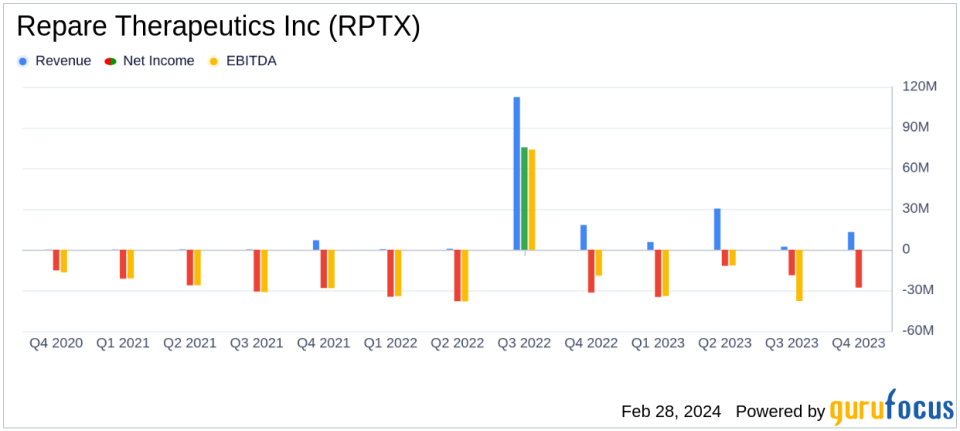

Revenue: Reported a decrease to $13.0 million in Q4 and $51.1 million for the full year, compared to the previous year.

Net Loss: Increased net loss to $28.0 million in Q4 and $93.8 million for the full year.

Research and Development Expenses: R&D expenses rose to $35.3 million in Q4 and $133.6 million for the full year.

General and Administrative Expenses: G&A expenses slightly increased to $8.6 million in Q4 and $33.8 million for the full year.

Liquidity Position: Cash, cash equivalents, and marketable securities totaled $223.6 million as of December 31, 2023.

Operational Milestones: Advanced clinical programs and received a $40 million milestone payment from Roche.

Collaboration Termination: Roche to terminate collaboration agreement with Repare in May 2024.

On February 28, 2024, Repare Therapeutics Inc (NASDAQ:RPTX) released its 8-K filing, detailing the financial results for the fourth quarter and the full year ended December 31, 2023. The precision oncology company, which specializes in developing synthetic lethality-based therapies for cancer patients, has reported a year of significant clinical progress despite facing financial headwinds.

Financial Performance and Strategic Highlights

Repare Therapeutics Inc (NASDAQ:RPTX) reported a decrease in revenue from collaboration agreements, which stood at $13.0 million for the fourth quarter and $51.1 million for the full year, compared to $18.2 million and $131.8 million for the same periods in 2022, respectively. This decline was attributed to lower deferred revenue recognized from the Roche collaboration and the BMS collaboration. Despite this, the company received a $40 million milestone payment from Roche, which contributed to its cash reserves of $223.6 million as of the end of 2023.

The company's net R&D expenses increased to $35.3 million in the fourth quarter and $133.6 million for the full year, primarily due to higher personnel-related costs and direct external costs related to the progress of their lunresertib clinical program. G&A expenses also saw a slight increase to $8.6 million in the fourth quarter and $33.8 million for the full year, mainly due to higher personnel-related costs.

Repare Therapeutics Inc (NASDAQ:RPTX) reported a net loss of $28.0 million, or $0.67 per share, for the fourth quarter, and a net loss of $93.8 million, or $2.23 per share, for the full year. This compares to a net loss of $31.7 million, or $0.75 per share, and $29.0 million, or $0.69 per share, for the same periods in 2022, respectively.

Operational Progress and Future Outlook

Throughout 2023, Repare Therapeutics Inc (NASDAQ:RPTX) made substantial progress in advancing its clinical programs. The company presented positive data from its ongoing Phase 1 MYTHIC trial evaluating lunresertib and announced a partnership with Debiopharm to explore the clinical synergy of Debio 0123, a WEE1 inhibitor, with lunresertib. Additionally, initial clinical data from the TRESR and ATTACC trials evaluating camonsertib were presented, showcasing a favorable safety and tolerability profile.

However, Repare received notice from Roche of their decision to terminate the collaboration agreement, effective May 2024. This will result in Repare regaining global development and commercialization rights for camonsertib from Roche.

Looking ahead to 2024, Repare Therapeutics Inc (NASDAQ:RPTX) plans to initiate a Phase 1/1b clinical trial of lunresertib and Debio 0123 in the first half of the year. The company also expects to report initial data from several trials, including the MINOTAUR trial evaluating lunresertib in combination with FOLFIRI, and the MAGNETIC trial evaluating lunresertib in combination with gemcitabine.

Repare Therapeutics Inc (NASDAQ:RPTX) believes that its current cash reserves are sufficient to fund its operations into mid-2026, providing a solid runway for continued research and development efforts.

Conclusion

Repare Therapeutics Inc (NASDAQ:RPTX) has demonstrated resilience in the face of financial challenges, maintaining a strong focus on advancing its clinical programs and strategic partnerships. The company's commitment to innovation in precision oncology and its robust cash position underscore its potential to deliver value to patients and investors alike.

For more detailed information about Repare Therapeutics Inc (NASDAQ:RPTX) and its financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Repare Therapeutics Inc for further details.

This article first appeared on GuruFocus.