Repay Holdings Corp (RPAY) Reports Mixed Q4 and Full Year 2023 Results

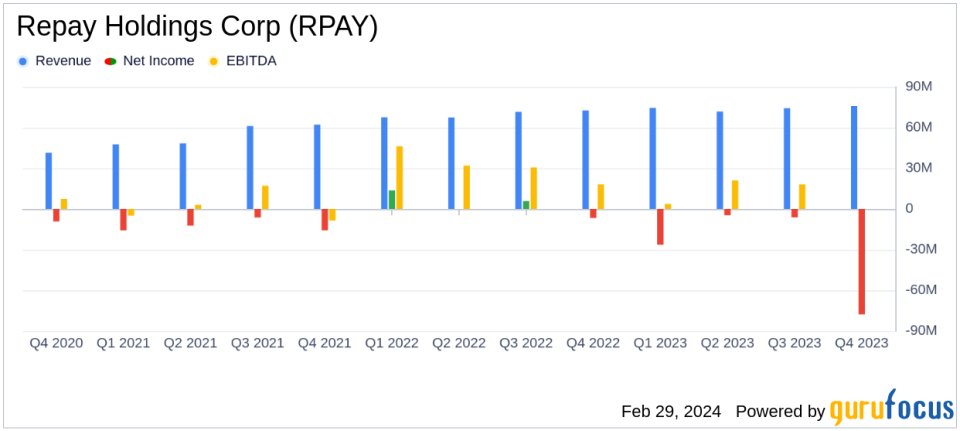

Revenue: Q4 revenue increased by 5% year-over-year to $76.0 million.

Gross Profit: Q4 gross profit rose by 2% year-over-year to $58.7 million.

Net Loss: Q4 reported a significant net loss of $77.7 million, impacted by a goodwill impairment loss.

Adjusted EBITDA: Q4 Adjusted EBITDA decreased by 7% year-over-year to $33.5 million.

Free Cash Flow Conversion: 2024 outlook anticipates an improvement to approximately 60%.

Card Payment Volume: Q4 card payment volume decreased by 3% year-over-year.

On February 29, 2024, Repay Holdings Corp (NASDAQ:RPAY) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of integrated payment processing solutions, reported a 5% increase in Q4 revenue year-over-year, reaching $76.0 million, and a 6% full-year gross profit growth. However, the quarter was marked by a significant net loss of $77.7 million, primarily due to a $75.7 million goodwill impairment loss.

Repay Holdings Corp operates in two segments: Consumer Payments and Business Payments, offering solutions such as debit and credit card processing, ACH processing, and other electronic payment acceptance solutions. The company's performance is critical as it provides insights into the payment processing industry's trends and the adoption of electronic payment solutions.

Financial Performance and Challenges

The company's card payment volume for Q4 2023 was $6,421.0 million, a 3% decrease from the same period last year. Despite this, RPAY saw a 13% year-over-year normalized organic gross profit growth in Q4 and for the full year. The Consumer Payments segment experienced approximately 13% organic gross profit growth year-over-year, while the Business Payments segment saw approximately 25% normalized organic gross profit growth year-over-year.

CEO John Morris commented on the results, stating,

We closed out the year seeing the continued demand from existing clients adopting more payment capabilities, and new clients demonstrating the need for our powerful payment technology. REPAY delivered solid performance in the fourth quarter, with normalized organic revenue and gross profit growth of 14% and 13%, respectively."

However, the net loss in Q4, influenced by the goodwill impairment loss, raises concerns about the valuation of the company's acquired assets and potential future profitability challenges.

2024 Outlook and Strategic Focus

CFO Tim Murphy provided an outlook for 2024, emphasizing an acceleration in free cash flow conversion. Murphy stated,

In 2024, we expect Adjusted EBITDA to grow faster than gross profit, and we also expect to reduce capital expenditures, leading to an acceleration of cash conversion."

This focus on cash conversion is important as it indicates the company's ability to turn profits into cash flow, a key metric for investors.

For the full year 2024, RPAY expects revenue to be between $314 - $320 million, gross profit between $245 - $250 million, and Adjusted EBITDA between $139 - $142 million.

Analysis of Financial Statements

The Balance Sheet shows that as of December 31, 2023, RPAY had cash and cash equivalents of $118.1 million, an increase from $64.9 million the previous year. The company's total assets stood at $1.52 billion, while total liabilities were $689.0 million. The increase in cash and cash equivalents is a positive sign, indicating improved liquidity.

The Income Statement reveals that the costs of services (exclusive of depreciation and amortization) for Q4 were $17.3 million, contributing to the gross profit margin of 77%. Selling, general, and administrative expenses were $36.7 million for the quarter.

The Cash Flow Statement indicates that net cash provided by operating activities for the year was $103.6 million, with capital expenditures totaling $63.4 million, leading to a Free Cash Flow Conversion rate that is expected to improve in 2024.

Overall, while Repay Holdings Corp faced significant challenges in Q4 2023, the company's strategic focus on cash conversion and continued growth in its gross profit suggest potential for recovery and growth in the coming year.

For further details and to access the full earnings report, please visit the 8-K filing.

Investors and interested parties can also join the conference call hosted by CEO John Morris and CFO Tim Murphy to discuss the Q4 and full year 2023 financial results.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Repay Holdings Corp for further details.

This article first appeared on GuruFocus.