Repertoire Partners LP Reduces Stake in Portman Ridge Finance Corp

On October 9, 2023, Repertoire Partners LP (Trades, Portfolio) executed a significant transaction, reducing its holdings in Portman Ridge Finance Corp (NASDAQ:PTMN). This article provides an in-depth analysis of the transaction, the profiles of both Repertoire Partners LP (Trades, Portfolio) and Portman Ridge Finance Corp, and the potential implications of this move.

Details of the Transaction

Repertoire Partners LP (Trades, Portfolio) reduced its stake in Portman Ridge Finance Corp by 544,911 shares, a change of -46.28%. The transaction, executed at a trade price of $19.15 per share, had an impact of -11.15% on Repertoire Partners LP (Trades, Portfolio)'s portfolio. Following the transaction, Repertoire Partners LP (Trades, Portfolio) holds 632,414 shares of Portman Ridge Finance Corp, representing 14.56% of their portfolio and 6.65% of Portman Ridge Finance Corp's total shares.

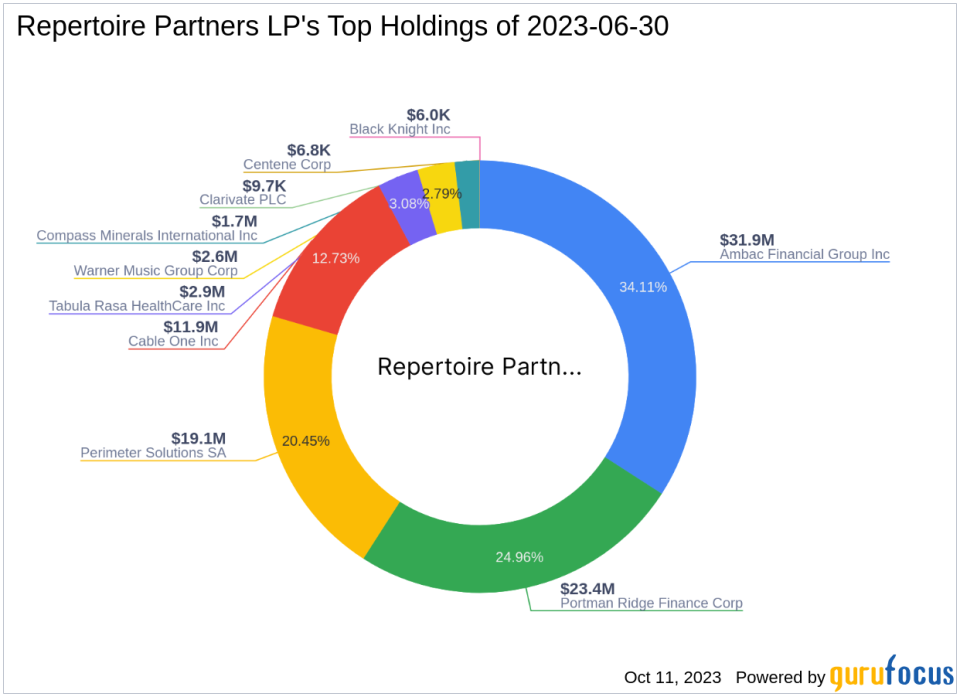

Profile of Repertoire Partners LP (Trades, Portfolio)

Repertoire Partners LP (Trades, Portfolio) is a New York-based investment firm with a portfolio of 13 stocks, valued at $94 million. The firm's top holdings include Ambac Financial Group Inc (NYSE:AMBC), Portman Ridge Finance Corp (NASDAQ:PTMN), Tabula Rasa HealthCare Inc (NASDAQ:TRHC), Cable One Inc (NYSE:CABO), and Perimeter Solutions SA (NYSE:PRM). The firm primarily invests in the Financial Services and Basic Materials sectors.

Overview of Portman Ridge Finance Corp

Portman Ridge Finance Corp is a non-diversified closed-end investment company based in the USA. The company's primary objective is to generate current income and capital appreciation by lending directly to privately-held middle-market companies. It invests in senior secured term loans and mezzanine debt primarily in privately-held middle market companies, asset management companies, and debt and subordinated securities. The company's market capitalization stands at $176.861 million, with a current stock price of $18.67.

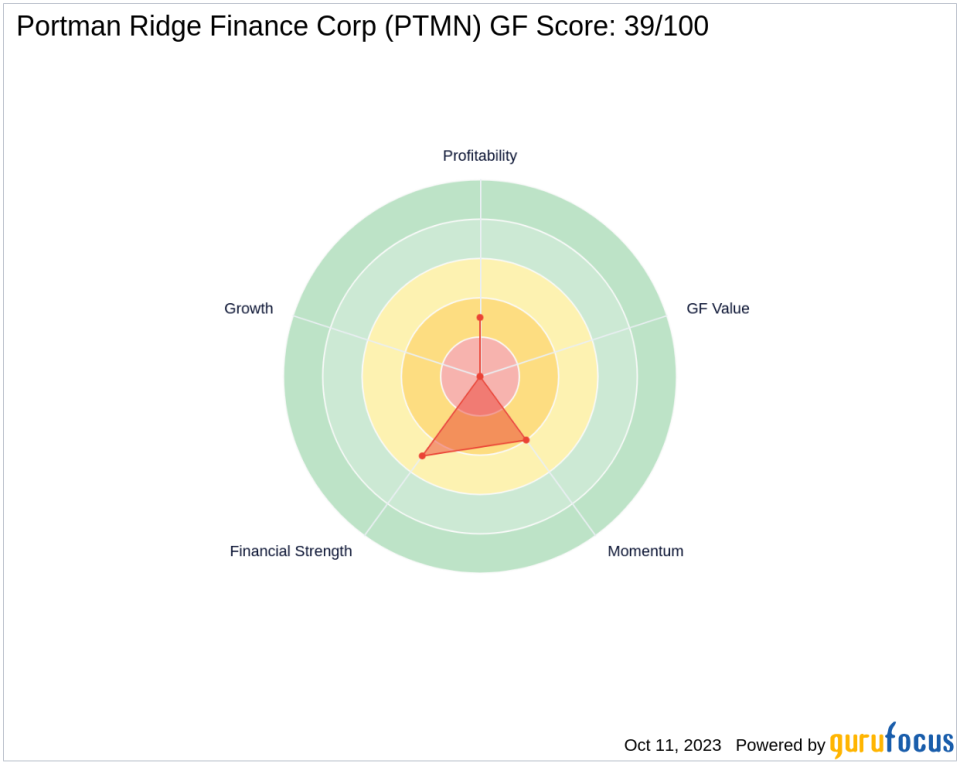

Financial Analysis of Portman Ridge Finance Corp

Portman Ridge Finance Corp's financial performance is evaluated using several metrics. The company's GF-Score is 39/100, indicating a poor future performance potential. The company's Financial Strength is ranked 5/10, while its Profitability Rank is 3/10. The company's Growth Rank is 0/10, indicating no growth. The company's cash to debt ratio is 0.06, ranking 1289 in the Asset Management industry.

Performance of Portman Ridge Finance Corp's Stock

Since the transaction, Portman Ridge Finance Corp's stock has seen a decrease of -2.51%. Since its IPO in 2006, the stock has decreased by -87.55%. The year-to-date price change ratio is -17.02%. The company's Momentum Rank is 4/10, indicating a weak momentum in the stock's price.

Conclusion

The reduction of Repertoire Partners LP (Trades, Portfolio)'s stake in Portman Ridge Finance Corp is a significant move that has implications for both entities. The transaction has decreased the firm's exposure to the stock, which has shown a weak performance recently. However, it remains a significant part of Repertoire Partners LP (Trades, Portfolio)'s portfolio. For Portman Ridge Finance Corp, the transaction represents a decrease in holdings by a major investor. The company's financial performance and stock performance will be crucial in attracting and retaining investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.