Repligen Corp (RGEN) Reports Decline in 2023 Revenue and Net Income

Total Revenue: $638.8 million for 2023, down from $801.5 million in 2022.

Net Income: $41.6 million for 2023, a decrease from $186.0 million in the previous year.

Earnings Per Share (EPS): GAAP EPS of $0.74 for 2023, compared to $3.24 in 2022.

Gross Margin: GAAP gross margin of 44.6% for 2023, compared to 56.9% in 2022.

2024 Financial Guidance: Total reported revenue projected to be $620M-$650M.

On February 21, 2024, Repligen Corp (NASDAQ:RGEN) released its 8-K filing, detailing the company's financial results for the fourth quarter and full year of 2023. As a global life sciences company, Repligen is known for its bioprocessing technologies that serve biopharmaceutical companies and contract manufacturers worldwide. Despite a strong order book, the company faced a challenging year with a decline in both revenue and net income.

Financial Performance Overview

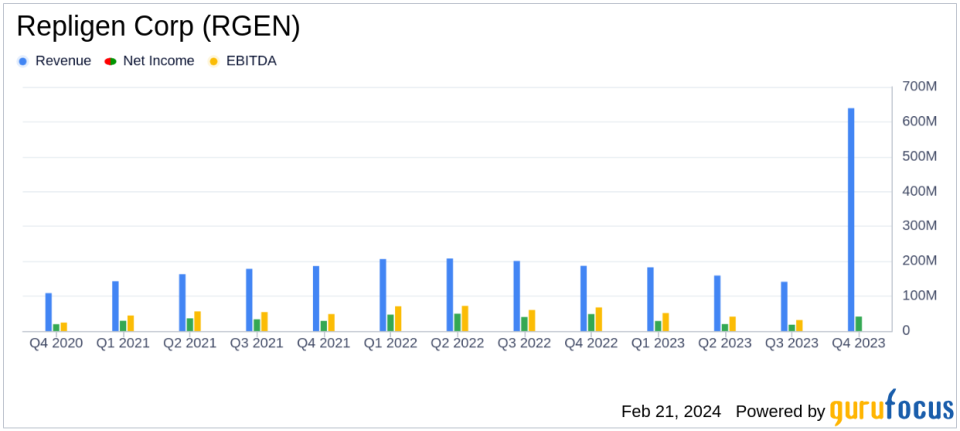

Repligen's total revenue for 2023 was $638.8 million, a significant decrease from $801.5 million in 2022. The company's net income also saw a sharp decline, falling to $41.6 million from $186.0 million in the previous year. Earnings per share on a fully diluted GAAP basis were $0.74 for 2023, down from $3.24 for 2022. The gross margin for 2023 stood at 44.6%, which was lower than the 56.9% reported in 2022.

Operational Challenges and Achievements

Despite the downturn in financial metrics, Repligen's CEO, Tony J. Hunt, highlighted the strength in the company's Filtration and Analytics franchises and the momentum from new modality accounts. The company's book-to-bill ratio remained above 1.0 for the second consecutive quarter, indicating a healthy order intake relative to revenue recognized. However, challenges persisted, particularly in China, where macro factors impacted the market.

2024 Financial Outlook

Looking ahead, Repligen provided financial guidance for 2024, projecting total reported revenue to be between $620 million and $650 million. This guidance reflects the expected impact of businesses acquired in 2023 and excludes the impact of any potential business acquisitions in 2024 and future fluctuations in foreign currency exchange rates.

Key Financial Metrics and Tables

Important metrics such as gross margin, operating margin, and EBITDA margin were presented, showing a mixed picture of the company's profitability. The GAAP gross margin for Q4 2023 was 43.4%, compared to 51.4% in Q4 2022. The operating (EBIT) margin for the full year 2023 was 8.5%, a decrease from 28.0% in 2022.

Repligen's balance sheet remains strong, with cash, cash equivalents, and marketable securities totaling $751.3 million as of December 31, 2023, up from $623.8 million the previous year. The company's working capital and total assets also increased, indicating a solid financial position despite the year's challenges.

Repligen's commitment to innovation and operational excellence remains steadfast, even as it navigates a complex market environment. Investors and stakeholders will be watching closely to see how the company's strategic initiatives and market conditions evolve in the coming year.

For a more detailed breakdown of Repligen's financial performance and future outlook, interested parties can access the full earnings report and listen to the conference call and webcast hosted by the company.

Repligen Contact: Sondra S. Newman, Global Head of Investor Relations, (781) 419-1881, investors@repligen.com

Explore the complete 8-K earnings release (here) from Repligen Corp for further details.

This article first appeared on GuruFocus.