Repligen (RGEN) Beats on Q1 Earnings, Lowers 2023 Guidance

Repligen Corporation RGEN reported first-quarter 2023 adjusted earnings per share (EPS) of 64 cents, which beat the Zacks Consensus Estimate of 59 cents and our model estimate of 57 cents. The bottom line, however, declined 30% year over year.

Total revenues of $183 million outpaced the Zacks Consensus Estimate of $181 million and our model estimate of $179.9 million. Sales declined 12% year over year and 9% in constant currency (cc) basis due to a predicted decline in COVID-related revenues.

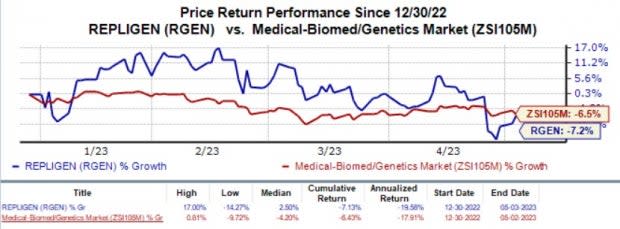

The stock was up 2.4% on May 2, as the company announced first-quarter results. Shares of Repligen have fallen 7.2% in the year-to-date period compared with the industry’s 6.5% decline.

Image Source: Zacks Investment Research

Quarter in Details

The company reported product revenues of $182.6 million, down 11.5% from that recorded in the year-ago period. It also recorded royalty and other revenues of $0.39 million, almost flat year over year.

Repligen’s base business revenues were up 7% year over year on a cc basis.

The company’s base business can be categorized under four franchises — filtration, chromatography, protein and process analytics.

RGEN’s chromatography and proteins businesses were the major growth drivers in the first quarter of 2023. The uptick in these two business franchises offset the decline in COVID-related revenues.

The company’s chromatography business performed well with 20% growth in revenues. This improvement can be attributed to an increased demand for OPUS pre-packed columns due to growing resin requirement.

RGEN expects its chromatography business to witness a 10% growth rate in 2023.

The protein franchise had a good quarter as well, driven by strong demand for NGL ligands that Repligen supplies to Purolite. However, the surge in revenues was partially offset by a decline in demand for Cytiva. The company expects this business’s 2023 revenues to be flat year over year.

The filtration franchise’s sales declined 20% year over year due to a drop in COVID-related revenues. The base filtration business was also down almost 5%. RGEN expects this business to recover in the third quarter of 2023 as the macro headwinds, such as the impact of forex, are likely to subside by then.

The process analytics franchise had an excellent quarter. Revenues were up 30% year over year. Repligen anticipates this business to grow 15-20% in 2023.

The gene-therapy business recorded 20% growth in revenues.

Adjusted gross margin was 55.2%, down 520 basis points (bps) year over year due to increased material cost, currency headwinds and a less favorable product mix.

Adjusted research and development expenses came in at $12.1 million, up 3% from the year-ago quarter’s level.

Adjusted selling, general and administrative expenses amounted to $47.7 million, up 5% year over year.

Adjusted operating income totaled $40.9 million, down 39% from that recorded in the prior-year quarter. Adjusted operating margin was 22.4%, down 1020 bps year over year.

As of Mar 31, 2023, Repligen had cash and cash equivalents worth $618 million compared with $623.8 million as on Dec 31, 2022.

Updated 2023 Guidance

Repligen cut its sales and profit guidance for 2023.

The company now expects total revenues in the range of $720-$760 million, down from the earlier projected level of $760-$800 million. This is due to lower base business revenues.

Repligen also anticipates base business revenues to increase 4-8% on a reported and constant currency basis. The range is lower than the previous guidance of 11-15% on a reported basis and 12-16% at cc.

Adjusted net income is projected in the band of $134-$138 million, down from the earlier guidance of $149-$154 million. Adjusted operating income is anticipated in the $153-$158 million range, lower than the earlier projected band of $176-$182 million.

Repligen projects adjusted gross margin in the 52-53% range, down from the previous guidance of 52.5-53.5%. Adjusted operating margin is expected in the range of 20.5-21.5%, also down from the earlier guidance of 22.5-23.5%.

Adjusted EPS is anticipated between $2.35 and $2.42, indicating a decline from the prior estimation of $2.61-$2.69.

Recent Updates

Repligen acquired FlexBiosys Inc. earlier last month. The acquisition will help RGEN to expand its fluid management portfolio with 2D and 3D single-use bags and assemblies.

Management anticipates the acquisition to ramp up business in 2024. It also expects the newly built manufacturing space to deliver approximately $5 million in revenues this year.

Repligen Corporation Price and EPS Surprise

Repligen Corporation price-eps-surprise | Repligen Corporation Quote

Zacks Rank & Stocks to Consider

Currently, Repligen has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Ocuphire Pharma OCUP, Allogene Therapeutics ALLO and Arcus Biosciences RCUS. While Ocuphire Pharma sports a Zacks Rank #1 (Strong Buy), Allogene Therapeutics and Arcus Biosciences, both carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss per share estimates for Ocuphire Pharma have narrowed from 29 cents to 24 cents for 2023 and from 86 cents to 81 cents for 2024 in the past 60 days. The company’s shares have surged 56.4% in the year-to-date period. Ocuphire’s earnings beat estimates in three of the last four quarters and missed the mark in one occasion, the average surprise being 23.85%.

Loss per share estimates for Allogene have narrowed from $2.56 to $2.44 for 2023 in the past 60 days. Shares of ALLO have plunged 15% in the year-to-date period. Allogene’s earnings beat estimates in each of the last four quarters, the average surprise being 8.33%.

Loss per share estimates for Arcus Biosciences have narrowed from $4.52 to $4.42 for 2023 and from $3.51 to $3.33 for 2024 in the past 60 days. Shares of RCUS have plunged 13.7% in the year-to-date period. Arcus Biosciences’ earnings outpaced estimates in two of the last four quarters, met the mark in one and missed in another, the average negative surprise being 48.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report