Reservoir Media Inc (RSVR) Posts Strong Q3 Fiscal 2024 Results with Organic Revenue Growth of 14%

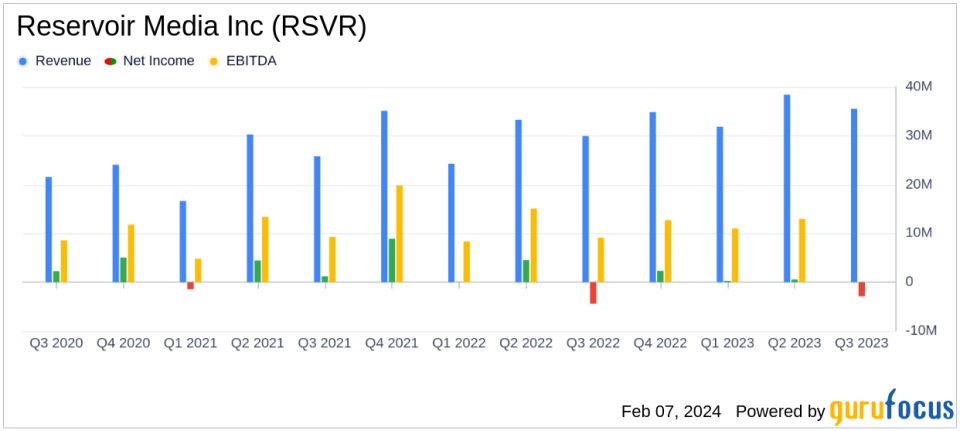

Revenue Growth: Total revenue increased by 19% year-over-year to $35.5 million in Q3 FY24.

Operating Income and OIBDA: Operating income surged 42% to $6.5 million, with OIBDA up 27% to $12.9 million.

Net Loss Improvement: Net loss narrowed by 30% to $2.9 million compared to the same quarter last year.

Segment Performance: Recorded Music revenue grew by 32%, while Music Publishing revenue increased by 15%.

Liquidity and Debt: Total available liquidity stood at $121.7 million, with a net debt position of $322.9 million.

Adjusted EBITDA: Adjusted EBITDA rose by 25% to $13.7 million, reflecting efficient operations and revenue growth.

On February 7, 2024, Reservoir Media Inc (NASDAQ:RSVR), an award-winning independent music company, released its third-quarter fiscal 2024 results, showcasing a robust top-line organic revenue growth of 14%. The company's performance was driven by strong demand across both its Music Publishing and Recorded Music segments. The full details of the financial results can be accessed through the company's 8-K filing.

Reservoir Media Inc operates primarily through its Music Publishing segment, which generates the majority of its revenue. The company's business model and strategic capital deployment have led to consistent delivery in line with its long-term growth strategy, as highlighted by Golnar Khosrowshahi, Founder and CEO of Reservoir.

Our third quarter results highlight the strength of our business model and our ability to deploy capital to further grow our portfolio. We posted double digit revenue growth across both our Recorded and Publishing segments, notably driven by record-setting Digital consumption across genres, said Khosrowshahi.

Financial Performance Overview

The company's total revenue for the third quarter of fiscal 2024 was $35.5 million, a 19% increase from $29.9 million in the third quarter of fiscal 2023. This growth was primarily attributed to a 32% increase in Recorded Music revenue and a 15% increase in Music Publishing revenue. Operating income for the quarter was $6.5 million, up 42% from the previous year, while OIBDA grew by 27% to $12.9 million.

Despite the impressive revenue and OIBDA growth, the company reported a net loss of $2.9 million, which was an improvement from the $4.1 million net loss in the same quarter of the previous year. This reduction in net loss was due to higher revenue and improved gross margins, although it was partially offset by higher losses on fair value of interest rate swaps and increased administrative expenses.

Segment Performance and Challenges

The Music Publishing segment saw a revenue increase to $23.1 million, driven by strong Digital and Synchronization revenue. However, it faced challenges with lower Mechanical and Other revenue. The segment's OIBDA increased by 33% to $7.8 million, with an OIBDA margin increase from 29% to 34%.

The Recorded Music segment also performed well, with revenue growing to $10.0 million, a 32% increase. This growth was driven by strong Digital revenue, Physical sales, and Synchronization revenue. The segment's OIBDA increased by 28% to $4.7 million, although the OIBDA margin slightly decreased due to a shift toward Physical revenues, which carry higher costs.

Balance Sheet and Liquidity

As of December 31, 2023, Reservoir had cash and cash equivalents of $19.5 million and $102.2 million available for borrowing under its revolving credit facility, totaling $121.7 million in available liquidity. The total debt stood at $342.5 million, net of deferred financing costs, with a net debt position of $322.9 million.

Fiscal 2024 Outlook

Based on the strong third-quarter performance, Reservoir has raised its financial outlook for fiscal year 2024. The company now expects revenue to be between $140 million and $142 million, representing a 15% growth at the mid-point, and Adjusted EBITDA to be between $53 million and $55 million, a 17% growth at the mid-point.

Our third quarter was hallmarked by strong top-line growth and adjusted EBITDA margin expansion as we capitalized on the secular tailwinds in the music industry and our efficient operating model. We are raising our guidance ranges for both revenue and adjusted EBITDA for the 2024 fiscal year to incorporate our strong third quarter performance, commented Jim Heindlmeyer, Chief Financial Officer of Reservoir.

Reservoir Media Inc's strategic focus on diversifying its portfolio and capitalizing on digital consumption trends in the music industry has positioned the company for sustained growth. The raised outlook for fiscal 2024 reflects the company's confidence in its business model and the robust demand for its Music Publishing and Recorded Music offerings.

Explore the complete 8-K earnings release (here) from Reservoir Media Inc for further details.

This article first appeared on GuruFocus.