Resideo Technologies Inc (REZI) Reports Mixed Financial Results for Q4 and Full Year 2023

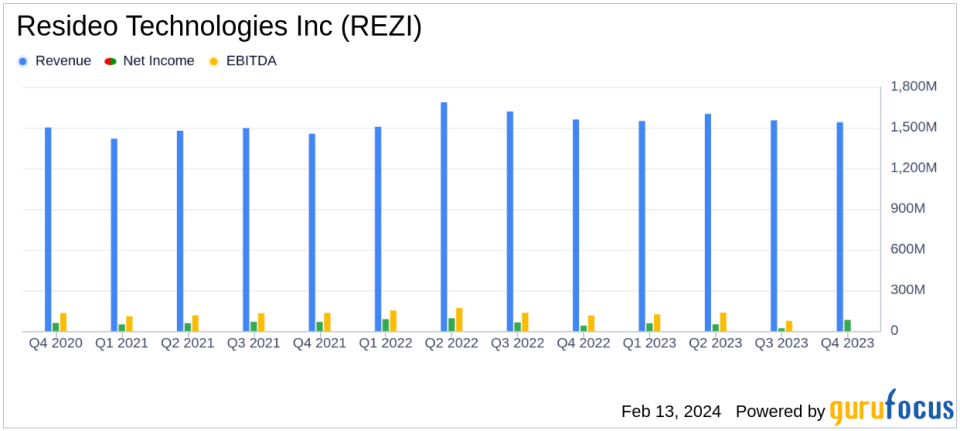

Net Revenue: Full year net revenue decreased by 2% to $6.24 billion from $6.37 billion in 2022.

Income from Operations: Full year income from operations was $547 million, down from $611 million in 2022.

Earnings Per Share (EPS): GAAP EPS for 2023 stood at $1.42, with non-GAAP EPS at $1.58, compared to $1.90 and $1.99 respectively in the prior year.

Operating Cash Flow: Cash provided by operating activities significantly increased to $440 million in 2023 from $152 million in 2022.

Share Repurchase: Resideo repurchased 2.6 million shares for $41 million as part of a $150 million repurchase program.

On February 13, 2024, Resideo Technologies Inc (NYSE:REZI) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its technology-driven products and solutions for home comfort, energy management, and safety and security, as well as its ADI Global Distribution segment, faced a slight downturn in net revenue but saw improvements in other key financial areas.

Company Overview

Resideo Technologies Inc operates in two main segments: Products and Solutions, which includes a range of home comfort and security products, and ADI Global Distribution, a wholesale distributor of low-voltage security products. The company has a strong presence in the United States, which contributes the majority of its revenue.

Financial Performance and Challenges

The company reported a full year net revenue of $6.24 billion, a 2% decrease from $6.37 billion in 2022. The income from operations also saw a decline to $547 million, including restructuring charges of $42 million, compared to $611 million in 2022, which included $35 million of restructuring charges. The decrease in revenue and income from operations reflects challenges such as slower residential repair and remodel activity, inventory rebalancing in the HVAC channel, and competitive pressures.

Despite these challenges, Resideo's operating cash flow for 2023 was a bright spot, increasing to $440 million from $152 million in the prior year. This improvement is crucial for the company's liquidity and its ability to invest in strategic initiatives, such as new product introductions and digital capabilities enhancements.

Financial Achievements

Resideo's financial achievements in 2023 include a significant increase in operating cash flow and a robust share repurchase program. The company's ability to generate cash from operations is a testament to its operational efficiency and effective working capital management. The share repurchase program reflects management's confidence in the company's intrinsic value and commitment to delivering shareholder returns.

Key Financial Metrics

Resideo's gross margin in the Products and Solutions segment improved sequentially for the third consecutive quarter, reaching 39.5%. The company's focus on working capital management led to a strong cash generation, ending the year with $440 million in operating cash flow. The repurchase of 2.6 million shares for $41 million underscores the company's commitment to returning value to shareholders.

We finished 2023 on a strong note with results exceeding the midpoint of our fourth quarter outlook driven by continued improvement in order activity and gross margin in our Products and Solutions business, said Jay Geldmacher, Resideos President and CEO. With a targeted focus on working capital, we significantly improved cash generation as the year progressed, ending 2023 with $440 million of operating cash flow. This performance, and the high level of free cash flow conversion over the past three years, highlights the strong cash generation capabilities of both of our businesses.

Analysis of Performance

While the overall revenue decline indicates market challenges, the improvements in operating cash flow and EPS suggest that Resideo is effectively managing its costs and capitalizing on its operational strengths. The company's strategic initiatives, such as the sale of the Genesis Cable business and enhancements in digital capabilities, are expected to further strengthen its market position and profitability in the coming year.

Resideo's outlook for the first quarter of 2024 and the full year indicates a cautious optimism, with projected net revenue ranging from $1,460 to $1,510 million for Q1 and $6,080 to $6,280 million for the full year. The non-GAAP adjusted EBITDA and EPS forecasts also reflect management's expectations for continued operational improvements and margin expansion.

For value investors and potential GuruFocus.com members, Resideo's financial results offer a mixed picture. While the revenue contraction may raise concerns, the company's strong cash flow generation and strategic initiatives to enhance profitability and margins could present opportunities for long-term value creation.

For more detailed financial analysis and updates on Resideo Technologies Inc (NYSE:REZI), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Resideo Technologies Inc for further details.

This article first appeared on GuruFocus.