ResMed (RMD) Gains From Mask Sales Amid Macro Headwinds

ResMed RMD is leading the market with its cloud-connected flow generator platforms. However, macroeconomic headwinds continue to affect the stock. The stock carries a Zacks Rank #3 (Hold).

ResMed continues to see robust demand for its market-leading mask portfolio despite facing challenges related to lower new patient setups from a competitor recall. Continued product development is driving growth within this business globally. The company has successfully introduced a full suite of masks in its AirFit and AirTouch and other ranges. Further, to promote greater patient adherence, ResMed offers advanced and expanded integrations of its therapy-based software solutions, including AirView.

In the fiscal 2023 fourth quarter, across the markets in the United States, Canada and the Latin America region, masks and other sales increased 19%, which reflected solid resupply and growth in new patients’ setups. In Europe, Asia and other markets, sales improved 14% at constant currency.

Meanwhile, ResMed’s respiratory care business continues to drive growth, courtesy of the adoption of bilevel and other non-invasive ventilator solutions worldwide. The company is investing in newer-to-market technologies for patients, including home-based high-flow therapy for treating chronic obstructive pulmonary disease or COPD at home.

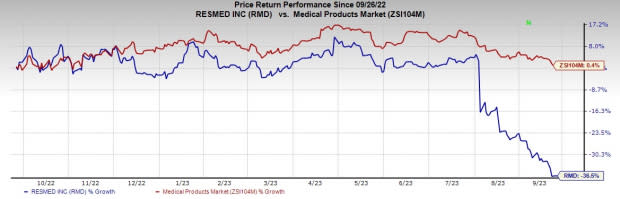

Image Source: Zacks Investment Research

Although still early for market development, ResMed continues to generate clinical evidence and economic outcomes to support the broader adoption of these technology innovations for treating lung disease at home. Investing in these opportunities enables the company to address COPD as one of the top global diseases for hospitalization and the principal cause of re-hospitalization in the United States.

Given the high incidence of respiratory insufficiency due to COPD and neuromuscular disease, ResMed aims to develop low-cost, high-quality solutions to address this health epidemic.

On the flip side, the company’s high debt level remains a concern. As of Jun 30, 2023, long-term debt was $1.43 billion, while cash and cash equivalents were only $228 million. A higher debt level induces higher interest payments, which comes along with the risk of failure to pay the same. At the end of fiscal 2023, the company had a times interest earned ratio of 24.3%, sequentially lower than the fiscal third quarter’s ratio of 29%.

Global macroeconomic conditions, including inflation, supply chain disruptions and fluctuations in foreign currency exchange rates, and volatility in capital markets, could continue to affect ResMed’s results of operations. A decline in the global economic environment may reduce demand for the company’s products, resulting in lower sales, lower product prices and reduced reimbursement rates by third-party payers, while increasing the cost of operating the business.

These factors have affected ResMed’s supply chain operations globally, primarily through constraints on raw materials and electronic components. Furthermore, with sustained inflationary pressures in the future, the company may struggle to keep its operating expenses as a percentage of net revenues in check. We are worried that this might adversely impact ResMed’s profitability.

Over the past year, shares of ResMed plunged 36.5% against the industry’s 0.4% rise.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Quanterix QTRX and Intuitive Surgical ISRG, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics stock has risen 22.8% in the past year. Earnings estimates for Haemonetics have increased from $3.74 to $3.82 for 2023 and remained constant at $4.07 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

Estimates for Quanterix’s 2023 loss per share have remained constant at 97 cents in the past 30 days. Shares of the company have surged 200.6% in the past year compared with the industry’s rise of 0.3%.

QTRX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Estimates for Intuitive Surgical’s 2023 earnings have remained constant at $5.57 per share in the past 30 days. Shares of the company have increased 53.3% in the past year compared with the industry’s growth of 2.8%.

ISRG’s earnings beat estimates in three of the trailing four quarters and missed in one, the average surprise being 4.19%. In the last reported quarter, Intuitive Surgical delivered an earnings surprise of 7.58%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report