ResMed (RMD)'s Hidden Bargain: An In-Depth Look at the 25% Margin of Safety Based on its Valuation

ResMed Inc (NYSE:RMD) experienced a daily gain of 3.37%, despite a 3-month loss of -35.59%. The company's Earnings Per Share (EPS) is 6.1. But, is this stock significantly undervalued? We aim to answer this question through an in-depth valuation analysis. Stay with us as we delve into the financials and operations of ResMed (NYSE:RMD).

Company Overview

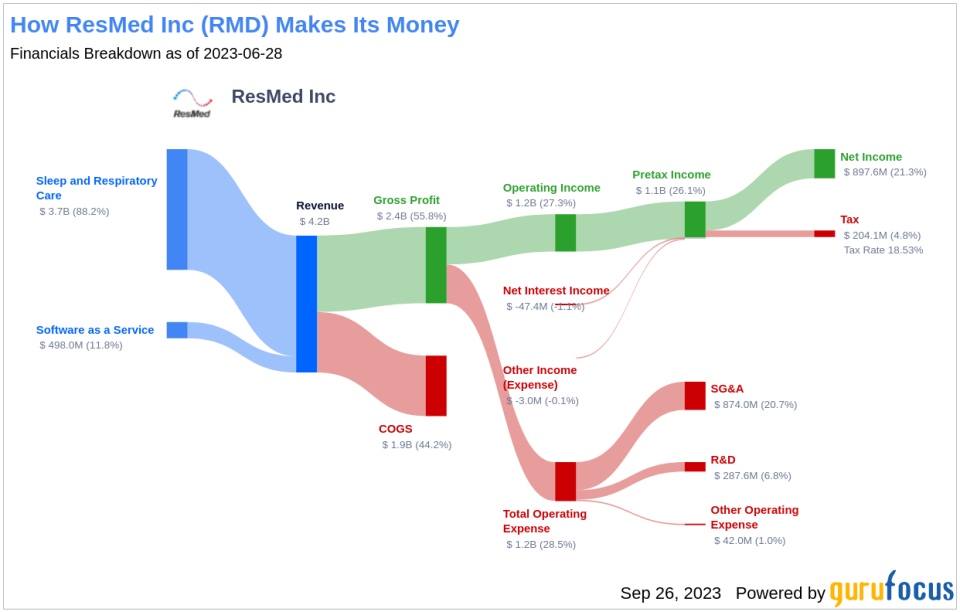

ResMed is a global leader in respiratory care device manufacturing, primarily producing flow generators, masks, and accessories for sleep apnea treatment. The increasing diagnosis of sleep apnea, coupled with ageing populations and increasing obesity prevalence, is driving market growth. ResMed earns approximately two-thirds of its revenue in the Americas, with the balance spread across Europe, Japan, and Australia. The company is focusing on digital health to differentiate itself by providing clinical data for patients, medical care advisors, and payers in the out-of-hospital setting.

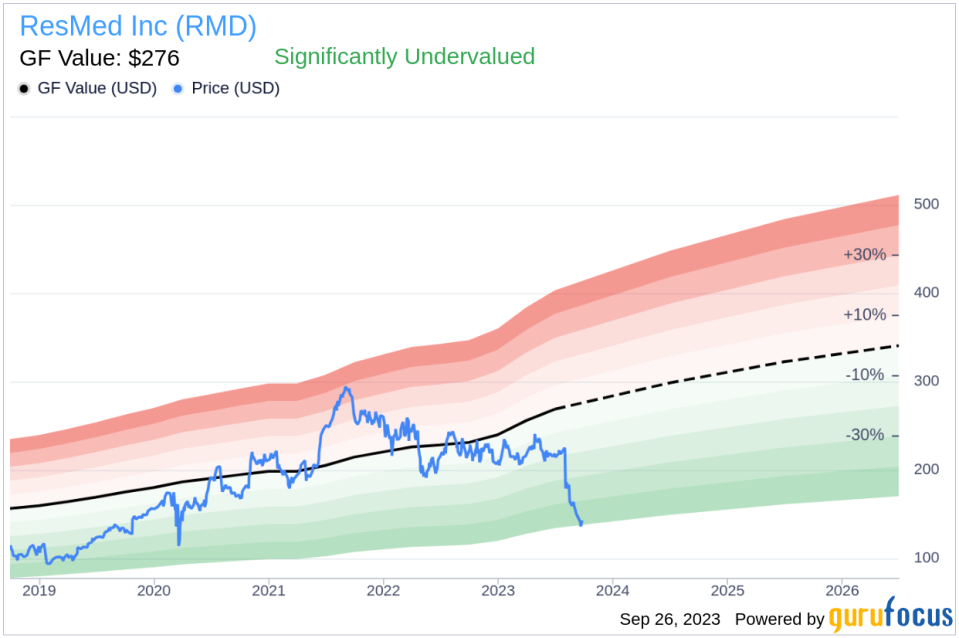

As of September 26, 2023, ResMed's stock price stands at $142.95, while its GF Value, an estimation of fair value, is $276. This discrepancy suggests that the stock may be significantly undervalued.

Understanding GF Value

The GF Value is a proprietary measure that provides an estimation of a stock's intrinsic value. It is calculated based on three factors: historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past performance and growth, and future business performance estimates.

The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

ResMed (NYSE:RMD) appears to be significantly undervalued, according to GuruFocus' valuation method. This suggests that the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

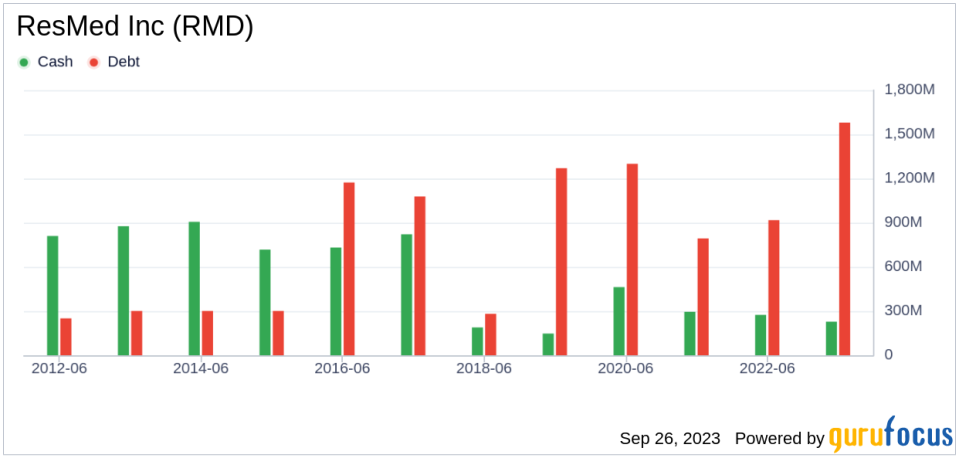

Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before deciding to buy shares. ResMed has a cash-to-debt ratio of 0.14, which ranks worse than 89.66% of 841 companies in the Medical Devices & Instruments industry. Based on this, GuruFocus ranks ResMed's financial strength as 7 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. ResMed has been profitable 10 over the past 10 years. Over the past twelve months, the company had a revenue of $4.20 billion and Earnings Per Share (EPS) of $6.1. Its operating margin is 27.26%, which ranks better than 91.15% of 836 companies in the Medical Devices & Instruments industry. Overall, the profitability of ResMed is ranked 10 out of 10, which indicates strong profitability.

Growth is one of the most important factors in the valuation of a company. ResMed's 3-year average revenue growth rate is better than 63.2% of 731 companies in the Medical Devices & Instruments industry. ResMed's 3-year average EBITDA growth rate is 10.4%, which ranks better than 53.66% of 738 companies in the Medical Devices & Instruments industry.

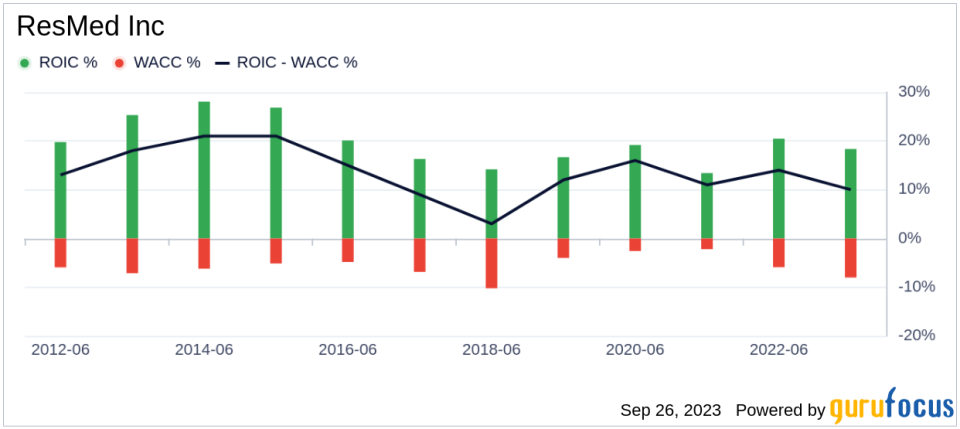

ROIC vs WACC

Another method of determining the profitability of a company is to compare its return on invested capital to the weighted average cost of capital. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, ResMed's return on invested capital is 17.77, and its cost of capital is 9.53.

Conclusion

In summary, the stock of ResMed (NYSE:RMD) appears to be significantly undervalued. The company's financial condition is fair and its profitability is strong. Its growth ranks better than 53.66% of 738 companies in the Medical Devices & Instruments industry. To learn more about ResMed stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.