ResMed (RMD) to Treat Sleep Apnea With New AirCurve 11 Device

ResMed, Inc. RMD recently introduced its AirCurve 11 series devices. These are the company’s newest bilevel devices that use two levels of support, inspiratory positive airway pressure and expiratory positive airway pressure. The device is combined with digital technology to make it easier for healthcare providers to treat sleep apnea and to help patients start and stay on therapy.

Built on ResMed's industry-leading AirSense 11 technology, AirCurve 11 devices enhance the range of options accessible to doctors and healthcare professionals in deciding how best to treat patients with sleep apnea.

More on AirCurve 11 Bilevel Devices

AirCurve11 is ResMed's advanced adaptive servo-ventilation device, which simulates the patient's own breathing. This is crucial for patients with central sleep apnea, obstructive sleep apnea, mixed apneas or periodic breathing.

AirCurve 11 is a bilevel PAP device meant to improve comfort and compliance by giving higher pressure during inhalation and lower pressure during exhalation. This design allows the gadget to better coincide with the patient's normal breathing rhythm.

Image Source: Zacks Investment Research

The new series is built with a robust combination of features and settings to give next-level support to patients and providers, including integrated cellular and bluetooth communication, which allows for secure and automated data transmission to the cloud. It can then be accessed via AirView and myAir. The device also includes an integrated heated humidifier that can be controlled automatically using the Climate Control feature or manually by the user.

Benefits of the Launch

ResMed’s new AirCurve11 series incorporates myAir and AirView digital health apps, which have increased patient compliance from 70% to 87% to provide maximum comfort and support during therapy.

Per management, its approach to product development is predicated on always doing what is in the best interest of patients. This customer-centric attitude drives RMD’s passion for launching products like AirCurve 11 that allow people to better manage sleep apnea from the comfort of their own homes.

Industry Prospects

Per a report by Grand View Research, the global sleep apnea devices market size was valued at $4.50 billion in 2023 and is expected to grow at a CAGR of 6.2% by 2030. The growing geriatric population's vulnerability to sleep apnea is expected to drive the adoption of sleep apnea devices.

Progress Within Sleep Apnea Treatment Business

RMD is leveraging traditional healthcare channels and investing in cost-effective social media-driven demand generation campaigns to help consumers, who are concerned about their sleep and breathing, to find their way into screening, diagnostic, treatment and management pathways. In lieu of this, ResMed is tracking new-patient starts in its physician and provider-based ecosystem, which now contains more than 26 million patient records as well as new-user starts in the myAir app.

ResMed noted that patient adoption of the myAir app continues to be strong. The adoption rates of myAir app by new patients set up on therapy with AirSense 11 continue to be more than double that of AirSense 10.

Recently, the company launched an in-market trial of a ResMed-developed generative AI product that serves as a digital concierge to help a group of people best navigate as they search for their sleep-related information.

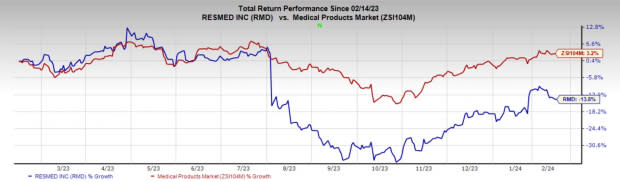

Price Performance

In the past year, shares of ResMed have declined 13.8% against the industry’s 3.2% growth.

Zacks Rank and Key Picks

RMD currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks to consider in the broader medical space are Universal Health Services UHS, Integer Holdings Corporation ITGR and DaVita DVA.

Universal Health Services, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 4.4% for 2024. UHS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 5.47%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UHS’ shares have gained 25% in the past six months compared with the industry’s 15% growth.

Integer Holdings, presently carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 47.2% in the past year compared with the industry’s 3.9% growth.

Estimates for DaVita’s 2023 earnings per share have remained constant at $8.07 in the past 30 days. Shares of the company have increased 37.9% in the past year compared with the industry’s 11.2% growth.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 36.6%. In the last reported quarter, it delivered an earnings surprise of 48.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report