ResMed's (RMD) New Buyout Aids Growth Amid Rising Costs

ResMed RMD continues to see improvement in patient diagnosis trends in sleep apnea, COPD and asthma. However, pricing pressure and FX headwinds weigh on the stock. ResMed carries a Zacks Rank #3 (Hold).

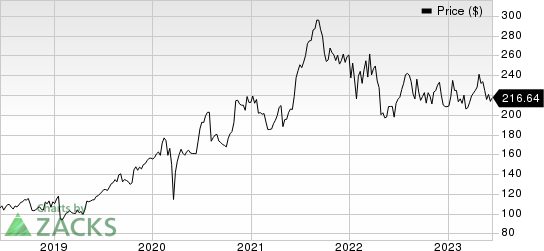

In the past year, ResMed has outperformed its industry. The stock has gained 7.1% against a 22.7% decline of the industry.

ResMed exited the third quarter of fiscal 2023 with better-than-expected earnings and revenues. Revenue growth reflected improved availability of sleep devices to support strong underlying demand and solid growth across the broader product portfolio. In the mask and accessory business, mask growth was supported by new patient growth and enhanced resupply programs for existing patients catalyzed by ongoing core patient demand.

Within the United States, the company has already achieved its target to meet the global demand for connected continuous positive airway pressure and automatic positive airway pressure devices with a combination of AirSense 10 and AirSense 11 by the end of calendar year 2023. ResMed noted that with increased production, it is working on a country-by-country basis to secure the necessary regulatory approvals to ensure delivery of the AirSense 11 platform across global markets.

ResMed Inc. Price

ResMed Inc. price | ResMed Inc. Quote

The respiratory care business witnessed continued customer uptake of bilevel and other non-invasive ventilator solutions worldwide in the fiscal third quarter. ResMed announced a pilot collaboration between its digital therapeutics team under the Propellor health brand and the University of California Davis Health System. Meanwhile, the company’s recent acquisition of MEDIFOX DAN contributed to the year-over-growth of the company’s SaaS business.

On the flip side, during the fiscal third quarter, ResMed’s selling, general and administrative expenses rose 25%, attributed to increases in employee-related costs, travel expenses and incremental operating expense associated with the MEDIFOX DAN acquisition.

Meanwhile, research and development expenses increased 14%. These mounting expenses led to an adjusted operating margin contraction of 51 basis points, which weighed on the company’s bottom line. Persistent supply-chain constraints in relation to securing sufficient components continue to pose challenges for ResMed’s ability to meet the growing device demand.

Meanwhile, pricing pressure in the United States and Europe has been an issue over the past few quarters. Healthcare reform in the United States has created a degree of uncertainty for medical devices companies and created a less flexible pricing environment. Currency headwinds continue to affect ResMed's overseas sales.

Key Picks

Some better-ranked stocks in the overall healthcare sector are Penumbra PEN, Lantheus LNTH and Haemonetics HAE. While Penumbra and Lantheus each sport a Zacks Rank #1 (Strong Buy), Haemonetics carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra’s stock has risen 190.8% in the past year. The Zacks Consensus Estimate for Penumbra’s earnings per share (EPS) has remained constant at $1.56 for 2023 and at $2.56 for 2024 in the past 30 days.

PEN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 109.42%. In the last reported quarter, the company registered an earnings surprise of 109.09%.

The Zacks Consensus Estimate for Lantheus’ 2023 EPS has remained constant at $5.60 in the past 30 days. Shares of the company have improved 44.7% in the past year against the industry’s 20.8% decline.

LNTH’s earnings beat estimates in each of the trailing four quarters, the average surprise being 25.77%. In the last reported quarter, the company recorded an earnings surprise of 13.95%.

Estimates for Haemonetics’ EPS have increased from $3.29 to $3.55 for 2023 in the past 30 days. Shares of the company have increased 42.7% in the past year against the industry’s 20.8% decline.

HAE’s earnings beat estimates in each of the trailing four quarters, the average surprise being 12.21%. In the last reported quarter, Haemonetics delivered an earnings surprise of 13.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report