Restaurant Brands (QSR) to Acquire Carrols Restaurant for $1B

Restaurant Brands International Inc. QSR is set to bolster its presence in the fast-food industry with the acquisition of Carrols Restaurant Group Inc. TAST for approximately $1 billion in an all-cash deal. The deal, set at $9.55 per share, represents a 23.1% premium to Carrols Restaurant’s 30-day volume-weighted average price as of Jan 12, 2024. The deal is likely to be sealed in the second-quarter of 2024.

This move reflects QSR's commitment to its Reclaim the Flame plan, which is focused on persistently pursuing a better experience for its guests. As the largest Burger King franchisee in the United States, Carrols Restaurant operates 1,022 Burger King restaurants and 60 Popeyes establishments. Notably, Carrols Restauran garnered approximately $1.8 billion in system sales in the 12 months ended Sep 30, 2023.

Future Plans

As part of the Reclaim the Flame plan, QSR plans to invest approximately $500 million to remodel 600 acquired restaurants over the next five years, bringing them to a modern image. The strategic move aims to significantly accelerate Carrols Restaurant current rate of remodels and support the brand's overall competitiveness in the market.

Following the remodels, QSR plans to refranchise the majority of the acquired portfolio to local franchise operators. This approach aims to leverage the expertise of smaller, motivated operators who live in the communities they serve. The strategic refranchising process is expected to be completed within five to seven years.

Josh Kobza, CEO of Restaurant Brands, expressed enthusiasm for the acquisition, emphasizing its alignment with the company's commitment to investing in long-term, high-return opportunities. The company anticipates that the buyout will have a nearly neutral impact on adjusted earnings per share. The incremental effect on net leverage will be marginal, ensuring that QSR stays in line with its established goal of achieving a net leverage target in the mid-four times range by the end of 2024.

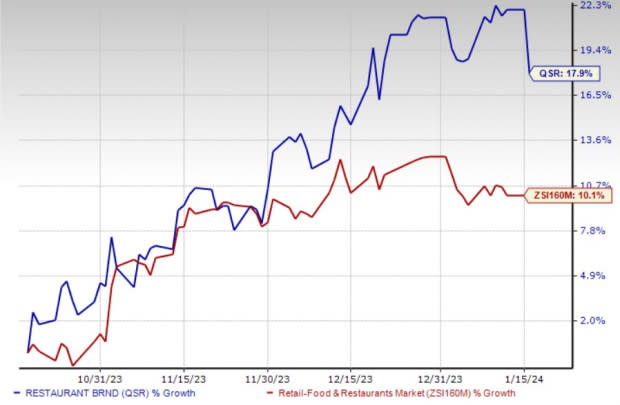

Image Source: Zacks Investment Research

Wrapping Up

This strategic move positions QSR for accelerated growth, improved restaurant operations and a more competitive Burger King restaurant base. It remains on track to reach its net leverage target, further solidifying its commitment to long-term success.

The acquisition of Carrols Restaurant underscores QSR's dedication to enhancing its portfolio and driving sustained growth in the competitive fast-food industry. Shares of the company have gained 17.9% in the past three months compared with the industry’s growth of 10.1%.

Restaurant Brands currently carries a Zacks Rank #2 (Buy).

Other Key Picks

Below, we present some other top-ranked stocks from the Zacks Retail-Wholesale sector.

Arcos Dorados Holdings Inc. ARCO flaunts a Zacks Rank #1 (Strong Buy) at present. It has a trailing four-quarter earnings surprise of 28.3%, on average. Shares of ARCO have jumped 39% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ARCO’s 2024 sales and earnings per share (EPS) indicates 10.6% and 15.5% growth, respectively, from the year-ago levels.

Brinker International, Inc. EAT currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 223.6%, on average. Shares of EAT have gained 4% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS implies 5% and 26.2% growth, respectively, from the year-earlier numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Carrols Restaurant Group, Inc. (TAST) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report