Restaurants Roar Back to Life: Stocks to Watch

The restaurant industry sure has been through a lot over the past few years. From a complete meltdown due to stringent COVID measures to a resurgence led by resilient consumers, it sure hasn’t been an easy road for restaurant owners. They’ve had to innovate and adapt more in the post-pandemic world than perhaps at any time in the past. But it looks like many who were able to forge through the adversity are coming out stronger on the other side.

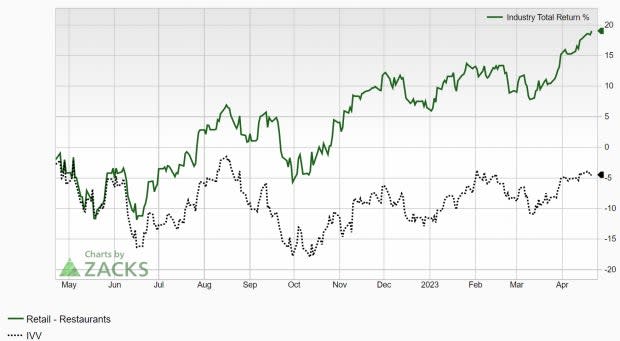

The Zacks Retail – Restaurants industry is comprised of many recognized and well-established restaurant companies. Despite one of the more difficult market environments we’ve seen in some time, this industry group steadily outperformed over the past year with a nearly 20% return:

Image Source: Zacks Investment Research

This industry currently ranks in the top 22% out of more than 250 Zacks Ranked Industries. Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

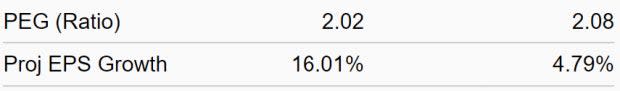

Note the favorable characteristics for this group below:

Image Source: Zacks Investment Research

With the earnings outlook promising for this industry, it makes sense to take a look under the hood at leading stocks.

Potbelly PBPB owns, operates, and franchises Potbelly sandwich shops in the United States. Its establishments offer sandwiches, soups, chili, smoothies, and snack items. Potbelly, a Zacks Rank #2 (Buy) stock, has witnessed its share price soar more than 80% this year:

Image Source: StockCharts

PBPB is ranked favorably by our Zacks Style Scores, with a top ‘A’ rating in our Growth category. This indicates that Potbelly is likely to see further upside based on promising sales and earnings growth metrics. PBPB is scheduled to report first-quarter earnings on May 4th.

Jack in the Box JACK operates and franchises Jack in the Box quick-service restaurants. One of the nation’s largest hamburger chains, JACK has exploded more than 35% this year already:

Image Source: StockCharts

Last year, JACK completed its previously announced acquisition of Del Taco Restaurants, which serve more than 3 million guests every week. Together, the companies boast more than 2,800 restaurants in 25 states. The Zacks Rank #2 (Buy) stock also pays a $1.76 (1.95%) dividend.

Wingstop WING franchises and operates restaurants under the Wingstop brand name. Its locations offer classic and boneless wings as well as chicken tenders that are cooked-to-order and tossed in a variety of sauces. The company has franchised nearly 1,700 restaurants and operates 36 company-owned restaurants in 7 different countries.

WING is ranked favorably by our Zacks Style Scores, with a top ‘A’ mark in our Momentum category. The stock has soared more than 43% year-to-date:

Image Source: StockCharts

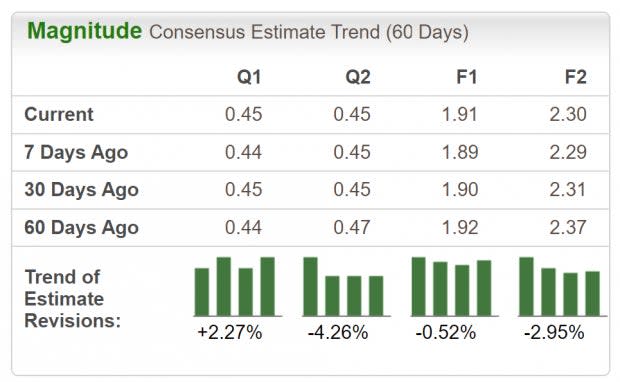

Wingstop has exceeded earnings estimates in three of the past four quarters, with an average earnings surprise of +22.72% over that timeframe. Estimates for the first quarter have been revised upward by 2.27% over the past 60 days. The Q1 Zacks Consensus Estimate now stands at $0.45/share, reflecting potential growth of 32.4% relative to the same quarter in the prior year.

Image Source: Zacks Investment Research

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently witnessed positive earnings estimate revision activity. This more recent information can be a better predictor for future earnings and can give investors a leg up during earnings season. The technique has proven to be quite useful for finding positive earnings surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

WING is a Zacks Rank #3 (Hold) and has a +2.64% Earnings ESP. Another beat may be in the cards when the company reports Q1 results on May 3rd.

Make sure to keep an eye on these restaurant leaders as well as the industry as a whole as we make our way deeper into earnings season.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report