Retail ETF Gains A ‘CLIX’ Away

It’s a tough time to be too positive on the retail segment, as the global pandemic shuts down economies around the world, drags U.S. consumer confidence to near a three-year low, and dents consumer discretionary spending.

That is, unless you’ve been investing in the ProShares Long Online/Short Stores ETF (CLIX).

When you think of retail ETFs, CLIX is probably not the first ticker that comes to mind. It’s a relatively small fund that came to market about two years ago, it’s alternative by design, and it isn’t all that cheap at 0.65% in expense ratio. But CLIX is one of the best-performing ETFs of the year.

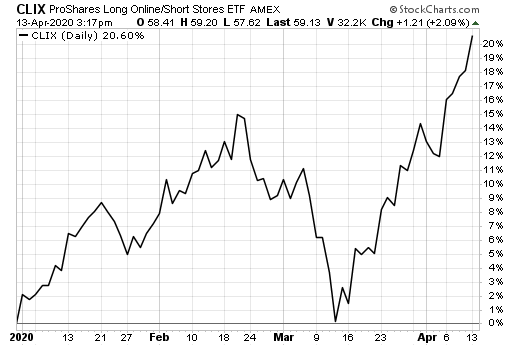

So far in 2020, CLIX is up 20%, outperforming all other retail ETFs—be they in-store or e-commerce focused—as well as the broader U.S. equity market.

Chart courtesy of StockCharts.com

CLIX isn’t just an ETF for anyone who believes the future of retail is online; it’s an ETF for those who also believe the days of brick-and-mortar shopping are numbered. CLIX is both a bullish and a bearish bet on retail in one wrapper.

The long/short approach invests in (goes long) online retailers and e-commerce giants such as Amazon, Alibaba and Wayfair. The long part of the portfolio excludes retailers that generate any revenue from physical stores. CLIX also sells (shorts) companies like Kroger, Macy’s, Ross and Foot Locker—firms that have most of their retail revenue, at least 75%, come from in-store sales.

Traditional Retail Lagging

The long/short approach to retail is leading the way this year. By comparison, consider how other retail ETFs (excluding leverage and inverse strategies) stack up this year.

The largest, the $267 million SPDR S&P Retail ETF (XRT), is down a whopping 27% year-to-date, delivering roughly twice the losses seen in the broader U.S. market as measured by the SPDR S&P 500 ETF (SPY).

XRT is the biggest and most popular retail ETF, but the fund is unique in its equal-weighting methodology. In XRT, a company like Amazon is as much a driver of returns as is Kroger, Rite Aid and Dollar General. In 2020, this equal-weighted approach has not worked well.

Compared to competing VanEck Vectors Retail ETF (RTH), which market-cap-weights its narrower basket of 25 holdings, XRT is lagging RTH by about 20 percentage points this year.

In RTH’s case, three retailers command more than 40% of the portfolio, being the biggest drivers of performance—Amazon, Home Depot and Walmart. That top-heavy concentration has worked in the current environment, and over time, it’s the source of ongoing return disparity (outperformance) between these two funds. See performance data below:

RTH is outperforming XRT handily, but both are lagging CLIX by a wide margin.

Online Focus Not Necessarily Winning

If you were to focus exclusively on online retail, you’d come across a similar issue.

The two bigger ETFs in this space, the Amplify Online Retail ETF (IBUY) and competing ProShares Online Retail ETF (ONLN), too, are delivering different returns this year because one is equal-weighted, the other is market-cap weighted. And they, too, are underperforming CLIX.

IBUY owns about 50 companies that have at least 70% of their revenues from online sales, and companies are equal-weighted within two buckets. U.S. retailers command about 75% of the portfolio, foreign retailers get the rest.

ONLN market-cap weights its e-commerce names, meaning that the bigger stocks in the portfolio such as Amazon, Alibaba and Wayfair—dominating a combined 36% of the portfolio—drive most of the returns.

Year-to-date, IBUY is down about 10% while ONLN is in the black, eking out gains of about 1.4%.

(For a full comparison of these two ETFs, check out our ETF Comparison Tool)

Whether CLIX will hold on to this outperformance going forward remains to be seen. We don’t really know what the extreme measures we’ve taken to combat a global pandemic will mean for long-term impact and guidance into this segment.

That said, it’s always cool to see the ETF wrapper at work—in this case, offering laser-focused access to an investment idea that in 2020 has proven a winner. And if conditions change; if you are a die-hard brick-and-mortar fan; or if you don’t like long/short investing, rest assured there are plenty of other retail ETF choices for you.

Contact Cinthia Murphy at cmurphy@etf.com

Recommended Stories