Retail sales, inflation, big banks — What you need to know in markets on Friday

The busiest day of the week for investors will come on Friday, with key economic data, big bank earnings, and the unlucky date of Friday the 13th looming.

The day’s biggest story will hit markets at 8:30 a.m. ET, when both the retail sales numbers and inflation data for September will be released.

Wall Street is looking for retail sales to rise 0.6% over the prior month, better than the 0.4% jump we saw in August.

Inflation will also be closely watched with this data having disappointed for most of the year, confounding some Federal Reserve officials who have been raising rates even as prices rise slower than the central bank’s 2% per year target.

“Core” inflation — which strips out the cost of food and gas and is the preferred measure used by the Fed — is expected to rise 1.8% over last year in September, up from the 1.7% increase we saw in August.

Also on the economic calendar will be the preliminary reading on consumer sentiment in October from the University of Michigan.

On the earnings side, big banks earnings are expected from Bank of America (BAC) and Wells Fargo (WFC), the second- and third-largest U.S. banks by assets.

Wall Street is looking for Bank of America to earn $0.46 per share on revenue of $21.9 billion while Wells Fargo should earn $1.03 per share on revenue of $22.4 billion.

These results will follow earnings from JP Morgan (JPM) and Citi (C) on Thursday which both beat analyst expectations on the top and bottom line, though both firms noted weakness in their trading segments.

We’d also note that Friday is the 13th of the month, considered a day of bad luck, and one that has actually been a bit worse than average for the S&P 500. LPL Financial notes that since 1928, there have been 152 instances of Friday the 13th, and the S&P 500 has averaged an annualized gain of 4.2% on these days, below the 12.8% annualized return the index averages on all Fridays.

Wall Street can’t stop talking Bitcoin

Right now, the most interesting thing happening in finance is in the cryptocurrency space.

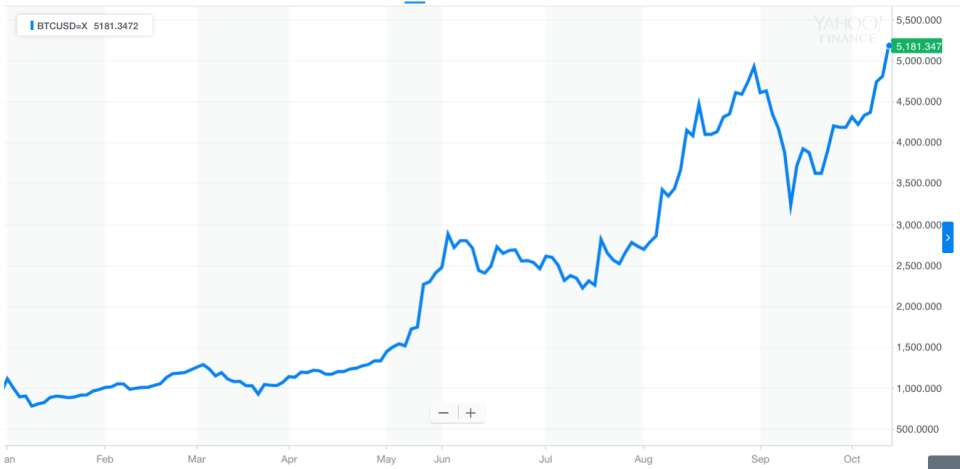

To those not steeped in the field, watching the price moves and news related to Bitcoin serves as a broad proxy for interest in the space. On Thursday, Bitcoin hit a new record high and traded above $5,000 for the first time.

And while the cryptocurrency evangelists and early adopters will contend that the blockchain technology and its possible uses are way broader than Bitcoin — and, look, these people know a lot more than I do — Bitcoin is the world casual observers know.

And in this case, casual observers include big bank executives.

Recall that back in September JP Morgan CEO Jamie Dimon made waves when he called Bitcoin a “fraud” and a bubble worse than the tulip bubble of the 1600s. Dimon added that he would fire anyone at JP Morgan he found trading Bitcoin. One of Dimon’s colleagues at JP Morgan, strategist Marko Kolanovic, also said in a note last month that the cryptocurrency market “exhibits some parallels to fraudulent pyramid schemes.”

On Thursday, Dimon was asked by reporters for his thoughts on Bitcoin and said he was done talking about the cryptocurrency, according to Bloomberg. JP Morgan CFO Marianna Lake, however, was less done talking about cryptocurrencies as a general concept, saying that the bank is, “very open minded to the potential use cases in the future for digital currencies that are properly controlled and regulated.”

This is notable for two reasons: one being that, again, Dimon does not seem to be the biggest fan of this stuff and two, this is essentially a bank calling for regulation. And that is not something you see everyday.

But the commentary out of JP Morgan comes on the heels of Goldman Sachs (GS) reportedly looking at setting up a trading venue for Bitcoin and other cryptocurrencies. And Goldman Sachs CEO Lloyd Blankfein said on Twitter earlier this month that he was, “still thinking” about Bitcoin wasn’t endorsing or rejecting the concept.

Blankfein added that, “folks also were skeptical when paper money displaced gold.” So, there’s that.

Additionally, Wall Street strategist Tom Lee — mostly known for his calls on the stock market — has spent considerable time in the last few months writing research reports on cryptocurrency and said back in August that he had a $6,000 price target for Bitcoin by mid-2018.

Lee also sees Bitcoin rising to $25,000 by 2022 and his bullish view on the currency is “premised on expanded acceptance of digital currencies (as payment platforms), and ultimately broader adoption as a “store of value” (digital currencies have a lot of characteristics that make gold attractive).”

Now, some cryptocurrency early adopters would argue that Wall Street and banking types are merely covering their butts by caring about the technology now because eventually fiat money will be replaced by digital money. This is certainly a grand vision, and in this vision the rise of Bitcoin poses a systemic risk to the Western banking industrial complex that has predominated since World War II.

But Wall Street’s interest in Bitcoin is also likely driven by the fact that it’s new, it’s interesting, trading this stuff is exciting, and the potential upside is big. There is, at this point, clearly no putting the cryptocurrency genie back in the bottle and a development in how money moves around is something the financial sector cannot miss if it wants to continue being known as the financial sector.

When Bitcoin first entered the public consciousness in 2013, the meme was that all you could do with it was buy drugs online. But in 2017, there is real money to be made and real money being invested in the space. And finding new ways to make money is more or less the whole point of modern finance.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: