Retailers Get Ready to Report Earnings Amidst Growing Fears of a Consumer Slowdown

The hope for interest rate cuts in the near-term as well as falling yields is what propelled major indices to multi-day rallies to start out November. It was the ending of those two things that snapped the longest winning streak in two years late last week. On Thursday, comments from Federal Reserve Chair Jerome Powell suggested that the Fed's work to reduce inflation was likely not done yet, causing the S&P 500, DJIA and NASDAQ to all post losses.

With peak earnings season complete, investors will be looking to the final leg of the Q3 season as retailers report in the coming weeks. Commentary from these companies will provide a read on the US consumer which has been hard to pin down as of late on account of mixed data. Last week results from apparel retailers began to trickle in and it was clear that while many companies continue to beat on the bottom-line, top-line growth has been more of a struggle. Both Under Armour (NYSE: UAA) and Steve Madden (NYSE: SHOO) beat on EPS but came in-line on revenues. Coach parent company Tapestry beat on EPS but missed revenues.? A bright spot in the space last week was RealReal Inc (NASDAQ:REAL) which surpassed both metrics, causing the stock to pop 35% since the report.?

With 92% of S&P 500 constituents reporting at this point, the blended EPS growth rate for Q3 has grown to 4.1% vs. last week's 3.7%.?

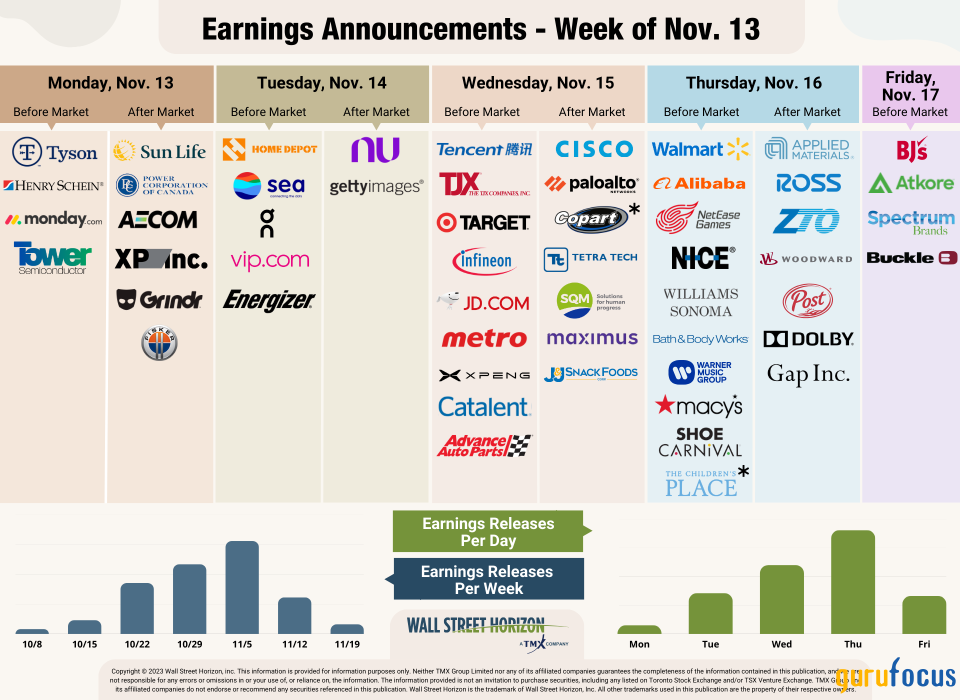

Earnings on Deck - Week of November 13, 2023

Peak earnings season is now in the rearview mirror, but there are still plenty of companies left to report for the third quarter. This week we expect earnings releases from 1,410 publicly traded companies (out of our universe of 10,000), with 12 of those coming from S&P 500 companies. There will be a big focus on retailers with reports from Home Depot (NYSE:HD), Target (NYSE: TGT), The TJX Companies (NYSE:TJX), Walmart (NYSE:WMT), Macy's (NYSE: M), Gap Inc. (NYSE:GPS), Ross Stores (NASDAQ:ROST) and more.

Source: Wall Street Horizon

Potential Surprises This Week: Henry Schein and Catalent

This week we continue to get results from companies that have pushed their Q3 2023 earnings dates outside of their historical norms. Only two of those companies are within the S&P 500 and have confirmed later than usual earnings dates and therefore have negative DateBreaks Factors*. Those companies are Henry Schein Inc (NASDAQ:HSIC) and Catalent, Inc. (NYSE: CTLT), both in the health care sector. According to academic research,? the later than usual earnings dates suggest these companies will report "bad news" on their upcoming calls.

Henry Schein (NASDAQ:HSIC)Company Confirmed Report Date: Monday, November 13, BMOProjected Report Date (based on historical data): Tuesday, November 7, BMODateBreaks Factor: -3*

Medical supplies distributor, Henry Schein, is set to report Q3 2023 results on Monday, November 13, six days later than expected. This would be the latest they've ever reported (since we began collecting data for this company in 2006).

On the dental side, HSIC has a large portfolio of implants, veneers and clear aligners. As these are often considered for cosmetic use and therefore not covered by insurance, sales of these supplies depend heavily on consumer demand which has started showing signs of softening in the fourth quarter.? A weak spot on the medical side of the business is waning sales of PPE products and COVID-19 test kits in comparison to the year-ago period.?

Another thing to keep in mind is Henry Schein's recent acquisition of Shield Healthcare which was just completed last month. Oftentimes acquisitions can be the culprit of delayed earnings dates.

Catalent, Inc. (NASDAQ:CTLT)Company Confirmed Report Date: Wednesday, November 15, BMOProjected Report Date (based on historical data): Wednesday, November 1, BMODateBreaks Factor: -3*

This isn't our first time highlighting a troublesome signal for Catalent. This global consumer health company develops and manufactures solutions for drugs, protein-based biologics, cell, and gene therapies. The $8 billion market cap New Jersey-based Pharma industry stock within the Health Care sector has a history of late earnings date confirmations and pushing back its quarterly results.

For FQ1 2024, CTLT has pushed back their earnings release to November 15, two weeks later than expected. This would be the latest they've ever reported (since we began collecting data for this company in 2014). It's also their first Wednesday report after reporting on Tuesdays for the last 5 years.

Lower demand for its consumer discretionary products caused a guidance cut in the year-ago quarter, sending shares crashing.? CTLT then soared earlier this year amid takeover speculation, but those gains were fleeting as a reorg in April cast doubt on the firm's long-term viability. Next, a guidance cut in May sparked a plunge to its year-to-date low, which it is dangerously close to matching at present. Finally, after another dismal outlook, Q2 results beat Street expectations back in June. A new CFO was named thereafter. In August the company reported FQ4 2023 results that showed revenues falling 19% year-over-year (YoY) and EPS that missed sell-side expectations by two cents.

1 Opening Remarks, Federal Reserve, Jerome H. Powell, November 9, 2023, https://www.federalreserve.gov2 Based on recent results for US Retail Sales, University of Michigan's Consumer Sentiment Survey, Credit Card delinquency data, Savings data.3 As compared to FactSet estimates4 As compared to FactSet estimates5 As compared to FactSet estimates6 Earnings Insight, FactSet, John Butters, November 10, 2023, https://advantage.factset.com7 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com8 Whispers of a consumer slowdown, Financial Times, Robert Armstrong, October 11, 2023,https://www.ft.com9 Henry Schein Reports Solid Second-Quarter 2023 Financial Results and Affirms Full-year Guidance, Henry Schein, August 7, 2023, https://investor.henryschein.com10 Catalent, Inc. Reports First Quarter Fiscal 2023 Results, Catalent, November 1, 2022, https://investor.catalent.com11 Catalent cuts forecast, delays results again as challenges mount, Reuters, Bhanvi Satija, May 19, 2023, https://www.reuters.com12 Catalent, Inc. Reports Preliminary Fourth Quarter and Fiscal 2023 Results, Catalent, August9, 2023, https://investor.catalent.com?

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Copyright 2023 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. The Future is Yours to See., TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange, TSXV and Voir le futur. Realiser l'avenir. are the trademarks of TSX Inc. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.