Should You Retain AvalonBay (AVB) Stock in Your Portfolio Now?

AvalonBay Communities’ AVB high-quality assets located in some of the premium markets of the United States are well-poised to benefit amid the healthy demand for residential properties. Moreover, its strategic acquisitions and development pipeline augur well for its long-term growth opportunities. However, an elevated supply of apartment units in some markets and an expected moderation in rent growth are worrisome for the company. A high interest rate environment adds to its concerns.

What’s Aiding It?

AVB mainly focuses on adding properties situated in the leading metropolitan areas where the market is characterized by growing employment in the high-wage sectors of the economy, higher home ownership costs and a diverse and vibrant quality of life. This offers AvalonBay an edge for generating superior long-term risk-adjusted returns on apartment community investments over other markets that lack such characteristics.

Furthermore, limited single-family home inventory is making the transition from renter to homeowner difficult in its markets. This makes renting apartment units a viable option. For 2023, management expects year-over-year same-store residential rental revenue growth to be 6.3% at the midpoint. We project same-store residential rental revenues to rise 6.2% year over year in 2023.

The residential REIT also leverages technology, scale and organizational capabilities to drive margin expansion in its portfolio. It is focusing on self-serve digital experiences to provide a seamless, personalized customer experience. Such efforts are likely to bring about operational efficiency and reduce costs, aiding net operating income (NOI) growth. Management expects to generate around $80 million of total incremental NOI from its operating model transformation.

To enhance its portfolio quality, the company has been focusing on strategic acquisitions. In 2022, it completed acquisitions worth $536.2 million. Given the favorable residential real estate market fundamentals in the newly expanded markets of Raleigh-Durham and Charlotte, NC, Southeast Florida, Dallas and Austin, TX, and Denver, CO, AvalonBay is tracking opportunities to increase its asset base here.

Moreover, AvalonBay has an encouraging development pipeline, with a majority portion being match-funded with long-term debt and equity capital. The projects, upon completion and stabilization, are expected to fuel funds from operations (FFO) and NAV growth in the future.

On the balance sheet front, AvalonBay had $508.6 million of unrestricted cash and cash equivalents, and $234 million in unrestricted cash as of Sep 30, 2023. As of the same date, the company did not have any borrowings outstanding under its $2.25 billion unsecured credit facility. With a well-laddered debt maturity schedule and enough financial flexibility, AVB is well-positioned to capitalize on growth opportunities.

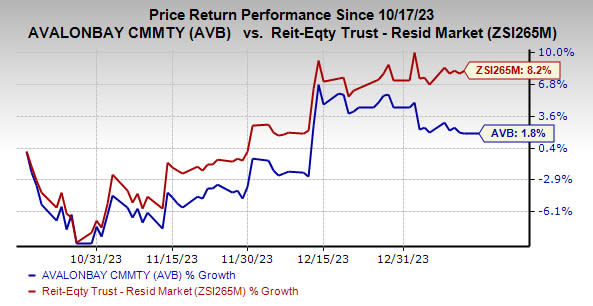

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 1.8% compared with the industry's upside of 8.2%.

Image Source: Zacks Investment Research

What’s Hurting It?

The continuation of the flexible working environment is resulting in lower renter demand for costlier and urban/infill markets, raising concerns for AvalonBay’s properties that are located in the urban markets. Further, an expected moderation in rent growth in the near term could impede top-line growth to a certain extent in some regions and markets.

The struggle to lure renters will persist, as supply volume is expected to remain elevated in some markets where the company operates. Moreover, it faces competition from other housing alternatives, such as rental apartments, condominiums and single-family homes. Such a competitive landscape limits the company’s ability to increase rent, thereby restricting its growth momentum to some extent.

Further, high interest rates are likely to keep the company's borrowing costs elevated, affecting its ability to purchase or develop real estate.

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Host Hotels & Resorts HST and OUTFRONT Media OUT, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Host Hotels’ 2023 FFO per share has been raised 1.7% over the past two months to $1.83.

The Zacks Consensus Estimate for OUTFRONT’s 2023 FFO per share has moved marginally north in the past two months to $1.63.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report