Should You Retain W.R. Berkley (WRB) Stock in Your Portfolio?

W.R. Berkley Corporation WRB has been favored by investors on the back of high retention, growth in premium rates and exposure as well as effective capital deployment.

Growth Projections

The Zacks Consensus Estimate for W.R. Berkley’s 2023 earnings is pegged at $4.53, indicating a 3.4% increase from the year-ago reported figure on 9.6% higher revenues of $12.02 billion. The consensus estimate for 2024 earnings is pegged at $5.53, indicating a 21.9% increase from the year-ago reported figure on 7.4% higher revenues of $12.91 billion.

Earnings Surprise History

WRB has a decent earnings surprise history. It beat estimates in three of the last four quarters and missed in one, the average surprise being 5.54%.

Zacks Rank & Price Performance

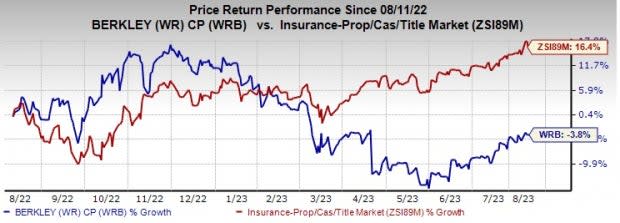

W.R. Berkley currently carries a Zacks Rank #3 (Hold). In the past year, the stock has lost 3.8% against the industry’s rise of 16.4%.

Image Source: Zacks Investment Research

Business Tailwinds

The Insurance business of W.R. Berkley is well-poised to grow, given higher premiums from other liability, short-tail lines, workers' compensation, commercial automobile and professional liability.

Higher premiums at casualty reinsurance, property reinsurance and monoline excess are likely to drive the performance of the Reinsurance & Monoline Excess segment. Underwriting income should gain from the compounding rate improvement above loss cost trends along with growth in exposure and lower claims frequency in certain lines of business.

WRB is one of the largest commercial lines property and casualty insurance providers. It has a solid balance sheet with sufficient liquidity and robust cash flows that support growth initiatives and effective capital deployment.

Net investment income witnessed a CAGR of 5.4% in the past eight years (2015-2022). The combination of a high-quality fixed maturity portfolio, along with solid operating cash flow, enabled the insurer to invest at higher interest rates in the first half of 2023. The metric should continue to improve as WRB also invests in alternative assets, such as private equity funds and direct real estate opportunities.

W.R. Berkley maintains a solid balance sheet with sufficient liquidity and strong cash flows. The insurer generated strong operating cash flow which increased 14.7% to $1.1 billion in the first six months of 2023.

A strong capital position helps WRB deploy capital via share repurchases, special dividends and dividend hikes that enhance shareholders' value. In June 2023, the insurer approved a 10% hike in its quarterly dividend, marking the 18th consecutive increase since 2005. In addition, the board has increased the share repurchase authorization to 15 million shares.

Stocks to Consider

Some better-ranked stocks from the property and casualty insurance industry are Kinsale Capital Group, Inc. KNSL, Arch Capital Group Ltd. ACGL and Axis Capital Holdings Limited AXS, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinsale Capital has a solid track record of beating earnings estimates in each of the last trailing four quarters, the average being 14.88%. In the past year, KNSL has gained 33.6%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings per share is pegged at $11.16 and $13.64, indicating a year-over-year increase of 43% and 22.1%, respectively.

Arch Capital has a solid track record of beating earnings estimates in each of the last trailing four quarters, the average being 26.83%. In the past year, ACGL has gained 67.5%.

The Zacks Consensus Estimate for ACGL’s 2023 and 2024 earnings per share is pegged at $6.58 and $7.25, indicating a year-over-year increase of 35.1% and 10.2%, respectively.

Axis Capital has a solid track record of beating earnings estimates in three of the last four quarters and missing in one, the average being 9.75%. In the past year, AXS has gained 2.5%.

The Zacks Consensus Estimate for AXS’ 2023 and 2024 earnings per share is pegged at $8.18 and $9.17, indicating a year-over-year increase of 40.7% and 12.1%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report