Retirement planning: Are you 401 oK?

Thank goodness for retirement anxiety

If you had been alive 150 years ago, your retirement plan would have been to keep working—or hope your family (or a philanthropic organization) could support you until you depart for the great unknown. Today, we spend years fretting about public pensions, private pensions, subsidized healthcare, retirement savings, and tax advantaged investment accounts, all to ensure we can make the most of our golden years.

Read more

All the sports that are part of Saudi Arabia's sportswashing plan

How many UBI trials do we need to prove giving away money works?

What has changed? Well, everything: Retirement (and the need to prepare for it) is a product of the Industrial Revolution, the rise of democracy, and the extension of human lifespans. Now, a huge chunk of social effort is focused on supporting the elderly, and in wealthy places like the US, Japan, and Western Europe, an increasingly elderly population will only reinforce those trends in the decades ahead.

But inflation, slowing economic growth, and economic precarity could mean more work for the elderly. Many economists fret that the Baby Boomers, the youngest of whom are in their early 60s, haven’t invested enough to retire securely, even as challenges to public retirement plans could mean benefit cuts if politicians don’t have the guts to raise taxes.

Our advice? Start saving now.

By the digits

19.3%: Share of Americans who said they were retired in 2022

$7 trillion: A 2019 estimate of the shortfall in Americans’ retirement savings

70%: Share of pre-retirement earnings economists think is required to maintain living standards when you stop working

22: Amount by which you should multiply your hoped-for retirement income to gauge how much you need to save, by one estimate

30,577: Number of assisted living communities for seniors in the US

66%: Decline in poverty rate among seniors over 65 in the last five decades

How do I plan for MY retirement?

Setting aside the rich debate over preserving the benefits of public pensions and healthcare for seniors: What can you do right now? While there is an entire industry for financial advice (and Quartz is not part of it), there are guidelines that can help clear a path. Here are some favorites:

Save automatically, then forget about it. Whether through 401k contributions (if you’re in the US) into an index fund or an automated transfer into a savings account, set it and forget it—and the sooner, the better.

Invest in low-fee retirement products. Favoring cheaper passive funds over actively-managed portfolios has saved investors billions of dollars, and makes for better returns.

Get a financial advisor, and ask them the right questions. Investing columnist Jason Zweig has a helpful checklist of queries to identify an advisor positioned to help you, not fleece you.

Quotable

“Call it socialism or whatever you like. It is the same to me.”

—Former German Chancellor Otto von Bismarck while introducing social insurance legislation to the Reichstag in 1881

Charted

One retirement, two genders

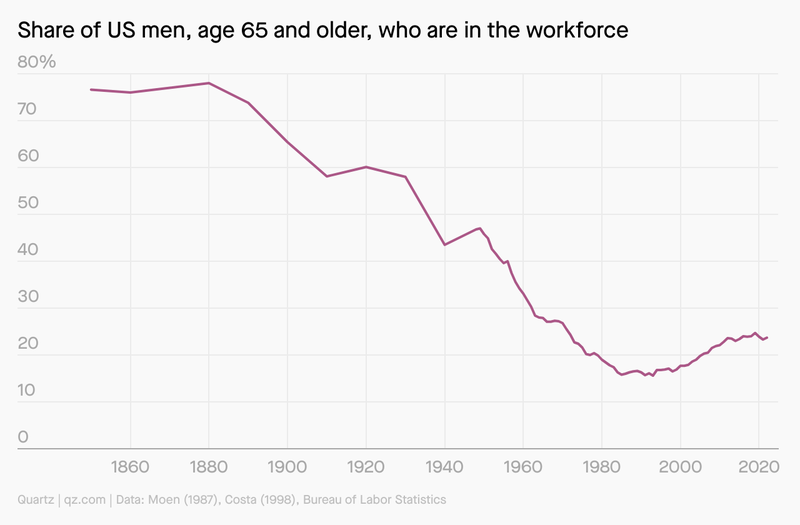

The history of retirement planning is a history of older men working less…

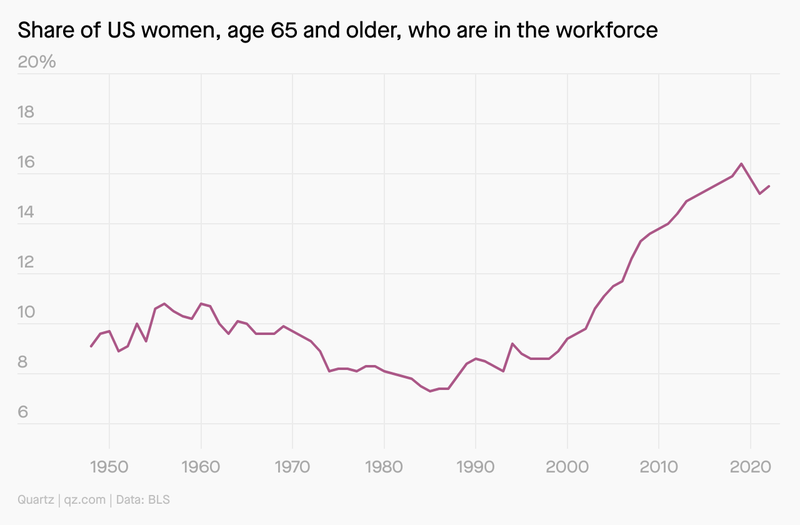

… and older women working more, as gender equality gives them more opportunity to be and remain in the workforce—although the share of men over 65 in the workforce is still slightly higher than women of the same age.

Pop quiz

Why is 65 the traditional “retirement age”?

A. It’s a mixture of historical accident and actuarial calculations.

B. That’s how old Otto von Bismarck was when he proposed retirement pensions.

C. It was beyond the average life expectancy when pensions were first proposed.

D. Honestly, you can do a lot of work before you’re 65.

We saved the answer for you at the bottom of this email.

Brief history

13 BCE: Roman Emperor Caesar Augustus creates one of the earliest recorded public pension plans to give former soldiers retirement cash instead of land grants.

1797: Radical writer Thomas Paine argues for a social insurance scheme to benefit the elderly and the young in his pamphlet Agrarian Justice.

1875: The American Express Company, at the time a shipping and money order business, establishes the first private pension plan for its employees who work for 20 years and are over the age of 60.

1880: The Baltimore and Ohio Rail Road Company creates the first pension plan that includes employee contributions, covering more than 77,000 workers.

1881: German chancellor Otto von Bismarck leads the creation of a public pension system, part of a package of social insurance legislation enacted to defang socialist opposition parties.

1935: The US creates the Social Security program under president Franklin Roosevelt, responding to public demands to aid the elderly during the Great Depression.

1974: The US creates the modern, tax-advantaged Individual Retirement Account by enacting the Employee Retirement Income Security Act (ERISA); the 401k would follow several years later.

1984: More people participate in defined-contribution pension plans like the 401k than in defined-benefit pension plans that guarantee a specific retirement income.

Fun fact!

In the 1930s, a group called the Technocrats advocated for engineers to run the US on scientific grounds; they expected their reforms to allow most people to retire at 45. Advocates included Thorstein Veblen, Upton Sinclair, and H.G. Wells, but the Technocrats were suspicious of names—at one rally, a speaker was identified as “1x1809x56.” That’s a lot of Xes.

Take me down this 🐰 hole!

One response to anxieties about economic precarity and work-life balance is simply to get it out of the way faster. A philosophy popularly known as Financial Independence, Retire Early (FIRE) takes the idea to the extreme; adherents attempt to cut spending while saving as much income as possible in order to become economically secure and ditch the rat race.

Originating with the book Your Money or Your Life, FIRE’s appeal peaked among young professionals in the post-financial crisis bull market. But the sacrifices required to achieve early retirement can be unpleasant, and for people without college degrees or even moderate family wealth, it just doesn’t work. (We’ve obsessed about FIRE’s impact before.)

Poll

How confident are you in your retirement savings?

I’m laddering Treasury bonds and maxing out my 401k.

Once I get these student loans taken care of, I’m on it.

My investment strategy is the lottery!

Take our one-question survey to let us know. We’re confident that investing your thoughts with us carries little risk.

💬 Let’s talk!

In our last poll about red dye no. 3, a whopping 68% of you said you’re not too concerned about being put off candy because you’re more into chocolate.

🤔 What did you think of today’s email?

💡 What should we obsess over next?

Today’s email was written by Tim Fernholz (congrats to my Dad on his retirement!) and edited and produced by Annaliese Griffin (counting on her side hustle in real estate) and Morgan Haefner (doesn’t think she’ll ever retire).

The answer is A. Despite the myth, Bismarck’s proposed retirement age was 70 years old. Sixty-five emerged as a compromise retirement age for Social Security in part because some politicians proposed 60. Today, with life expectancy rising, many governments are pushing for older retirement ages.

More from Quartz

Sign up for Quartz's Newsletter. For the latest news, Facebook, Twitter and Instagram.