Will Revenue Contraction Hinder Corning's (GLW) Q2 Earnings?

Corning Incorporated GLW is scheduled to report its second-quarter 2023 results on Jul 25, before the opening bell. In the last reported quarter, the communications components provider beat the Zacks Consensus Estimate of 39 cents. Corning delivered a trailing four-quarter earnings surprise of 3.44%, on average.

The company is expected to have registered lower revenues year over year, owing to inflationary pressure, weakness in several end markets and macroeconomic headwinds.

Factors at Play

During the second quarter, Corning signed a joint venture agreement with SGD Pharma to establish a new glass tubing facility in India. The collaboration aims to expand pharmaceutical manufacturing capability in the subcontinent, enabling quicker and more efficient delivery of crucial medications. Leveraging proprietary technology, Corning’s Velocity Vials — borosilicate vials with patented uniform coating — optimize manufacturing efficiency and reduce production costs.

The Velocity Vial technology platform offers easy access to pharma and biotech companies into Corning’s game-changing pharmaceutical packaging technology. It elevates the quality of vials, boosts productivity on filling lines and accelerates the global delivery of injectable medicine.

On the other hand, strategic partnerships with pharma firms enable the company to extend its manufacturing footprint, localize its supply chains and facilitate the sale of Velocity Vials through an extensive network of selling partners. It is likely to have had a positive impact on the second-quarter performance.

In the quarter under review, Corning announced a 20% hike in its display glass substrate prices across all geographic regions. This decision comes in response to the escalation of production costs, as the company revealed that it is forced to pass on the inflated raw material and energy costs to consumers to sustain profitability.

Despite improved market conditions in China and the recovery of panel maker utilization, inflationary pressure remains a major concern in Display Technologies. Demand softness in the smartphone and IT end market, combined with macroeconomic headwinds is straining margins.

Inventory adjustments and lower demand for COVID-related products are affecting net sales in the Life Sciences segment. The display and optical segments account for around 59% of total revenues. This lack of end market diversification makes it vulnerable to economic cycles and augments business risk.

Our estimate for revenues from the Optical Communications vertical is pegged at $1205.6 million. For the Display Technologies segment, our estimate for revenues is pegged at $791.5 million. Our estimate for revenues from the Specialty Materials and Environmental Technologies is pegged at $420 million and $378.7 million, respectively.

For the June quarter, the Zacks Consensus Estimate for revenues is pegged at $3,468 million. The company reported revenues of $3,762 million in the year-ago quarter. The consensus estimate for adjusted earnings per share stands at 45 cents, which suggests a decline from the year-ago tally of 57 cents.

Earnings Whispers

Our proven model does not predict an earnings beat for Corning in the second quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -1.60%. The Most Accurate Estimate is pegged at 44 cents while the Zacks Consensus Estimate stands at 45 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

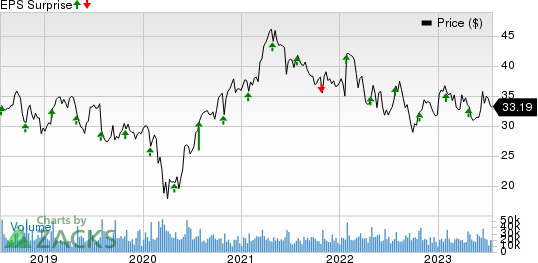

Corning Incorporated Price and EPS Surprise

Corning Incorporated price-eps-surprise | Corning Incorporated Quote

Zacks Rank: Corning has a Zacks Rank #3.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

Alphabet Inc. GOOGL is set to release quarterly numbers on Jul 25. It has an Earnings ESP of +2.49% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Meta Platforms META has an Earnings ESP of +5.83% and carries a Zacks Rank of 2. The company is set to report quarterly numbers on Jul 26.

T-Mobile US, Inc. TMUS has an Earnings ESP of +3.94% and a Zacks Rank of 2. The company is scheduled to report quarterly numbers on Jul 27.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corning Incorporated (GLW) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report