Revenue Diversification to Aid Evercore (EVR) Amid Cost Woes

Evercore Inc EVR remains well poised for growth on the back of its efforts to boost client base in advisory solutions, diversify revenue sources and expand geographically. Further, strength in investment banking business will likely drive top-line growth. However, elevated expenses, competitive landscape and muted Investment Management segment’s revenues are key headwinds.

The majority of Evercore’s revenues comes from its investment banking business. Though investment banking’s net revenues declined in the first half of 2023 and 2022, it witnessed a compound annual growth rate (CAGR) of 7.6% from 2018-2022. The metric is expected to weigh in 2023 due to lower global mergers and acquisitions, and underwriting activity on the back of macroeconomic and geopolitical concerns.

Nonetheless, the company’s efforts to elevate its client base in advisory solutions, diversify revenue sources and expand footprints will aid the top line going forward.

Evercore maintains a solid balance sheet and liquidity position. As of Jun 30, 2023, cash and cash equivalents were $520.6 million, and investment securities and certificates of deposit were $962.1 million. Total notes payable due were $373.6 million as of the same date. EVR seems well-positioned to meet its debt obligations, even if the economic situation worsens.

Further, the company’s meaningful capital distribution efforts through regular dividend payments and share repurchases are likely to continue enhancing shareholders’ wealth.

However, revenues generated by the Investment Management segment accounts for a smaller portion of Evercore's top line. Though segmental revenues increased marginally in the first half of 2023 on a year-over-year basis, it witnessed a negative CAGR of 1.2% over the last five years ended 2022. This was largely attributable to disposal and restructuring of several related units. Any change in the institutional assets under management trend due to foreign exchange fluctuations will likely lead to lower fees in the upcoming period.

Evercore continues to record a rise in expenses, witnessing a CAGR of 9.6% over the 2019-2022 period. In 2022 and the first six months of 2023, expenses decreased due to a decline in employee compensation and benefit expenses. Management expects the compensation ratio to remain elevated throughout 2023.

Competition in the financial advisory market is fierce and forces companies to keep up with evolving trends. Evercore competes with other well-established financial institutions with better brand recognition and product diversification, which enhance their competitive position. Further, new entries into the market could create additional pricing and competitive pressures, which may affect its results.

Analysts seem bearish regarding EVR’s earnings growth prospects. The Zacks Consensus Estimate for the company's 2023 earnings has been revised marginally downward over the past 30 days. The company currently carries a Zacks Rank #3 (Hold).

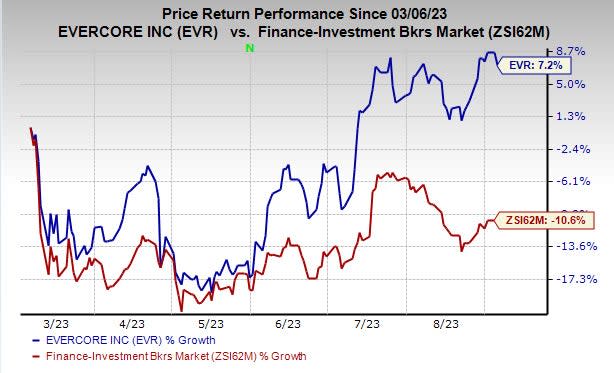

Over the past six months, shares of EVR have gained 7.2% against the industry's decline of 10.6%.

Image Source: Zacks Investment Research

Finance Stocks Worth a Look

A couple of better-ranked stocks from the finance space are T.Rowe Price (TROW) and SEI Investments SEIC.

T.Rowe currently sports a Zacks Rank #1 (Strong Buy). Its earnings estimates for 2023 has been revised 1.4% upward over the past 30 days. In the past three months, TROW’s shares have increased 0.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SEI Investments’ current-year earnings has been revised marginally upward over the past 30 days. Its shares have gained 5.9% in the past three months. Currently, SEIC carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Evercore Inc (EVR) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report