Revenues Working Against Locality Planning Energy Holdings Limited's (ASX:LPE) Share Price

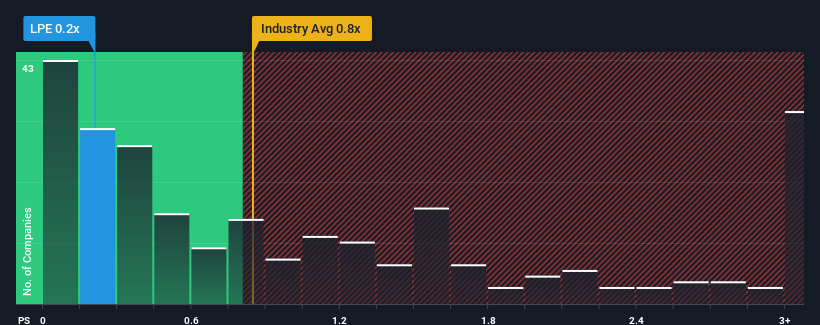

When you see that almost half of the companies in the Electric Utilities industry in Australia have price-to-sales ratios (or "P/S") above 2.1x, Locality Planning Energy Holdings Limited (ASX:LPE) looks to be giving off some buy signals with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Locality Planning Energy Holdings

What Does Locality Planning Energy Holdings' P/S Mean For Shareholders?

For instance, Locality Planning Energy Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Locality Planning Energy Holdings will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Locality Planning Energy Holdings' earnings, revenue and cash flow.

How Is Locality Planning Energy Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Locality Planning Energy Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 10% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 3.3% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that Locality Planning Energy Holdings is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Locality Planning Energy Holdings' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Locality Planning Energy Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Locality Planning Energy Holdings has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.