Revolve Group Inc (RVLV) Navigates Challenging Economic Terrain in 2023 Earnings Report

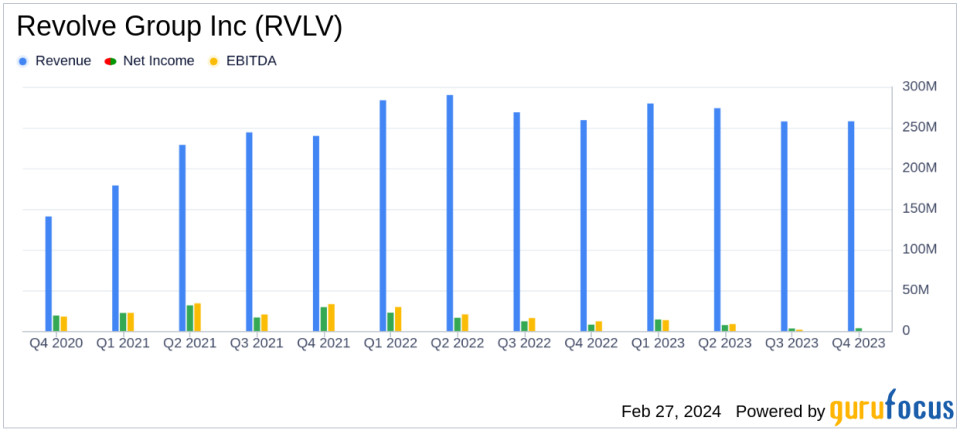

Net Sales: Reported a slight decrease of 1% year-over-year to $257.8 million in Q4 and a 3% decrease to $1.07 billion for the full year.

Gross Margin: Improved to 52.0% in Q4, marking a year-over-year increase, and stood at 51.9% for the full year.

Net Income: Experienced a significant drop of 56% year-over-year to $3.5 million in Q4 and a 52% decrease to $28.1 million for the full year.

Adjusted EBITDA: Decreased by 40% to $8.5 million in Q4 and by 52% to $43.4 million for the full year.

Active Customers: Increased by 9% year-over-year, indicating continued customer engagement and brand reach.

Stock Repurchase Program: Revolve Group Inc (NYSE:RVLV) invested in shareholder value through a $100 million stock repurchase program.

Outlook for 2024: The company provided guidance for the full year, expecting gross margin between 52.5% and 53.0%.

On February 27, 2024, Revolve Group Inc (NYSE:RVLV) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, a leading e-commerce retailer for Millennial and Generation Z consumers, faced a challenging economic environment but managed to report a solid fourth quarter with improved sales trends and gross margin expansion.

Financial Performance and Challenges

Revolve Group Inc (NYSE:RVLV) reported a slight decrease in net sales for the fourth quarter of 2023, with a 1% drop to $257.8 million compared to the same period in the previous year. The full year also saw a decrease in net sales by 3% to $1.07 billion. Despite the dip in sales, the company achieved a gross margin of 52.0% in the fourth quarter, a year-over-year increase of 57 basis points. This improvement was primarily driven by margin expansion in the REVOLVE segment and was the first year-over-year increase in gross margin in six quarters.

However, net income for the fourth quarter fell sharply by 56% to $3.5 million, and the full year saw a 52% decrease to $28.1 million. Adjusted EBITDA also decreased by 40% to $8.5 million in the fourth quarter and by 52% to $43.4 million for the full year. These declines were primarily due to growth in operating expenses that outpaced the slight growth in gross profit.

Operational Metrics and Financial Achievements

Revolve Group Inc (NYSE:RVLV) continued to grow its customer base, with active customers increasing by 9% to 2,543,000 as of December 31, 2023. The company also saw a 3% increase in total orders placed in the fourth quarter, although the average order value decreased slightly by 1% to $303.

The company's focus on operational efficiency and cost containment was evident in its efforts to reduce shipping and logistics costs. Additionally, Revolve Group Inc (NYSE:RVLV) demonstrated its commitment to creating shareholder value through its stock repurchase program, buying back shares at an average cost of $13.91 per share.

Co-founder and co-CEO Mike Karanikolas expressed pride in the team's accomplishments, stating:

Im proud of our teams accomplishments in 2023 that set us up well for 2024. Despite the challenging backdrop for consumer discretionary spending, we closed out the year with a solid fourth quarter that included improved sales trends, year-over-year expansion of our gross margin and early progress on selling and distribution cost efficiencies.

Co-founder and co-CEO Michael Mente highlighted the company's competitive advantage:

Our profitable and cash generative business remains a key competitive advantage that has enabled us to invest in longer-term growth initiatives throughout the cycle at a time when many industry peers have no choice but to significantly reduce investment.

Looking Ahead

For the full year ending December 31, 2024, Revolve Group Inc (NYSE:RVLV) anticipates a gross margin between 52.5% and 53.0%. The company's guidance reflects its strategic focus on maximizing long-term value creation through investments in brands, technology, and operations.

Revolve Group Inc (NYSE:RVLV) remains debt-free, with cash and cash equivalents growing to $245.4 million as of December 31, 2023. The company's strong balance sheet and cash flow generation position it well to navigate the uncertain economic landscape and continue investing in growth initiatives.

Investors and analysts are encouraged to review the additional trend information and financial details available in the Q4 and FY 2023 Financial Highlights presentation on the company's investor relations website.

For further insights and analysis on Revolve Group Inc (NYSE:RVLV)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Revolve Group Inc for further details.

This article first appeared on GuruFocus.