Revolve's (NYSE:RVLV) Q4: Beats On Revenue

Online fashion retailer Revolve Group (NASDAQ: RVLV) reported results ahead of analysts' expectations in Q4 FY2023, with revenue flat year on year at $257.8 million. It made a GAAP profit of $0.05 per share, down from its profit of $0.11 per share in the same quarter last year.

Is now the time to buy Revolve? Find out by accessing our full research report, it's free.

Revolve (RVLV) Q4 FY2023 Highlights:

Revenue: $257.8 million vs analyst estimates of $246 million (4.8% beat)

EPS: $0.05 vs analyst estimates of $0.02 ($0.03 beat)

Free Cash Flow was -$4.96 million, down from $11.49 million in the previous quarter

Gross Margin (GAAP): 52%, up from 51.4% in the same quarter last year

Trailing 12 months Active Customers : 2.54 million, up 203,000 year on year

Market Capitalization: $1.22 billion

"I'm proud of our team's accomplishments in 2023 that set us up well for 2024," said co-founder and co-CEO Mike Karanikolas.

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

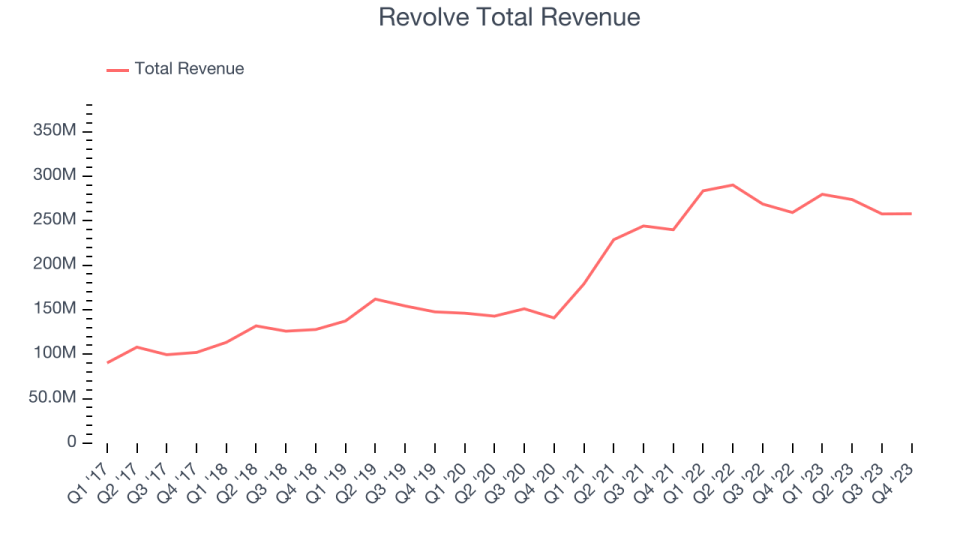

Sales Growth

Revolve's revenue growth over the last three years has been strong, averaging 25.5% annually. This quarter, Revolve beat analysts' estimates but reported a year on year revenue decline of 0.5%.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Usage Growth

As an online retailer, Revolve generates revenue growth by expanding its number of buyers and the average order size in dollars.

Over the last two years, Revolve's active buyers, a key performance metric for the company, grew 23.9% annually to 2.54 million. This is strong growth for a consumer internet company.

In Q4, Revolve added 203,000 active buyers, translating into 8.7% year-on-year growth.

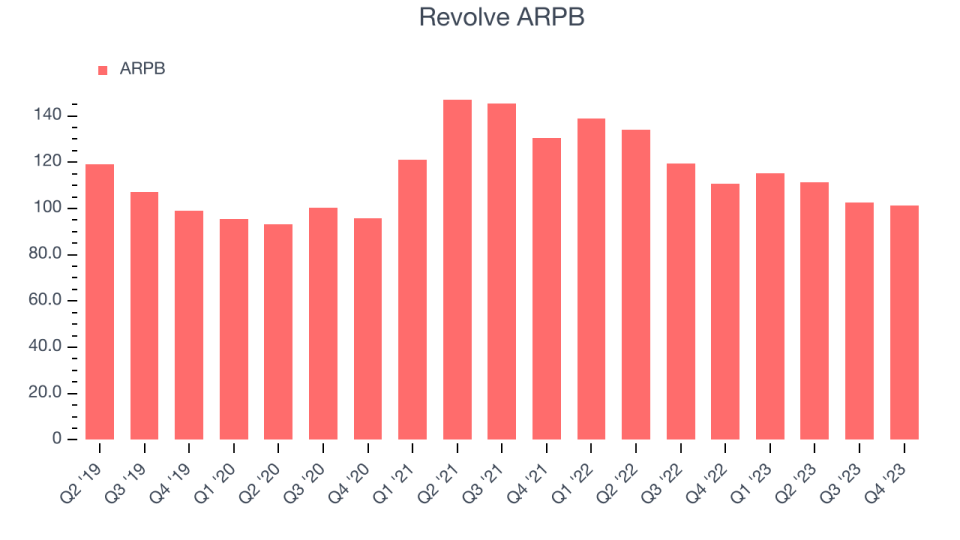

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Revolve because it measures how much customers spend per order.

Revolve's ARPB has declined over the last two years, averaging 10.4%. Although it's unfortunate to see the company lose its pricing power, it was still able to achieve strong buyer growth. This quarter, ARPB declined 8.5% year on year to $101.37 per buyer.

Key Takeaways from Revolve's Q4 Results

It was great to see Revolve beat analysts' revenue expectations this quarter. We were also glad it expanded its user base. On the other hand, its revenue growth regrettably slowed. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 3% after reporting and currently trades at $17.99 per share.

So should you invest in Revolve right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.