Revvity (RVTY) to Report Q2 Earnings: What's in the Cards?

Revvity, Inc. RVTY is slated to report second-quarter 2023 results on Aug 1, before market open. In the last reported quarter, the company delivered an earnings surprise of 2.02%. PKI’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 5.19%.

Q2 Estimates

The Zacks Consensus Estimate for revenues is pegged at $705.15 million, indicating a decline of 42.7% from the year-ago quarter’s reported figure. The consensus mark for earnings is pinned at $1.18 per share, indicating a deterioration of 49.1% from that recorded in the prior-year quarter.

Company Name Change

The company changed its name to Revvity with effect from Apr 26. The change in the company’s name followed the completion of divesture of its Applied, Food and Enterprise Services ("AES") business to an investment firm, New Mountain Capital, in March. The divestment deal was signed in 2022 for up to $2.45 billion in total consideration. The deal is likely to have boosted RVTY’s cash position during the soon-to-be-reported quarter.

The AES business was part of Discovery & Analytical Solutions that generated more than 28% of total combined revenues for erstwhile PerkinElmer in 2022. The divesture is likely to be a key factor for a significant decline in estimated revenues for the second quarter.

Following the divestment, the company now consists of the high-growth Life Sciences and Diagnostics business.

Lower COVID Revenues Likely to Hurt Diagnostics

Revvity’s Diagnostics business is expected to have continued its declining trend in the quarter to be reported. Sales of this segment declined 47.2% in the last reported quarter, primarily due to a drop in demand for COVID-related products. However, this is likely to be partially offset by strong demand for non-COVID products in the second quarter.

The removal of COVID-19 restrictions in China might have boosted the continued demand for RVTY’s immunodiagnostics business. This, in turn, is likely to have partially offset loss of sales from COVID-related products.

Our estimate for the Diagnostic segment is $396.5 million, indicating a 30.3% decline year over year.

Another Revenue Driver

In the first quarter of 2023, Discovery & Analytical Solutions business, excluding AES business, grew 7.2%. This was mainly due to continued demand for Revvity’s preclinical discovery business and strength in its informatics franchise. This trend is likely to have continued in the quarter to be reported.

Our estimate for this segment is $311.4 million, indicating a 4.7% year-over-year decline.

Meanwhile, continued supply-chain challenges and inflationary pressures in some countries are expected to have fueled material costs, thereby hurting margins. However, productivity initiatives, improved pricing and strict cost control measures are likely to have benefited RVTY’s second-quarter gross and operating margins. New product introductions might have improved product mix and, thereby, gross margin.

Other Factors to Consider

In May, Revvity inked a new license agreement with AstraZeneca for its next-generation base editing technology, Pin-point. The new agreement is expected to have significantly strengthened Revvity’s Life Sciences business unit in the to-be-reported quarter.

In June, Revvity launched two new systems — Signals Research Suite, a cloud-native SaaS platform supporting drug development; and UNIQO 160 (CE-IVDR), an autoimmune diagnostic. Although these two systems are unlikely to have any material impact on quarterly performance, RVTY may provide an update on the launch progress during the second-quarter earnings call.

What the Zacks Model Unveils

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here, as you will see below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate ($1.19 per share) and the Zacks Consensus Estimate ($1.18 per share), is +0.32%. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: Revvity currently has a Zacks Rank #4 (Sell).

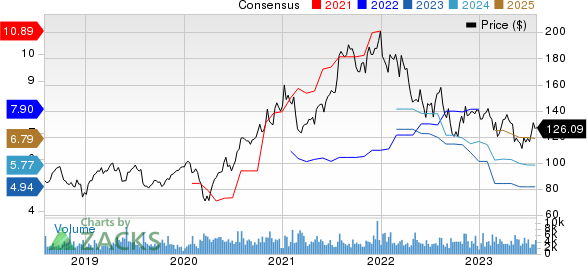

Revvity Inc. Price and Consensus

Revvity Inc. price-consensus-chart | Revvity Inc. Quote

Stocks Worth a Look

Here are some medical stocks worth considering as these have the right combination of elements to post an earnings beat this reporting cycle.

AmerisourceBergen ABC has an Earnings ESP of +0.59% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The stock has gained 12.5% year to date. ABC’s earnings beat estimates in the last reported quarter. It has a four-quarter earnings surprise of 3.14%, on average.

Becton, Dickinson and Company BDX has an Earnings ESP of +0.48% and a Zacks Rank of 2 at present.

The stock has gained 10.2% year to date. BDX’s earnings missed estimates in the last reported quarter. It has a trailing four-quarter average earnings surprise of 5.79%.

Pacific Biosciences of California PACB has an Earnings ESP of +5.88% and a Zacks Rank of 3 at present.

The stock has gained 65% year to date. PACB’s earnings beat estimates in the last reported quarter. It has a negative four-quarter average earnings surprise of 3.66%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Revvity Inc. (RVTY) : Free Stock Analysis Report