Revvity's (RVTY) New Tie-Up to Boost NGS Research Workflow

Revvity, Inc. RVTY recently collaborated with Element Biosciences, Inc. The tie-up is aimed at introducing workflow solutions that can save the time and effort needed for the genomic analysis of samples.

Notably, Element Biosciences is the developer of an emerging genomic sequencing platform, the AVITI System.

Revvity and Element Biosciences are currently planning to make the combined solution available to an expanded customer base interested in the full workflow or specific modules.

The latest collaboration is expected to significantly boost Revvity’s multi-omics and specialty diagnostics business on a global scale and solidify its foothold in the niche space.

Rationale Behind the Partnership

Genomic data generated by next generation sequencing (NGS) plays an increasingly significant role in scientific innovation and research. The NGS process encompasses a series of detailed steps, including sample collection and processing and sequencing, among others. However, this process can be especially challenging for labs that are new to NGS and are considering routine use of genomic sequencing data. Additionally, the data is key to driving research into human health improvements, as indicated in research publications and ongoing studies in many disease identification efforts, including neonatal research applications.

Per Revvity’s management, the partnership between the companies will likely enhance the overall customer experience by providing compelling application-specific data, stronger support and easier access to the critical components essential for a lab to go from sample to result.

Element Biosciences’ management believes that collaboration with Revvity will likely allow it to expand the reach of sequencing as part of a complete solution for the customers’ benefits.

Industry Prospects

Per a report by Grand View Research, the global NGS market was estimated at $6.96 billion in 2022 and is anticipated to witness a CAGR of approximately 21.7% between 2023 and 2030. Factors like the rise in applications of NGS and the growing technological developments in NGS instruments and technologies are expected to drive the market.

Given the market potential, the latest tie-up is expected to significantly boost Revvity’s global business.

Notable Developments

Last month, Revvity unveiled its innovative Pin-point base editing platform reagents. This is expected to provide researchers with greater access to implement the advanced gene editing technique in their preclinical laboratories.

The same month, Revvity launched three next-generation technologies that aim to help scientists drive breakthrough discoveries in biological research. These technologies include the IVIS Spectrum 2 and IVIS SpectrumCT 2 imaging systems, the Quantum GX3 microCT imaging solution and the Vega preclinical ultrasound system.

In August, Revvity announced its second-quarter 2023 results, wherein it registered solid non-COVID organic growth. The revenues from its Life Sciences segment were also robust during the quarter, both on a reported and organic basis.

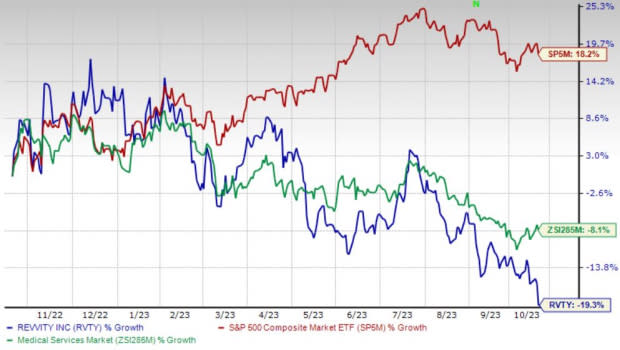

Price Performance

Shares of the company have lost 19.3% in the past year compared with the industry’s 8.1% decline. The S&P 500 has witnessed 18.2% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Revvity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Integer Holdings Corporation ITGR, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Integer Holdings, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Integer Holdings has gained 34.3% compared with the industry’s 0.6% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 1.6% against the industry’s 8.1% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 26.9% compared with the industry’s 22.5% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Revvity Inc. (RVTY) : Free Stock Analysis Report